Crop conditions were released this morning a day later than usual by the USDA and perhaps gave the bears some fuel this morning in regards to soybeans. The national average for good to excellent condition came in at 68 percent. This is up 2 points on the week with top producer Illinois up 3 week on week at 79 percent …

AG TIME – Let’s See The Numbers

The markets came under pressure today. The usda release will come tomorrow. It makes little sense to make bold predictions. I will say the weekly progress showed a 2% increase in beans. A late in the year increase perhaps indicating the aug, sept weather has added yield. The market, it appears, is anticipating a further increase in yield. Adding bushels. …

It’s Always Something

The USDA reports are set to be released at 11:00 Chicago time on Wednesday! Early harvest results for beans in Central and Southern Illinois are positive as some producers are reporting excellent yields………………..Sometimes it takes a couple of reports (October, November, and January’s final figures and sometimes even years later in the census figures) for the reported yields to …

Livestock Report

The cattle markets were quiet on Monday September 10, 2018. They tested resistance at 110.80 in the October Live Cattle, making the high at 110.775. The October Feeder Cattle contract traded up to 153.30, just shy of resistance at 153.50. Cash cattle traded higher on Friday reaching 108.00 for live cattle in the Southern Plains and Colorado, while in Nebraska …

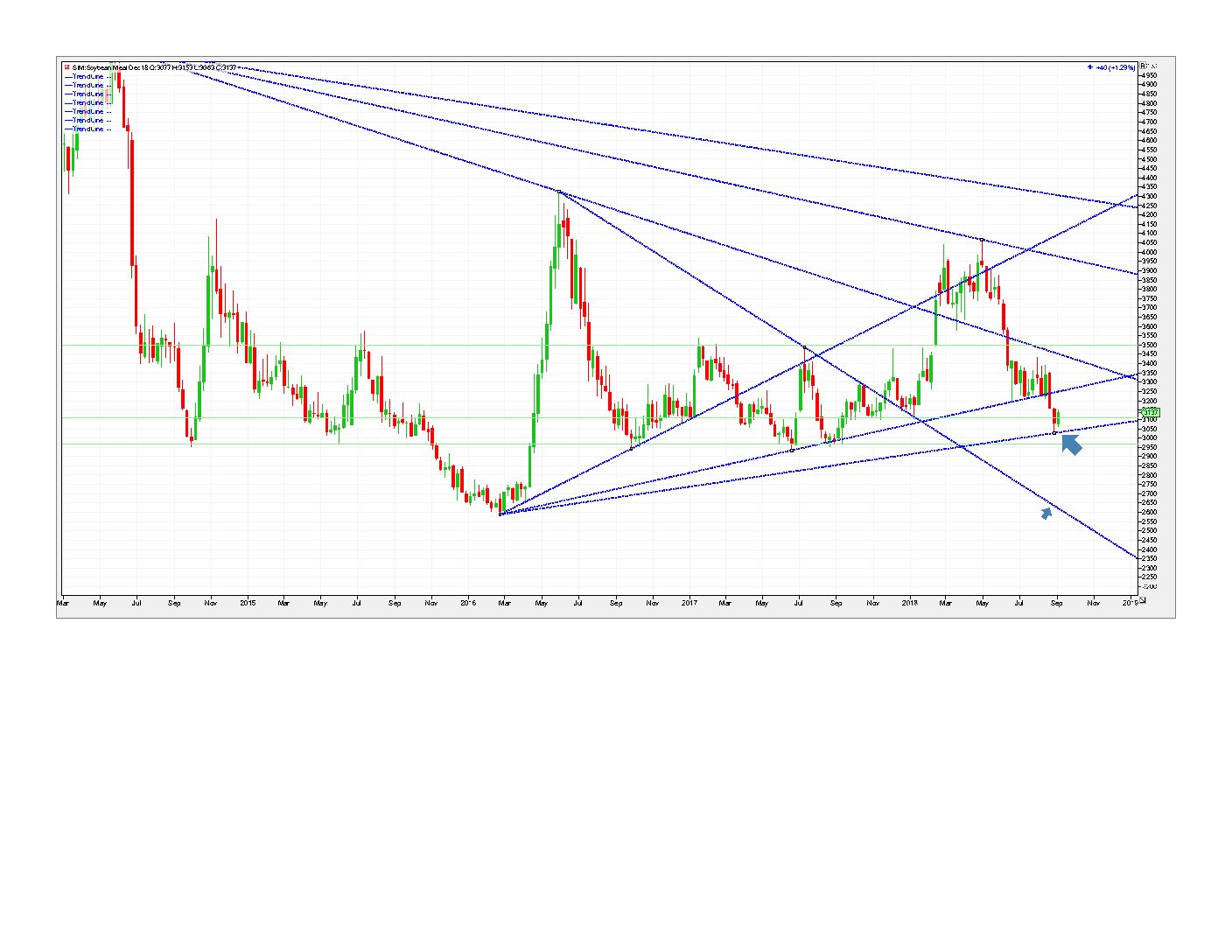

AG TIME – Long Term Changes, Perhaps

The soy was higher today. I would like to take a step back and look at the market from a longer term perspective. No specific trade ideas. Just a thought on where we may be going. It is my belief the complex is on a major shift. The last while has been based on crushing for meal demand. Protein. The …

Buy Corn, Wheat, Sell Spus, Stocks?

ARP here, I will jump right in. There are a lot of Olives I am looking for. The Volatility creates risk, but olive opportunities as well. Fridays can be interesting days for the trade. In addition we can look for setups into the next week. STOCKS I have put out a Olive Line sell in the Dow at 26170. Could …

AG TIME – Marking Time Now

The soy markets have corrected a bit here with meal leading the way. The USDA report Wednesday should provide a couple things. 1) confirmation of a larger carry. 2) confirmation of a weakening demand base. The current estimates have cut China’s demand back. It is important in my opinion to understand that the numbers in and of themselves by all …

Livestock Report

There isn’t much to say about the Live and Feeder Cattle markets today as they traded in a narrow range with the Feeders trading within Wednesday’s narrow range. There was a limited amount of trading in the cash market, with dressed cattle moving at $170.00 in the Iowa/ Minnesota area. It was quiet in the other 4 major areas. Packers …

Grain Spreads: Gameplan

The next big mover for grains could be next Wednesday’s crop report at 11 am. In reading the charts and studying trend lines and recognizing what time of year it is, I would posit that one consider the following courses of action in the following markets. The rule of thumb for me is that once corn and beans are 35 …