Commentary:

Remember when the USDA told the market not to expect significant soybean purchases from China until the late Spring/summer time frame? Well it appears that they may be proven correct after all. Whether the Chinese are experiencing food shortages or are living up to some previous trade agreements per the Phase 1 deal remains for debate, its Christmas come early for American farmers as spot futures have rallied over 1.80. This sustained rally in beans comes on three fronts. First reason is demand in my view. China has made daily purchases of U.S. soybeans for the past 11 trading sessions. There’s no reason to believe the bull run will end next week, but I think its prudent to point out that the market is heavily overbought and funds hold an aggressive net long position (approx +230K contracts), both of which could trigger a corrective pullback without notice.

Second in my view is that Brazil could be sold out. Brazilian importers have clocked up multiple purchases of Argentine soybean oil cargoes over the past few weeks marking the first time in two years that the world’s largest soybean producer and exporter has had to buy in bulk from its neighbor. The move comes after Brazil ran dry of beans, causing a lack of domestic oil supply with around 60,000-70,000 mt of Argentine soybean oil bought by Brazilian importers over the past two weeks. Despite Brazil harvesting a record soybean crop earlier this year, a record soybean export programme to China has left the country short of the oilseed, with tight supply expected to persist until its next harvest in February.

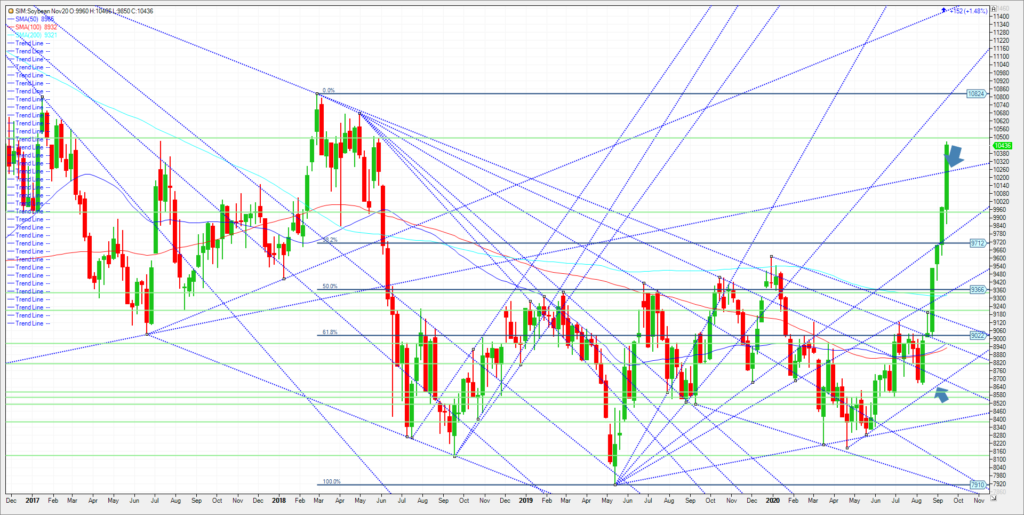

Lastly, weather issues in August in some areas of the Midwest that began in early August with the Derecho and followed with three weeks of drought, took some yield off the top. Its still a big bean crop, most likely over 51 bushels per acre, with production around 4.3 billion bushels. Its just not the bin buster some were predicting back in late July early August. In my view a late season La Nina that is being forecasted could heavily impact seedings in Brazil and force a later planted crop due to drought. This type of weather premium should it emerge, would keep funds on the long side of this market for some time. Look for the market to test the 1080 area on another push higher before harvest pressure and month and quarter end profit taking emerge. Plus we have the quarterly stocks report at month end as well. Reasons for profit taking. Watch 1025.6 to the downside next week. (Blue Arrow on chart). That trendline needs to hold or a deeper pullback to the 975/980 area (50 percent retracement of this recent rally) could be seen.

Trade Ideas

Futures and Options-N/A

Risk/Reward-N/A

Please join me every Thursday at 3pm Central for a free grain and livestock webinar. We discuss supply, demand, weather, and the charts. A link will be sent to your email upon signup. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involve substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.