Commentary

The average trade guesses for Wednesday’s November USDA Supply and Demand Report show the trade keeping corn and soybean yields unchanged at 171.9 and 49.8 bushels per acre, respectively. Analysts put ending stocks slightly higher compared to October as many expect export estimate reductions after a weak start to the 2022/23 exporting campaign. The average trade guess for ending stocks for beans is 212 million bushels. That is up slightly from the October report at 200 million. The range of estimates is 185 million to 296 million bushels. Ending stocks for Corn are at 1.207 billion bushels. This is slightly higher than last month’s, 1.172 billion bushels, with a range of guesstimates from 1.050 BB to 1.390. All wheat ending stocks comes in at 578 million bushels on the average trade guess versus 576 last month. The range of guesstimates comes in at 541 million on the low to 606 on the high.

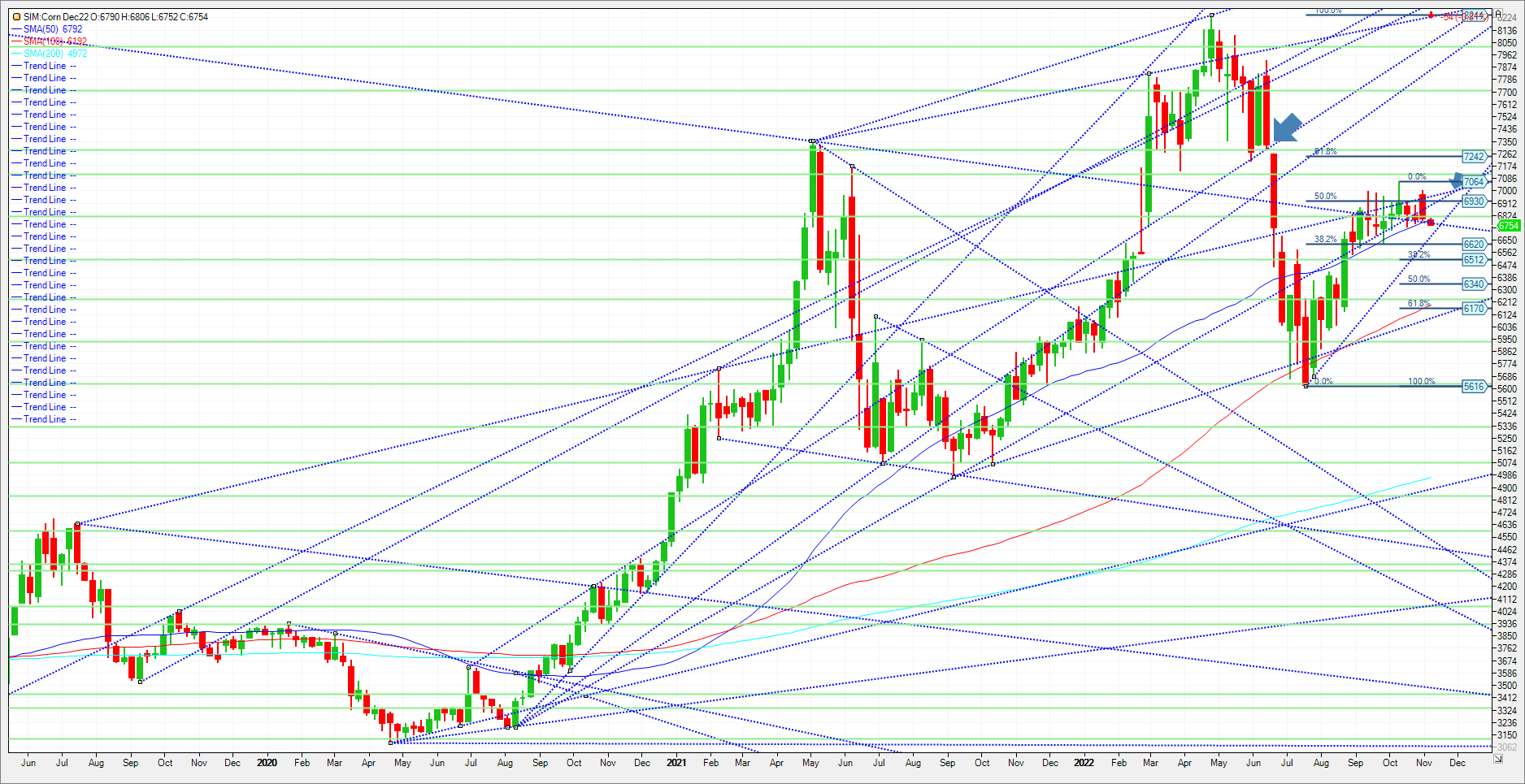

I doubt very much that the USDA leaves yield unchanged from the month prior for Corn and Beans. The wild card here for me is beans. Last month, we saw a Sub 50 bushel per acre yield, a bullish surprise in my view. That said private estimates are all coming in higher per Crop Scouts and some brokerage houses as harvest wraps up. They also see better yields for Corn. However, these are private estimates, and at the end of the day they are essentially guesstimates. Trend and Index following funds, the big money in grains take their cue from how the USDA sees the size of the crop in most cases. Given where the economy is at and the Greenback, Thursday’s CPI release may carry more weight for funds. Should this key inflation gauge continue to run hot, I look for the current pullback in the Dollar to become a buying opportunity, while the Stock indices reverse course and move lower. This may prod the funds that are long 270K corn contracts to offset or liquidate in my opinion. With this in mind, consider the following trade.

Please join me for a free grain and livestock webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Trade Idea

| Futures-N/A Options-Using a Diagonal option strategy, consider the following trade. Buy the Jan 23 660 Corn put, while at the same time selling the March 23 Corn 610 put. Offer the spread at -2.4 cents. Symbol: ZCH23P610:F23P660[DG] Risk/Reward Futures-N/A Options-the cost to entry here is 2.4 cents or $125.00 plus all commissions and fees. The risk here is unlimited as we are long a January put and short a March 233 put with approximately 60 days longer until the option expires. I am looking for a potential move towards the 50 percent retracement at 6.34 which derives from the October high (7.06) to the July low (5.61). Should the Corn market move higher to settle over 7.00, I would exit as a spread, liquidating both sides. |

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604