Walsh Trading Daily Insights

Commentary

April Lean Hogs consolidated within Friday’s trading range, making the high at 96.30 and the low at 94.725. Settlement came in at 95.70. Cutouts and cash hogs are looking stronger which is being reflected in the rising Indices. Futures are still rich compared to cash so in my opinion consolidation is occurring to allow for cash to catch up to futures. If cash doesn’t continue to strengthen, we could see a pullback in futures. A failure from the low could see price test support at 93.50. If the high is taken out, we could see price re-test resistance at 97.30. A breakout above 97.30, could see price test resistance at 98.475.

The Pork Cutout Index increased and is at 95.25 as of 1/28/2022.

The Lean Hog Index increased and is at 80.61 as of 1/27/2022.

Estimated Slaughter for Monday is 475,000, which is above last week’s 448,000 and below last year’s 477,000. Friday and Saturday’s slaughter were revised lower to 463,000 and 194,000 respectively. It brings the weekly estimated total to 2,526,000, which is above last week’s 2,440,000 and below last year’s 2,660,000.

March Feeder Cattle opened higher, made the session low at 159.75 and rallied the rest of the session, making the high at 163.25 and then settling nearby at 163.025. The rally took price past resistance at 162.00 while stopping just shy of resistance at 163.50. Corn prices took one on the chin to start the week and with slaughter expected to improve this week as the newest incarnation of the covid virus wanes. A failure from settlement could see price test support 162.00. Support then comes in at the 100 DMA at 161.40. If price can overtake the 163.50 level, we could see a test of resistance at the rising 50 DMA now at 164.575 and the decking 21 DMA now at 164.75. 162.00. The rally closed the gap from the Wednesday high at 162.30 to the Friday low 163.15.

The Feeder Cattle Index decreased and is at 158.44 as of 1/28/2022.

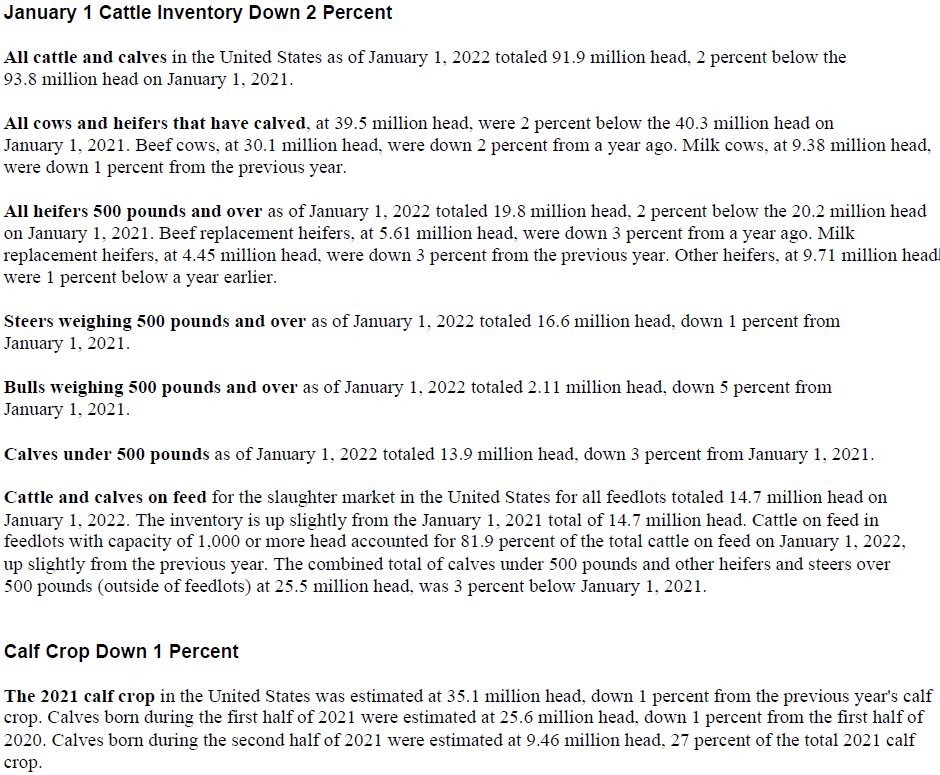

April Live Cattle gap opened higher, making its low at 143.275 and then rallying to the high of the day at 144,825. The gap is from the low to the Friday high at 143.225. Cattle settled near the high at 144.525. The rally took price to a new high for the up move, taking out the January 19th high at 143.775. The new high and settlement is above resistance at 144.025. In my opinion, traders expected slaughter to return to “normal” levels this week, which could potentially lead to higher cash prices going forward. Slaughter did make it to a “normal” level, hitting 120,000 on Monday. The Cattle inventory report was also expected to be bullish in my opinion, so the combination of the two led to a breakout rally. A breakout above the high could see price move towards the resistance at 146.825. A failure from support at 144.025 could see price test support at 142.25. The Cattle Inventory report is below.

Boxed beef cutouts down-ticked as choice cutouts dipped 0.02 to 290.40 and select dipped 0.12 to 283.27. The choice/ select spread widened to 7.13 and the load count was 88.

Monday’s estimated slaughter is 120,000, which is above last week’s 115,000 and last year’s 116,000.

The USDA report LM_Ct131 states: So far for Monday negotiated cash trading has been at a standstill in the Southern Plains, Nebraska and Western Cornbelt. Last week in the Texas Panhandle live purchases traded at 137.00. In Kansas live purchases traded at 136.00. For the prior week in Nebraska live and dressed purchases traded from 136.00-137.00 and at 218.00, respectively. In the Western Cornbelt live and dressed purchases traded from 137.00-138.00 and at 218.00, respectively.

The USDA is indicating no cash trades for live cattle and on a dressed basis (so far).

For those interested I hold a weekly grain (with Sean Lusk) and livestock webinar on Thursdays (except holiday weeks) and our next webinar will be on Thursday, February 03, 2022 at 3:00 pm. It is free for anyone who wants to sign up and the link for sign up is below. If you cannot attend live a recording will be sent to your email upon completion of the webinar.

**Call me for a free consultation for a marketing plan regarding your livestock needs.**

Ben DiCostanzo

Senior Market Strategist

Walsh Trading, Inc.

Direct: 312.957.4163

888.391.7894

Fax: 312.256.0109

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.