5/6/24

The Feeders continued their push lower today, while Live Cattle stayed positive. June’24 Live Cattle were 30 cents higher today and settled at 176.97 ½. Today’s high was 177.37 ½ and the 1-month high is 179.65. Today’s low was 175.80 and the 1-month low is 170.25. Since 4/5 June Live Cattle are 4.92 ½ higher or almost 3%. The Feeders dipped lower again today. August’24 Feeder Cattle were 1.87 ½ lower today and settled at 252.87 ½. Today’s high was 254.75 and the 1-month high is 261.80. Today’s low was 252.15 and the 1-month low is 243.27 ½. Since 4/5 August’24 Feeder Cattle are 4.25 higher or more than 1 ½%. The Hogs continued to slide lower as well. June’24 Lean Hogs were 77 ½ cents lower today and settled at 98.17 ½. Today’s high was 99.05 and the 1-month high and the 52-week high is 109.65. Today’s low was 97.82 ½ and that is the new 1-month low. Since 4/5 June’24 Lean Hogs are 9.72 ½ lower or 9%. The heavy weights in the Cattle Market continue to push the Feeders lower. Production has been strong, and Beef has flooded the Market, and the feedlots are still full of heavy Cattle. The average dressed Cattle weight last week was 848 pounds, the same as the week before, but still much higher than the 819 pounds from this time last year. Last week 619,000 head were slaughtered, compared to 621,000 head last year. The heavy weight produced over 523 million pounds last week, much more than 507 million pounds last year. Bird Flu was in the news again today. The CDC told dairy workers to wear protective gear, because they may be at risk of contracting the disease. Additionally, Canada has made a change to their Livestock import regulations. Imported Cattle must now be tested for Bird Flu and have a negative test result. June’24 Hogs were lower again today, and if the Funds start to liquidate their huge, long position, the hogs will continue lower. I feel if there is another scare in the Market, just before the peak of grilling season, demand will be gone.

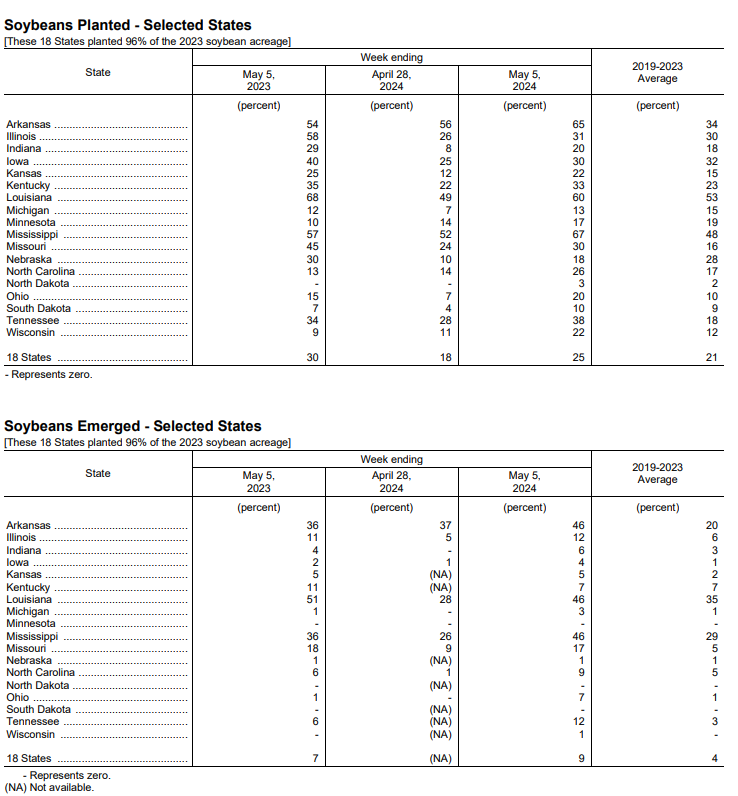

The Grains were all higher today. July’24 Soybeans were 33 ¾ cents higher and settled at 1248 ¾. Today’s high of 1251 ¼ is the new 1-month high. Today’s low was 1207 and the 1-month low is 1145 ¾. Since 4/5 July’24 Soybeans are 52 cents higher or almost 4 ½%. July’24 Corn was 8 ¾ cents higher today and settled at 469. Today’s high was 470 and that is also the new 1-month high. Today’s low was 454 ¼ and the 1-month low is 435 ¾. Since 4/5 July’24 Corn 22 ¼ cents higher or almost 5%. Wheat is still climbing. July’24 Wheat was 26 ¼ cents higher today and settled at 648 ¾. Today’s high was 650 ¼, and that is also the new 1-month high. Today’s low was 609 ½ and the 1-month low is 550. Since 4/5 July’24 Wheat is 67 cents higher or about 11 ½%. The Grains traded much higher today, on heavy volume. July’24 Soybeans traded over 1250 today before pulling a few cents back before the close. Traders took advantage of the big move higher today, and purchased Puts, in July’24 Soybeans. Take a look at the large numbers traded today and the open interest in the strikes between the 1000 Puts and the 1200 Puts, it is impressive. This afternoon, the USDA released its weekly Crop Progress Report, and it showed that as of yesterday, 25% of the Soybean Crop had been planted, with the average between 2019-2023 being 21% planted. It looks like the weather could be improving over the next week, and Farmers will be quick to pick up the planting pace. Recently, the focus has been on flooding in Brazil, but it has mainly been in Rio Grande do Sul. Before the flood, Rio Grande do Sul was expected to be the second highest producing State of Soybeans in Brazil. Last week Rio Grande do Sul had roughly 40% of their Soybeans left to harvest, but were expected to produce 68% more Soybeans this season, compared to last according to CONAB, and Emater projected a record crop of 22.25mt, up 71.5% from last year. We will see how much damage was done soon. I am still expecting a large crop to come out of Brazil this year. I expect to hear more acres of Soybeans were planted this year, than were expected or reported, and that the yields will be large. If the beans look as good as they did in Rio Grande do Sul, before the flood, in other parts of Brazil, then it will be a big crop. It was just one week ago, when I wrote about the President for Cargill, in Brazil, Paulo Sousa who said, “Our view is that the Soybean harvest is not much worse than last year” and that Soy output projections may be revised upwards. We will find out on Friday, and I feel we will see a Bearish report.

USDA CROP PROGRESS REPORT FOR SOYBEANS BELOW.

Full USDA Crop Progress Report Link Below

–Bill

I have market commentary and option charts in

Pure Hedge – Livestock

Pure Hedge – Grain

Listen Live at 7:25am on

Tuesday-Friday

Call for specific trade recommendations.

Email me for free research.

Bill Allen

Senior Account Executive

Direct: 1 312 957 8079

WALSH TRADING INC.

53 West Jackson Boulevard, Suite 750

Chicago, Illinois 60604

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.