PURE HEDGE

| CATTLE |

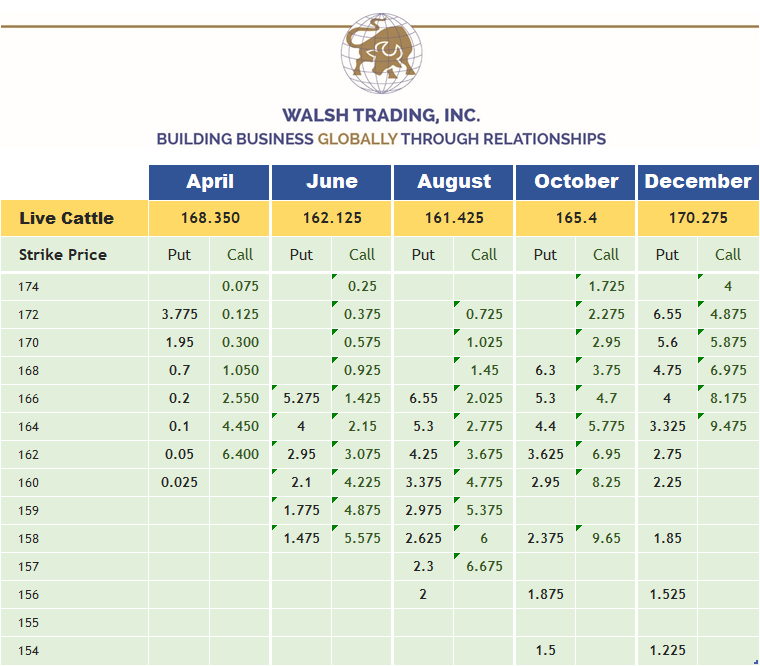

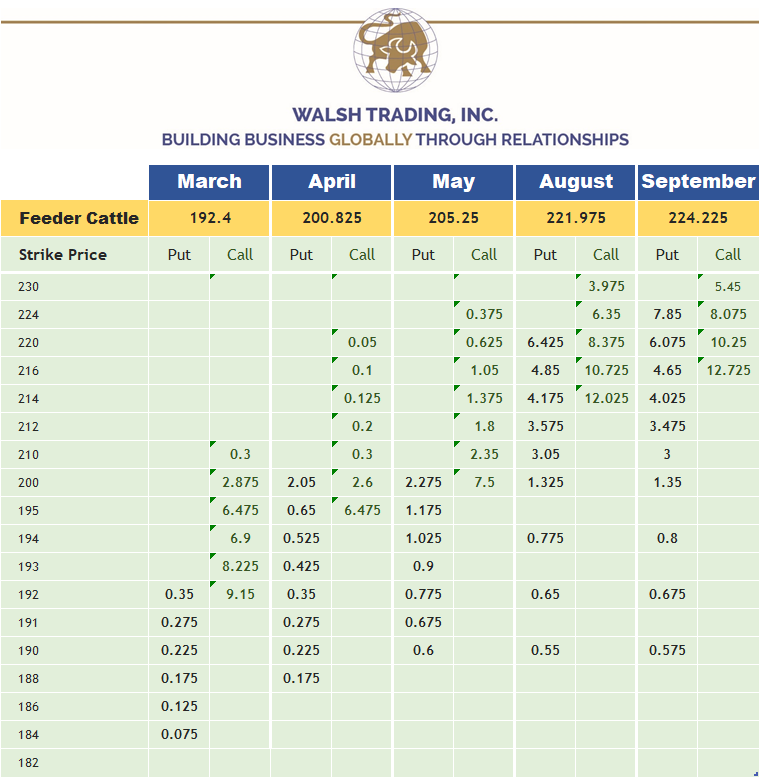

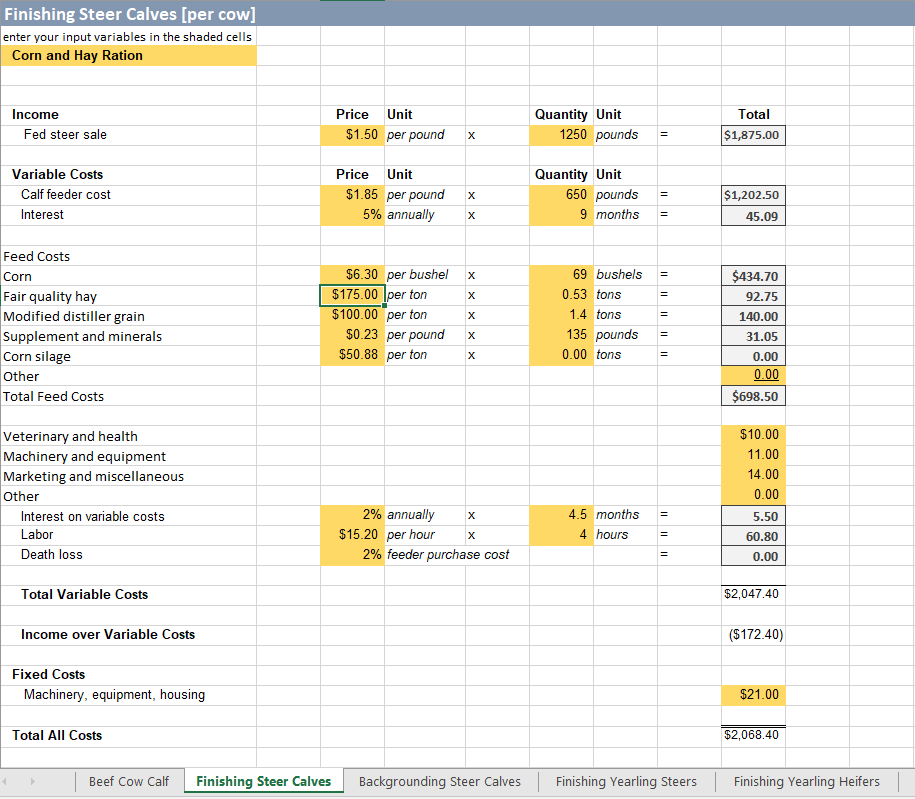

Cattle prices this week rallied sharply with the April live cattle contract settling at 168.350 and the March Feeder cattle contract settling at 192.40. Moderate to active fed cattle cash trade occurred in the North at $168 to $172 live and a range of to $266 to $276 dressed with the average being about $171. This is mostly $4 to $6 higher than last week, and the highest trade seen so far this year. Moderate volumes traded in the South at $165 to $168 which is $2 to $4 firmer than last week. Cattle futures finished in the green today with live cattle gaining $0.80 to $1.725/cwt and reaching new highs in the nearby April and the deferred Winter and Spring 2024 contracts. Feeder cattle also continued higher adding $0.95 to $1.925/cwt and seeing new highs in the late Summer and Fall 2023 contracts. The CME feeder cattle index added $1.11 to go to $192.35/cwt. Lean hog futures were mixed, finishing $0.55 lower to $0.775 higher. The CME lean hog index lost $0.25 to $76.00/cwt. Corn finished 1 to 4-1/2 cents lower, soybeans were 3-1/2 cents lower to 1 cent higher and wheat was 1 to 4-1/4 cents higher. Given the discounts built into the summer live cattle contracts, I expect producers to keep their marketings current, thereby tending to limit the speed and size of the usual late spring-summer price decline. Slaughter rates will almost surely increase as the second-quarter passes, which will tend to put downward pressure upon the market. But the key to the summer outlook probably goes back to the behavior of the retail sector. That is, if grocers regularly feature beef, making it a loss leader, the market could be quite well supported through spring. However, as seems more likely, if they actively pass increased wholesale beef costs on to consumers, and begin featuring cheap pork more aggressively, the cattle market seems likely to prove vulnerable to larger losses by late spring and summer. See below an example of the Cattle Producers Breakeven Calculator, only available to Walsh Trading customers, to get a more defined outlook at how you can protect your cattle production. Keep in mind, commissions and fees are not included in the cost of the option.

*Cost in above table does not include commissions and fees

*Cost in above table does not include commissions and fees

**Call me for a free consultation for a marketing plan regarding your livestock needs.**

Peter McGinn

Account Executive

Walsh Trading, Inc.

Direct: 312-985-0931

Toll Free: 800-556-9411

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research