MARKET INSIGHTS

We are proud to offer easily-digestible reports on market events that matter to you. Through our email subscription, you can receive the latest reports of interest to you. Sign up to get our email updates by clicking the button below.

Walsh Trading offers a variety of articles and reports sharing insights and analysis on market events and discussing major themes and trends driving opportunities today.

WEBINARS

Walsh Trading offers a variety of free weekly webinars to keep our clients informed and up to date. On Tuesdays at 3PM CST we host our Livestock Outlook webinar with Ben DiCostanzo and on Thursdays at 3PM CST we host our Grain Market Outlook webinar with Sean Lusk.

-

Livestock Outlook on Tuesday, October 22nd at 3:15PM CST

Grain Market Outlook on Thursday, October 24th at 3PM CST

Upcoming Webinars

GET INVITES

Grain Market Outlook

Thursday, October 17th - WATCH NOW >

Livestock Outlook

Tuesday, October 15th WATCH NOW >

Recent Webinars

VIEW ALLRESOURCES

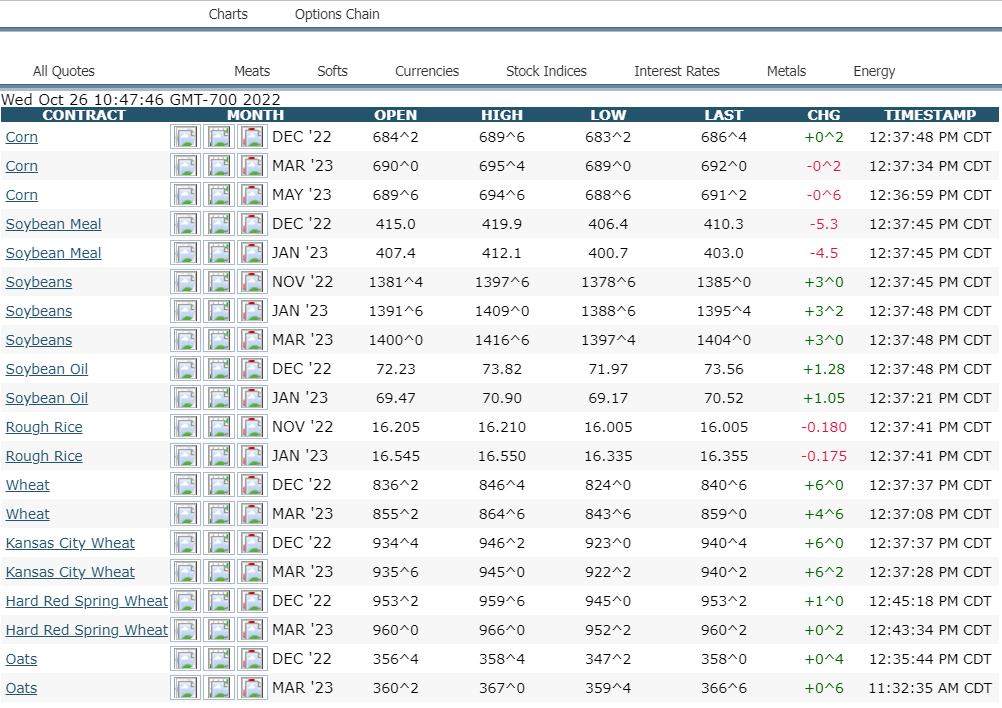

Quotes and Charts

We now offer Quotes and Charts through Quick Screen Trading. Markets include Grains, Meats, Softs, Currencies, Stock Indices, Interest Rates, Metals and Energy. You can also customize the Chart Options.