3/25/24

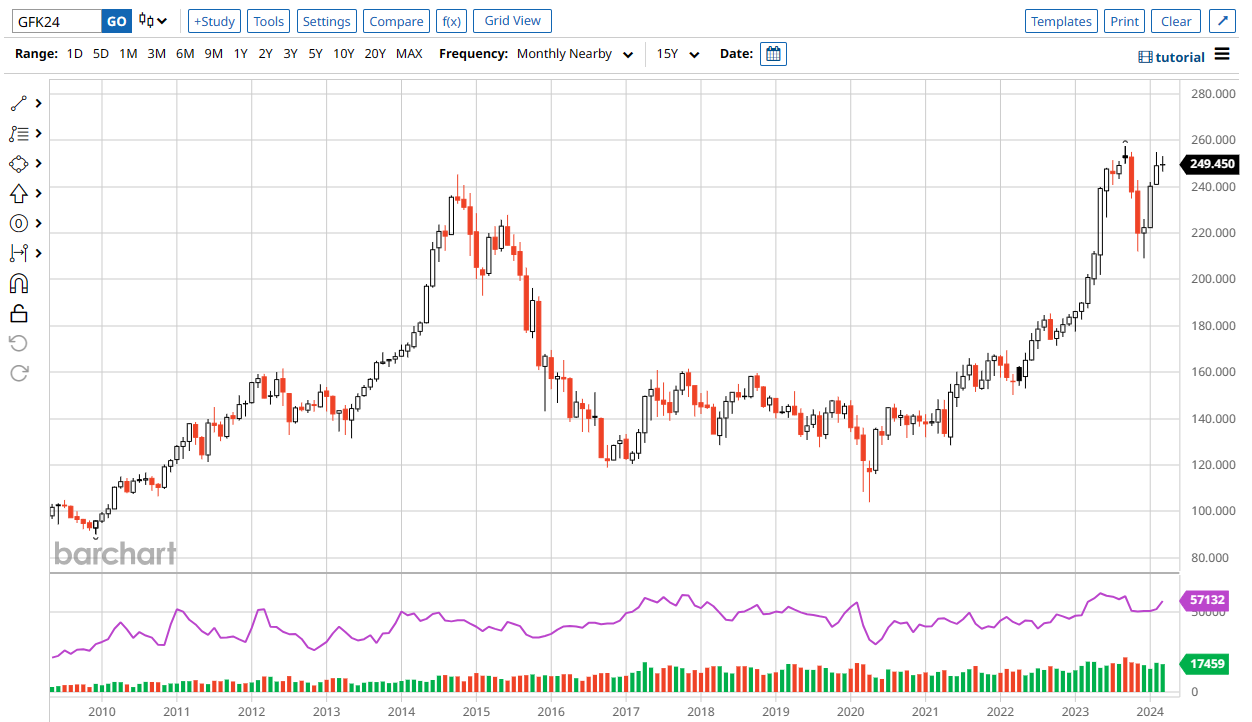

The Livestock and Grain Markets were mixed today. The Cattle Markets continued lower today. June’24 Live Cattle were 1.30 lower today and settled at 181.600. Today’s high was 183.350 and the 1-month high is 186.62 ½. Today’s low was 180.75, just above the 1-month low of 180.62 ½. Since 2/23 June’24 Live Cattle are 2.25 lower or more than 1%. May’24 Feeder Cattle were 1.15 lower today and settled at 252.62 ½. Today’s high was 255.40 and the 1-month high is 263.12 ½. Today’s low and the 1-month low is 250.40. Since 2/23 May’24 Feeder Cattle are 9.47 ½ lower or more than 3 ½%. The Hogs had a nice gain today. May’24 Lean Hogs were 1.97 ½ higher and settled at 101.67 ½. Today’s low was 99.20 and the 1-month low is 98.62 ½. Today’s high and the 52-week high is 103.47 ½. Since 2/23 June’24 Lean Hogs are 2.02 ½ higher or just over 2%. The Cattle Markets opened lower this morning, but they were not down very long. The Fat’s and the Feeders caught a bid, and May’24 Feeders were more than four dollars higher at one point. When the Bulls ran out of steam, May’24 Feeders broke and settled 3.30 lower from today’s highs. The Cattle on Feed numbers are still fresh, and the attempted rally was not in the cards today. I feel that the 245.00 level in May’24 Feeders is my next target, but not the last downside level. The 50% retracement from the 52-week high/low is 246.40 and the 100-day moving average is 244.11. In June’24 Live Cattle, I feel that 177.00 is the next, but not last level lower. The 50% retracement from the 52-week high/low is 178.38 and the 100-day moving average is 176.48. Take another look at the Feeder Cattle 10-year chart. The chart below is the 15-year chart for May’24 Feeder Cattle, so you can see all of 2014. If history repeats itself, most of the break is yet to come. Protect your downside exposure in the Cattle and Soybean Markets. The Soybean Market ended the day on a rally. May’24 Soybeans were 16 ¾ cents higher today and settled at 1209 ¼, just below today’s high of 1210. The 1-month high is 1226 ¾. Today’s low was 1188 ½ and the 1-month and 52-week low is 1128 ½. Since 2/23 May’24 Soybeans are 67 ½ cents higher or almost 6%. The Corn Market was a little lower today. May’24 Corn was 1 ½ cents lower today and settled at 427 ¾, just above today’s low of 437. The 1-month and 52-week low is 408 ¾. Today’s high was 441 ¼ and the 1-month high is 445 ¾. Since 2/23 May’24 Corn is 24 ¼ cents higher or almost 6%. The Wheat Market was all over the place today. May’24 Wheat was ¼ cent higher today and settled at 555. Today’s high was 567 and the 1-month high is 589 ½. Since 2/23 May’24 Wheat is 14 cents lower or almost 2 ½%. Planting intentions will be released on Thursday, and that will help show where these markets are heading. Pro Farmer’s survey showed and expected 3% decrease in Corn acres and Soybeans showed a 4% increase in acres. Will know soon enough is those numbers match the USDA numbers at 11:00am central time Thursday. (The Markets are closed on Friday, for Good Friday) I am still Bearish the Soybean Market, for all the same reasons. I believe the rally today was short covering. I would continue to recommend selling into strength. The 50% retracement from the 4-week high/low for May’24 Soybeans is 1177 5/8, and the 20-day moving average is 1177. I believe those levels will be hit, and then head lower. I feel that 1150 and then 1128 ½ are good downside targets. 1128 ½ is the 1-month and 52-week low. The Corn Market could bounce, but if the beans tank, the Corn might be dragged down with it. The 50% retracement from the 4-week high/low in May’24 Corn is 427 ¼. May’24 Wheat settled 12 cents off its highs today, and it is capable of moving in any direction, at any time. The 50-day moving average for May’24 Wheat is 578. I recommend getting everything hedged and ready for the report Thursday. It will be a long three-day weekend until the open Monday morning.

15-Year May’24 Feeder Cattle Chart Below

-Bill

312-957-8079

I have market commentary and Option charts in

Pure Hedge – Livestock

Pure Hedge – Grain

at WWW.WALSHTRADING.COM and on Barchart

Call for specific trade recommendations.

1-312-957-8079

Email me for free research.

Bill Allen

Senior Account Executive

Direct: 1 312 957 8079

WALSH TRADING INC.

53 West Jackson Boulevard, Suite 750

Chicago, Illinois 60604

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.