Commentary

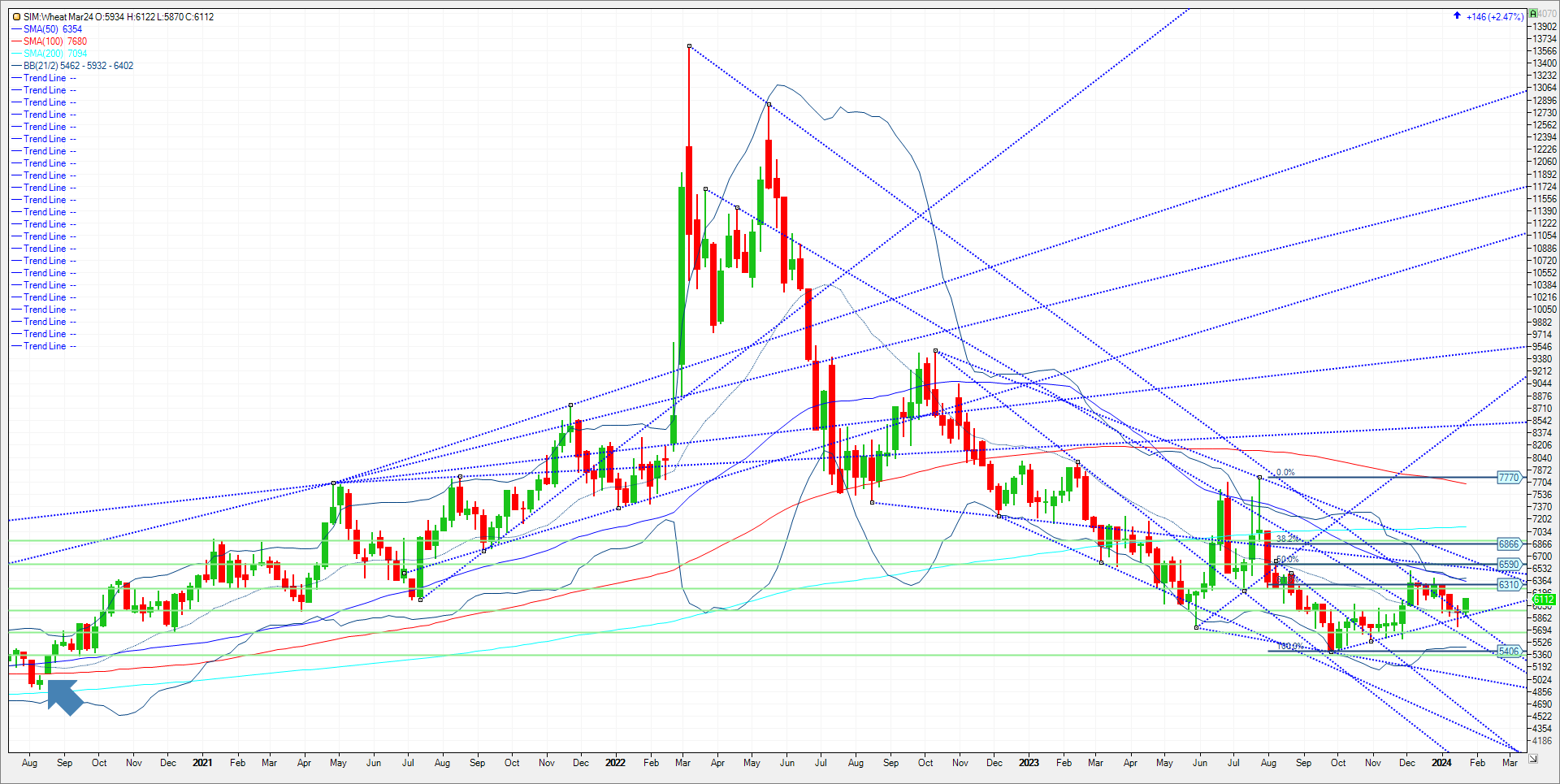

Chicago wheat futures led the way across the complex as they posted a higher close for six sessions consecutively amid a 38-cent rally off the recent low. The close today in WH24 cleared some important technical levels in my view. March wheat on the daily chart closed above the 50- and 100-day moving averages which may have ignited further short covering amid stop losses being initiated. Where to from here? There is some rumor this week about further Chinese buying, which means tomorrows export sales will be scrutinized. That said there has been no shortage of geo-political news highlighted by a Russian military transport plane shot down with 74 people aboard. Ukraine is said to be responsible. It is important to note that rallies off of geo-political uncertainties in Eastern Europe have become selling opportunities on the Board. We shall see if that trend continues. While this recent rally is bullish technically, US values are building back a premium to Russia with HRW (KC Wheat) at a FOB $40 per metric ton over Russia. It is my belief one should watch open Interest tomorrow; it was near flat today and a decline in open interest would indicate to me that funds are short covering. I included a weekly continuous chart below. Weekly technical levels through next week come in as follows. Key support is 5.97 (5 % down for year) and then 5.93 the 21-week moving average. Then trendline support at 5.90 and 5.80. Under 5.80 and we move to 5.66 in my view. Resistance isn’t seen until 6.28. That is where we closed 2023. Any sustained rally means we need to trade higher on the year in my view. Above 6.28 and the next levels are trendline resistance at 6.43, 6.53, and a 50% retracement from the July 23 rally to the Sept 23 low at 6.59.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a grain webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604