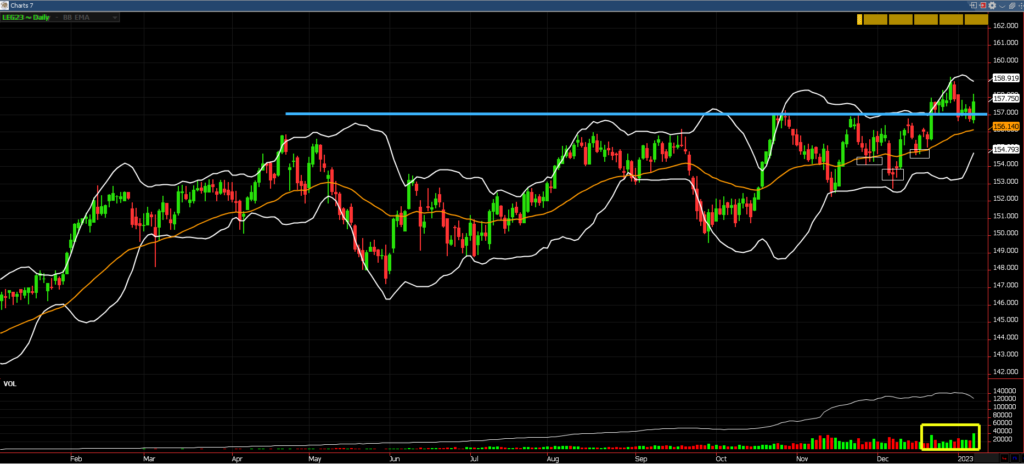

Cattle contracts were higher today with February leading the way being up 97.5 cents, settling at 157.750. In my opinion, it looks like 157 is good support in the market as Friday’s afternoon reported cash trades come in at 157.41 on average and $157.18 on average this Monday morning. Also on Friday, wholesale beef prices firmed with Choice up $1.36 and Select $2.39 higher. From a technical analysis point of view on the market, it is continuing to trend higher with the most volume that has been traded today since December 21st where it rallied over $2 to $158. There were no reported cash trades this afternoon based off of the USDA Afternoon National Slaughter Cattle Review as of 2pm, if we see a higher trending cash trade this week then I believe the next upside target is through the most recent high of $159 and possibly up to $160-$161. I’ve been hearing from some sale barns in South Dakota and Iowa that $160+ have been traded on some light volume for 800-1000 lb steers, so that’s something to keep an eye on going forward.

The feeder cattle market continues to trend upward as well in my opinion. After the corrective selling that happened last Thursday and Friday, there was a nice bounce off of the 40 Day Moving Average. Depending on what corn futures do tomorrow, I believe March feeders will continue to trend high this week and try to breakout of the 188 high that was traded last Wednesday.

Feb Cattle

**Call me for a free consultation for a marketing plan regarding your livestock needs.**

Peter McGinn

Account Executive

Walsh Trading, Inc.

Direct: 312-985-0931

Toll Free: 800-556-9411

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research