Commentary

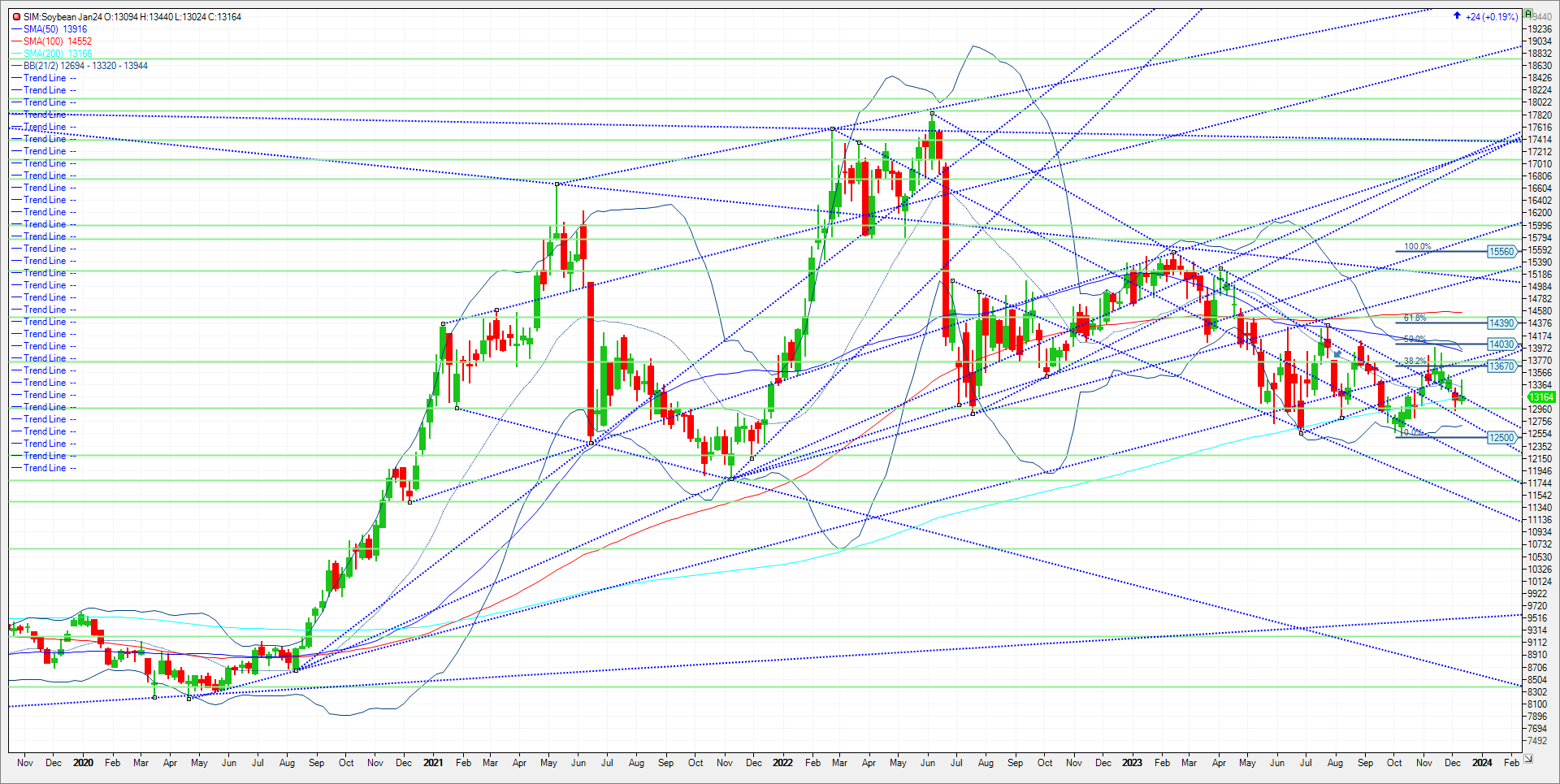

Despite eight straight daily soybean export flash sales announcements, buyer interest remained limited this week. With Brazil still actively exporting its record 2022-23 crop and U.S. exports playing catchup, buyer interest remained limited in my view. Forecasts for improved Brazilian rainfall also potentially weighed on prices, but crop stress prodded the USDA to lower its crop estimates to move from 163 to 161 million metric tons in last Friday’s WASDE. Keep in mind further losses are likely should rains miss in key areas. That said Argentina bean production could be up 20 million metric tons from last year as two years of severe drought come to an end with a strong El Nino in place versus multiple years of a hot and dry Argentina (La Nina). So, we could see South American production increase by 20 to 25 million metric tons versus last year. For some reason though USDA has increased demand nearly as much. They are predicting close to 20 million metric tons globally. That may not be justified to increase that amount of demand this soon with declining hog populations in China for example. If rains verify in South America into February, look out below for beans deeper into 2024 in my opinion. Trade recs coming in my 2024 outlook prior to yearend. Support for January 24 beans next week comes in as follows. Support is first at essentially today’s settlement at 13.16 and then the trendline at 13.11. A close under these levels and its 12.95 and 12.75. Under 12.75 we could push to the Oct lows at 12.50. However, should we hold 13.16 and 13.11, look for the market to test 21 week moving average at 13.32. A close over that level and its 13.60. A close over 13.60 and its 13.77/78.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604