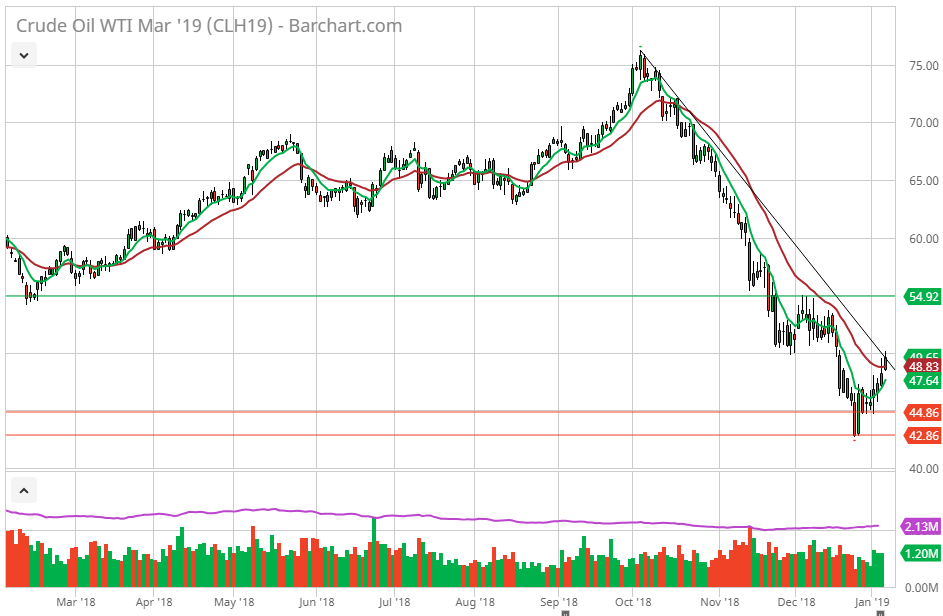

I see continued strength in Crude Oil after rallying from under 43.00 a barrel from over sold conditions (42.67 – 12/24/19). March crude futures settled near 48.90, up another 60 cents for today’s session. I think they can potentially rally to 55.00 a barrel as imports fell from 7.6 million to 7.3 million barrels per day last week. The charts point to me that this rally will not exceed potentially the 55.50 to 56.00 area because even though OPEC has cut production, OPEC countries like Nigeria, Congo and Libya will not cut back because they depend heavily on revenue from oil exports. Canadian Sands has cut production and US shale has slowed down some which should keep the market bid. However I see any production cut as temporary and therefore expect US Shale to ramp back up soon. Inevitably I think that some OPEC members will cheat, ramping up their production with Russia leading the way, pumping more as well. We have seen this scenario play out time over time as this usually happens when Oil prices trade higher.

On an outright Futures Basis you can get long here or a better level, maybe the 48.50 area with a stop at 47.50 risking $1000 to make up to potentially $5000 on a rally to 54.50 or higher.

March Crude Oil Options are expensive the March 53.00 Call cost 1.30 = $1300.00 of quantifiable risk plus fees and associated costs per transaction to enter the trade, even the March 54.00 Call cost 1.10 = $1100.00 of quantifiable risk plus fees and associated costs per transaction to enter the trade. Consider Call Spreads the March 53.00– 1.30 /55.00– .90, Call Spread cost .40 = $400.00 of quantifiable risk plus fees and associated costs per transaction to enter the trade, the March 52.00– 1.70 /55.50– .80 Call Spread cost .90= $ 900.00 of quantifiable risk plus fees and associated costs per transaction to enter the trade.

For downside protection consider the March 44.00 Put cost 1.03 = $1030.00 of quantifiable risk plus fees and associated costs per transaction to enter the trade. The March 45.50 Put cost 1.37 so consider the 45.50 /44.00 Put spread cost .34 = $340.00 of quantifiable risk plus fees and associated costs per transaction to enter the trade.

MARCH OPTIONS EXPIRE IN 38 DAYS ON 2/14/2019 THE UNDERLYING FUTURE IS THE MARCH 2019 CONTRACT

To discuss any strategies feel free to call 888-391-7894 or email me peterori@walshtrading.com

………………………………………………………………….

Walsh Trading, Inc. is registered as an Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (WTI) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71. The information contained on this site is the opinion of the writer and obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in current market prices.