Commentary

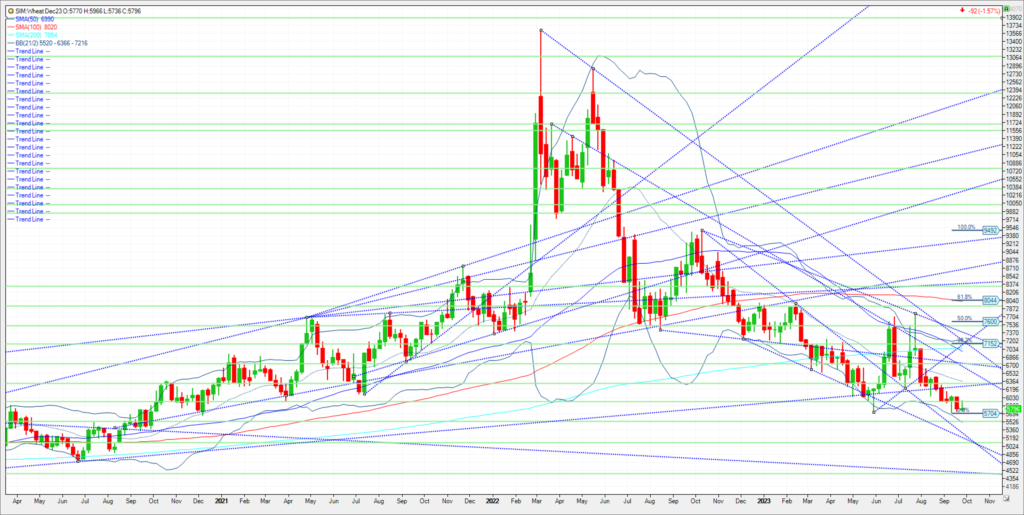

Ukraine and Poland announced they are currently in negotiations to lift Poland’s grain import ban of Ukrainian grain. The flood of exports moving west out of Ukraine previously caused an oversupply situation in Poland other EU countries. This was responded to with an import ban on those imports to help stabilize other EU markets. Polish Agriculture Minister Robert Telus said both sides are actively engaged in dialogue and are working to establish future mechanisms while addressing emotional aspects of the dispute. The Ukrainian Agriculture Ministry has announced that its chief, Muykola Solsky, will meet with Telus in a week to discuss Ukraine’s proposed licensing system, which aims to implement import licenses for corn, rapeseed, sunflower seed and wheat destined for five eastern European countries within the European Union. Ukraine said weeks ago it was working on a subsidy package to help cover insurance coverage, not sure though if it has been enacted. The goal is to get water exports to 30% of pre-war levels, that when combined with land exports, would bring total shipments to roughly 4.5 million metric tons per month. Russia has thus far avoided direct attacks on ships, choosing instead to target the port facilities. That is slowly destroying Ukraine’s loading capabilities, while raising risks for ships docked for loading. Those port strikes increased notably this week as ship movement has escalated as well. Egypt was able to secure 170,000 MT of wheat in their tender, with the majority coming from Romania. Technical levels through the first week of October comes in as follows. Support is first at 570. A close under and its 553 to 552. A close under here and its katy bar the door 5.22 and 5.16. Resistance is 5.92. Consecutive closes over are needed to push the market back above 6.00 and challenge 6.28 and 6.32.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain and livestock webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now