Commentary

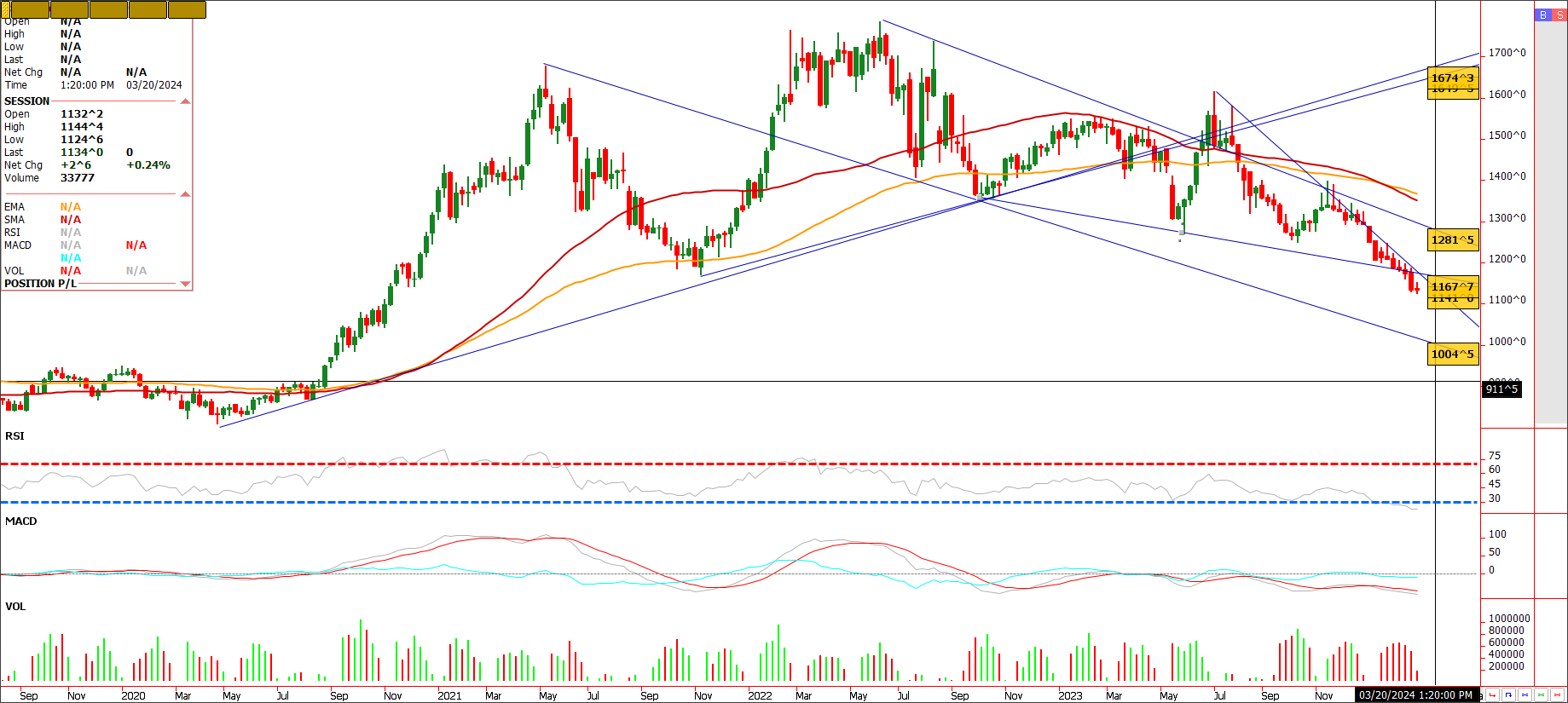

Bean prices saw a mid-session rally after the market tested recent lows at the 1133 level, hitting 1134 after the open then rallying 17 cents to 1151. But that rally was short lived, with today’s settlement a tad underwhelming posting a 4.4 cent gain. Private forecaster ABIOVE slashed the Brazilian bean crop 2.3 million metric tons to 153.8. This is below USDA but way above most private forecasters and CONAB which are all below 150 MMT. In fact the most bearish Brazilian production forecast calls for a crop of 147 MMT. Should we see forecasts come in below this number, I could see a more pronounced rally off of some production uncertainties there. That said, Argentina is looking at a 50 million metric ton crop, besting last year by a whopping 25 to 30 million metric tons. If you add Argentina’s increase versus Brazil’s decline, South America could post a 15 million metric ton increase year on year. Brazil’s basis today is back to weakening again, down 5-10 cents per bushel in the spot market. Export sales forecasts look for very low new purchases for the US in tomorrow’s report. The trade range virtually expects 0 to .5 mmt of business after the near zero business last week. As it stands right now, Brazil’s discount of $1.70 per bushel landed China keeps the bean market in sell the rallies mode. We continue to lose market share to Brazil. If you want to establish longs in beans in my opinion, use new crop contracts. There could be a major weather story there coming to the Midwest this growing season. With this in mind consider the following trade using option diagonals. Beans historically don’t spend a lot of time in the 11.00 handle. The next level of support in my opinion is 11.03, which represents 15 % down for the year in beans. Below that 10.77 and then 20% down is 1038. Unless we get a weekly close over 11.68, we remain in a downtrend.

Trade Ideas

Futures-N/A

Options-Buy the May 24, 1140, soybean put, (5 cents out of money) vs selling the Nov 24, 1040, put (95 cents out of money) for parity or even money plus trade costs and fees.

| ZSX24P1040:K24P1140[DG] |

Risk/Reward

Futures-N/A

Options-unlimited risk here as one is short a bean put that expires in late October 2024 vs a long option expiring in the end of April 24. The cost to entry is even money, there is nothing to put up except commissions and fees. Unlimited risk however. A close over 1168 basis May futures and I suggest getting of the position. One can place a GTC stop loss at 8 cents from entry to risk $400 plus trade costs and fees. We are looking for a move to the 1080/11 area and then exit the trade for decent collection. Call me with questions.

Please join me for a free grain webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. SIgn Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.