Clients, Farmers, Ranchers, x-Floor Traders,

Option players welcome

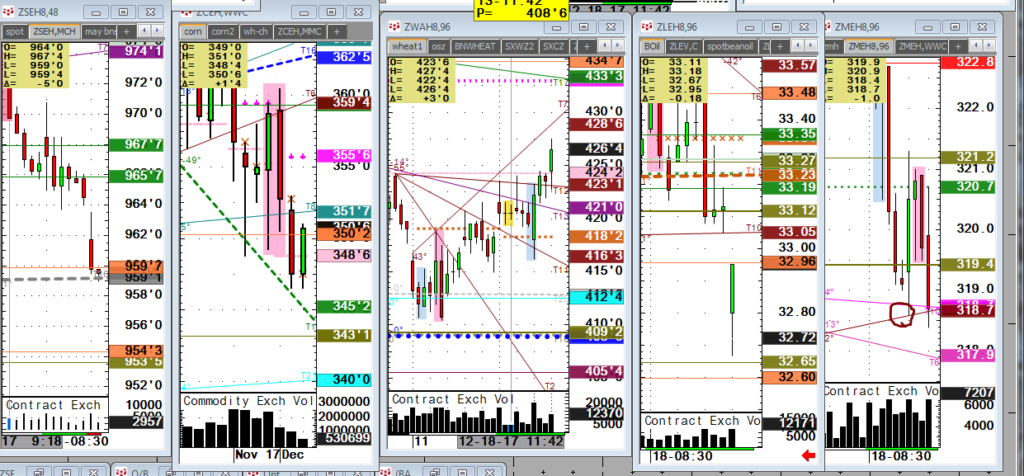

Everything is live, cocoa, cotton although over, beans in day 12, wheat explosive up in my mind, WHCH ration spread OLB now higher (buy WH).

Meats less so but USDA COT Friday 11am. Grains live. Lumber olive alert, Beans 3 diamonds conditions live Fri, list goes on as we go into year end.

PLEJ $881 hit filled (up 5% bounce)along with Gold and silver but SI weakest. All these markets in my opinion are at MAJOR CYCLICAL LOWS

Bonds broke $4,000 in 3 days, this may be the beginning of the , strike that, big markets going forward eventually morphing into the biggest bull markets with much bigger inflation.

Macro $2T tax evasion by multi nationals, and the money guys now Est $4Tril. This still could double and I have many thoughts on why you say no when someone soon wants to buy you out. That is way big picture.

Tax pkg- $750 interest deduction stands. THIS MEANS $10 MIL HOUSE (5%=$500,00 interest expense) is subsidized by you. A $10mil house deducts $750K. How many people have a $10mil house?

This pkg is riddled with this and will excel the inequality going forward except now with inflation. Big Bond Bear Market? Dust those old rules from the 80’s because this is going to get to be a wild ride going forward. All my opinion.

Sign up for Alan’s lively daily voice comments.

http://www.byoaudio.com/play/WsRQQr1Q

I haven’t had an opinion like this since I got my CBOT chance to ask Alan Greenspan in CBOT boardroom about how accounting practices doubled and double again the P/E in NASD in spring of 99’. It doubled after that before it popped. NASD hit over 700 to 1 P/E. His response, “yep.”

Let me get these charts out now for the traders.

Merry Christmas and remember what Pence said, “buckle up.”

The time to be setup was a few weeks ago to catch Bonds, Metals and now grains. Let beans finish this deep in tooth (3 diamonds today) swan dive.

I have advised to put your open orders in early so you do not miss the low tick,

But that’s just my take on approach in this high frequency trading market. They don’t care about fundamentals and they have the biggest wallet.

Throw in they trade in nanoseconds. You need to protect yourself with risk stops because this casino in my opinion has or is turning.

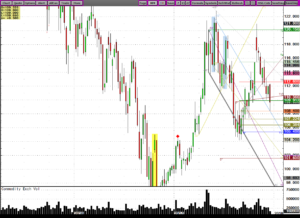

Cover your wheat needs now has passed, See this May Wheat chart. I call this the olive line victim. I was an olive line victim for years and it always cost me $100k-$200k in a previous life as a human floor trader. THIS RIGHT BEFORE MAJOR TURNS. Like now? Let me do your buy hedge because you guys are too blue in AG.

Study this chart in wheat. I call this the fat lazy money. Someone always blows top or bottom tick in size. An Alan-ism

I just had a customer get filled better than his sell stop! This is HFT that I have studied 10 years now. This is a whole new game. HOW CAN YOU GET FILLED BETTER THAN YOUR BUY STOP PX?

Email the answer after it takes a few hours. Train is a leaving the station. All my opinion. HFT high frequency abuse.

Best

Alan