Commentary

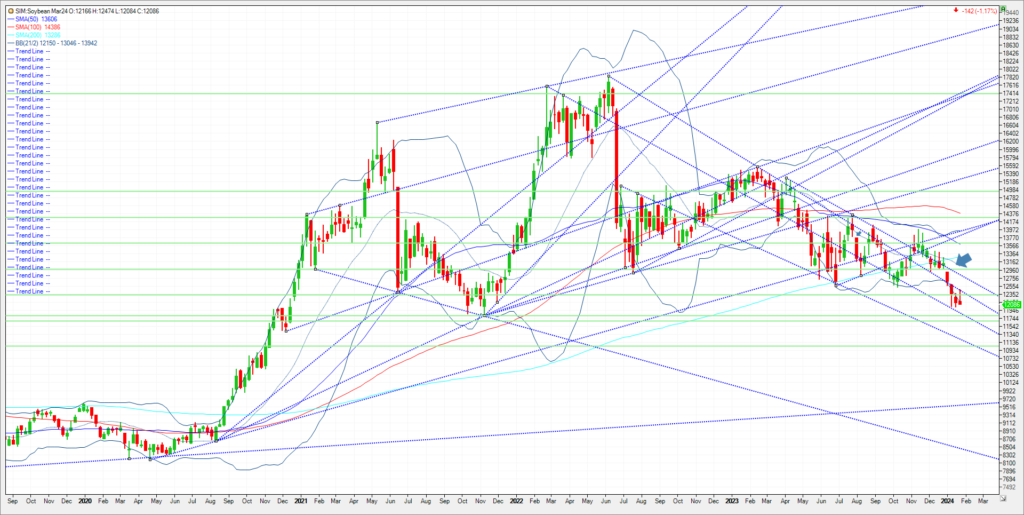

After a three-day short covering rally in the bean sector by managed funds, bean futures reversed course on Thursday 1/25 on three fronts. First Brazil’s premiums fell this week on the availability of newly harvested supply. Brazil’s soybean basis continues to slide with another 6 cents off today which makes it a 45 cent drop for the spot market this week. Second, soybean export sales came in below the trade estimate range this week at just 20.6 million bushels, down from 28.7 million bushels last week and 36.2 million bushels on the comparable week last season; sales over the past four weeks have totaled less than 60 million bushels, compared to 111.6 million bushels over the same span last season. The third reason in my opinion was that the Buenos Aires Grain Exchange raised their Argentine bean production number near 52.5 million bushels. About the only bullish tidbit that entered into the market in my view was news that private exporters reported sales of 100,000 metric tons of soybean cake and meal for delivery to unknown destinations during the 2023/2024 marketing year. Unknown is spelled CHINA. Declining basis in Brazil, good weather in Argentina so far, and limited demand here in the US are bearish fundamentals near term in my view. That said it doesn’t mean the market will continue to probe lower. I’m watching technical levels now as soybeans, soymeal and soy oil have net short positions by managed funds. It has been I believe early 2020 since we could say that and Covid lockdowns hadn’t even begun yet. Trade the charts here. It will only take one person to shout “fire” in the theater for the shorts to cover. Could that be at current levels or if/when prices deteriorate further because of bearish fundamentals. Technical levels for March soybeans come in as follows for next week. Key support has three levels below 12.00. First support at 1185 and then 1181. If neither holds 1168 is next. This level represents 10% down for 2024. Underneath 1168 and its Katy bar the door to 11.20. Key resistance is 1234 and 1238. In my view trendline resistance at 1238 is key as consecutive closes over it could push the market to the next trendline at 1276. Above that level the next level or resistance is the year opening gap at 1291 to 1297.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain and livestock webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.