Commentary

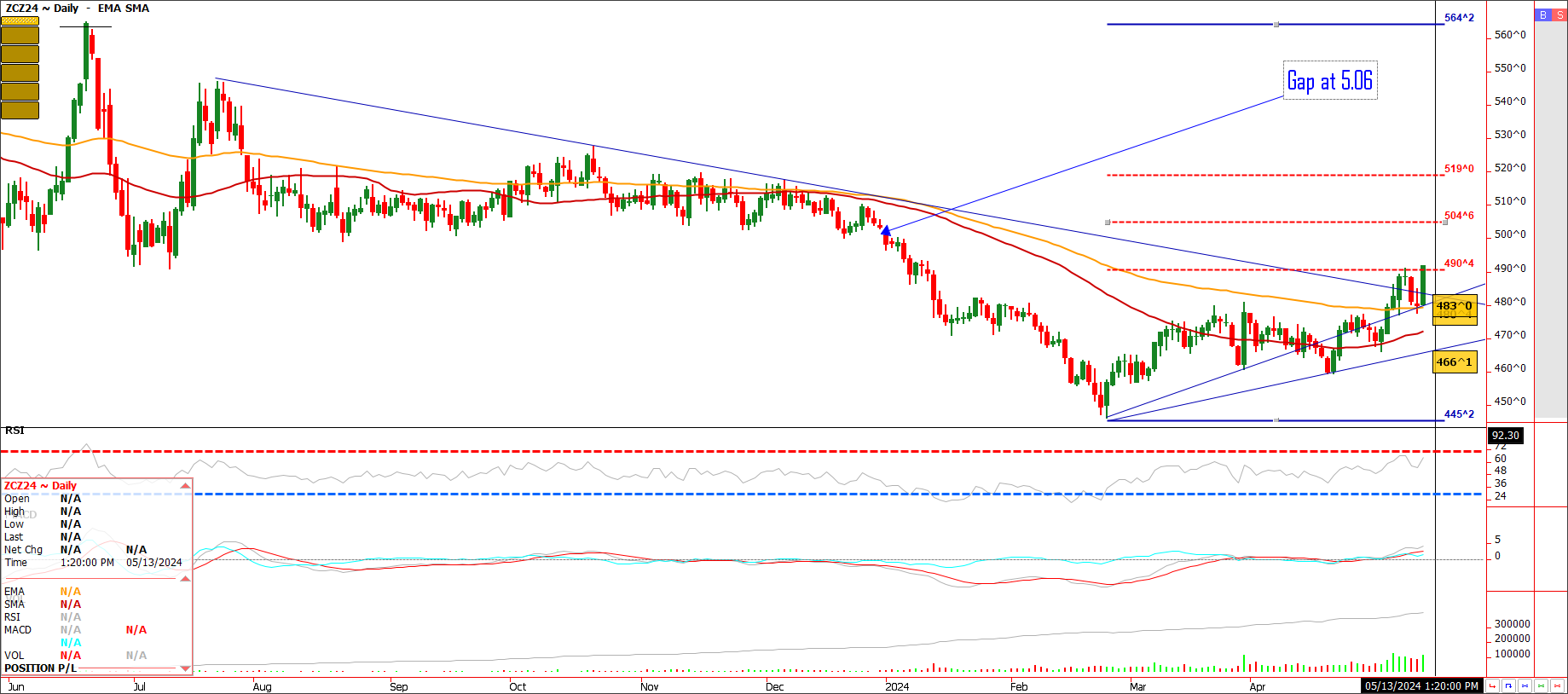

If you are planting corn this year or still have old crop corn to sell, todays numbers from USDA were Xmas come in May in my opinion. Don’t get me wrong, there is nothing inherently bullish with an old crop and new crop carry-out of 2 billion bushels. However the numbers were bullish versus expectations. USDA cut old-crop corn carryover 100 million bushels from last month. That’s 78 million bushels below the average pre-report trade estimate. Much of the reduction can be attributed to an increase in 2023/24 exports and corn use for ethanol up 50 million bushels each, leaving overall old-crop carryout down to 2.022 billion bushels versus 2.122 last month. For 2024-25 corn or new crop, USDA projects carryover of 2.102 billion bu., up 80 million bu. from this year but 182 million bushels below the average pre-report trade estimate thanks to a lower carry-in, as well as reduced acreage compared to the baseline figure. Keep in mind the USDA sees national yield at a whopping 181 bushels per acre. During last year’s El Nino, we had a monster crop due to a wet Midwest post July, that yielded 177.3 on a national average. A 181 to me is a big ask as of now especially with the potential of a La Nina entering into the forecast this Summer. That said, we will see multiple flip flops for Midwest weather into July, the key month for corn production. Wheat also aided corn today and is poised for a breakout amid short covering and a weather premium in Russia. Frost freezes earlier this week with more on the way are concerning and raising questions on production losses with lots of unknowns. A severe frost freeze is on tap this weekend until weather warms next week in the world’s biggest exporter, Russia. Watch wheat to see if it extends up to 7.00 basis Chicago. Near term new crop December 24 corn technical levels come in as follows. Support is first at 4.82. A close under and its 4.67. Under 4.67, its 4.48 to 4.46. Resistance is at 5.04 and the gap at 5.06. A close over next week and its 5.18/19.

Trade Ideas

Futures-N/A

Options-N/a

Risk Reward

Futures-N/A

Options-N/A

Please join me for a free grain and livestock webinar every Thursday at 3pm Central. We discuss supply, demand weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax