Commentary

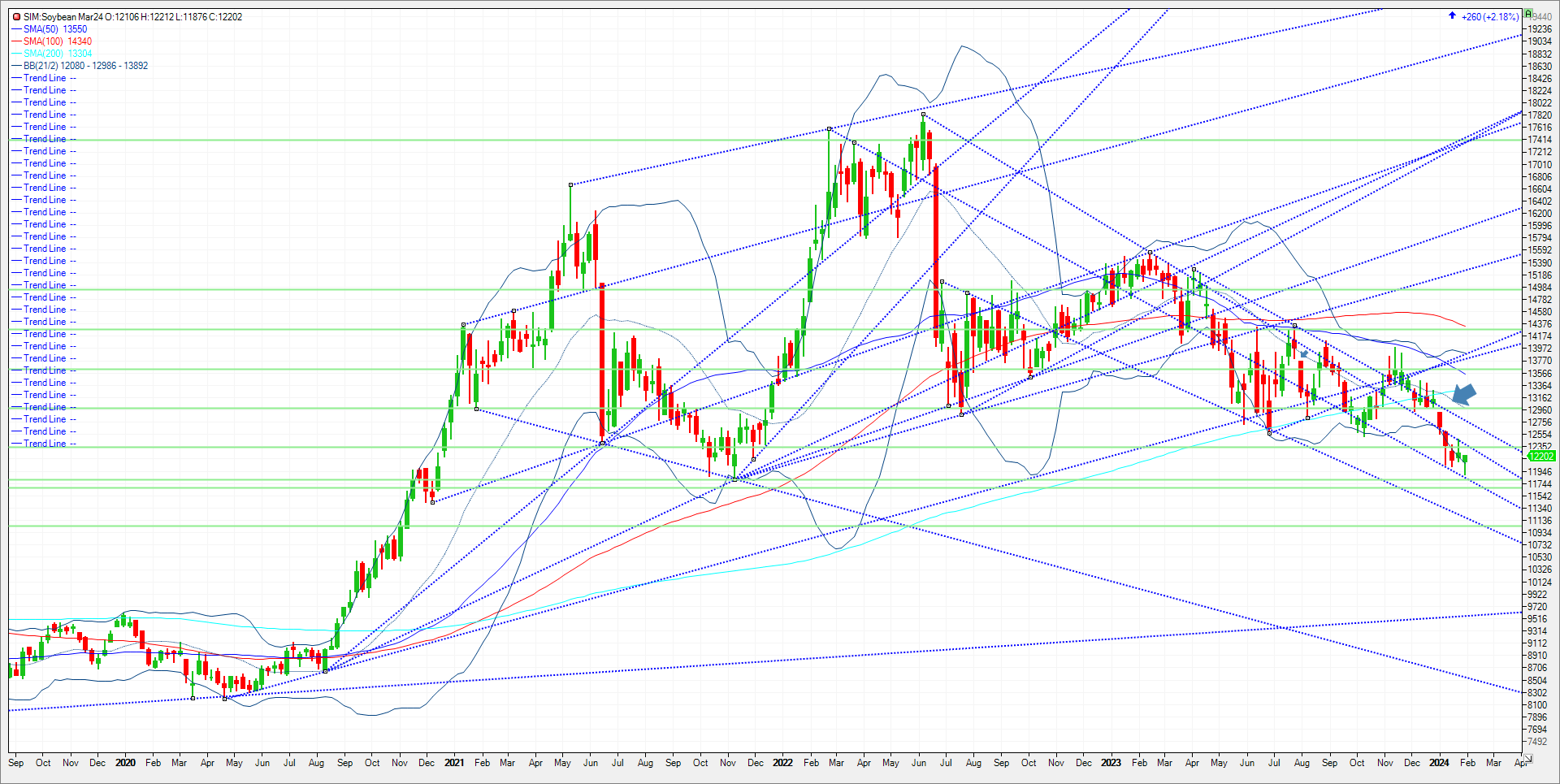

Soybean futureseroded to the lowest level since November 2021 early Tuesday morning at 11.87 basis March, which in my opinion prompted a round of bargain buying on Tuesday that led to double-digit gains. March bean futures climbed 26 cents to $12.2025, with May futures rising 24 cents to $12.29. The rest of the soy complex was also in the green. March soymeal futures jumped almost 2.75% higher, while March soy oil futures were up around 1%. Private forecasters such as Ag Resource cut their 2023/24 Brazilian soybean production estimate from 150.7 to 145.5 MMT at midday today. Datagro put yield at 148.55 million metric tons (their previous estimate was 152.88 MMT). Pro Farmers top crop scout put the Brazilian crop at 149 MMT, amid another revision lower. The USDA in the January WASDE had Brazil at 157 MMT while Conab was at 155. The February WASDE should see the USDA lower their estimate probable to the low 150’s in my opinion. Funds are heavily short corn, all wheat, and the soy complex. Last time they were this net short was 2020 during the early days of the pandemic. While harvest is proceeding in Brazil the reports are not positive in the higher yielding areas where combines are running. The hope in my view is that the later maturing crop will be offsetting the early crop that was hit by exceptional dryness. Soybean basis bids were steady to mixed across the central U.S. after trending as much as 3 cents higher at an Indiana processor and as much as 7 cents lower at an Ohio elevator on Tuesday. In our opinion Brazil’s soybean basis so far does not indicate a problem as it continues to slide to a greater discount to US FOB. China continues to struggle with negative crush margins and today the Dalian Meal Futures contract traded 1-year lows. This tells me with month end tomorrow, the Fed interest rate announcement at 1pm central tomorrow, and Fridays jobs report, profit taking by managed funds led the grain sector higher. The funds have the profit and the risk, making short covering an easy decision in my view. Weekly chart below. Resistance for the remainder of the week is at 12.34 and then major trendline resistance at 12.38. A close over 12.38 in March futures and I wouldn’t be short. Further short covering could lead us to the next key resistance at 12.76 and then the gap between 1291 and 1296.6. Support is just under the overnight low at 1185-1181. A breach here and the market could test the 10% down for the year level at 11.68. A close under 11.68 and its Katy bar the door to 11.20.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604