Commentary

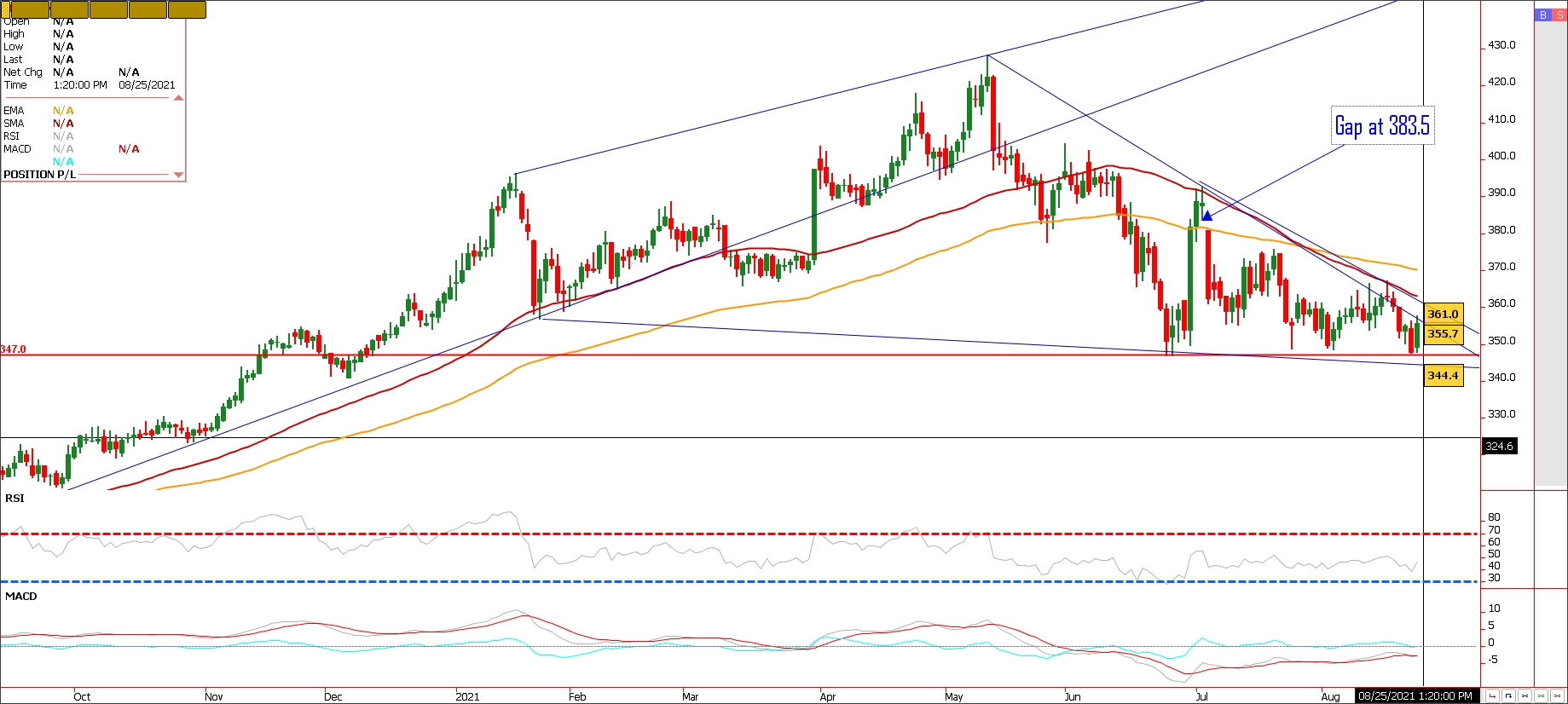

The bean market was buoyed by strong demand data and another drop in crop condition ratings from USDA. This may have countered Pro Farmer data which predicted yield at 51.2 BPA versus 50 by the USDA the week prior. Uncertainty reigns in my view which in my view could cap near term selling. Outside markets aided as well. News of another soybean sale to China, along with strength spilling over from resurgent crude oil futures sent the soy complex higher in my view. USDA announcement China had bought 132,000 metric tons of soybeans contributed to buying interest. Bulls were probably heartened by Monday’s 1% dip in the U.S. soybean crop’s “good” to “excellent” rating to 56%, particularly with some private analysts saying last week’s rains came too late to substantially boost fall harvest yields. The bullish kicker in my opinion came from the commodity sector leader crude oil, since its second straight bullish surge spilled over into soybean oil values. Nearby crude added almost $2 per barrel today after jumping about $3.50 yesterday. It is my belief that, bulls had to be encouraged by the underlying idea that last week’s late breakdown prompted a quick, aggressive return of Chinese buyers to the U.S. export market. I included a soy meal chart. Gap at 383 on the December futures chart. Prices held near term support at 3.48. We have key resistance levels to get through to turn bullish, but the gap seen on the chart maybe a near term target should the path of least resistance become higher in the soy sector.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain and livestock webinar at 3 pm Central. we discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604