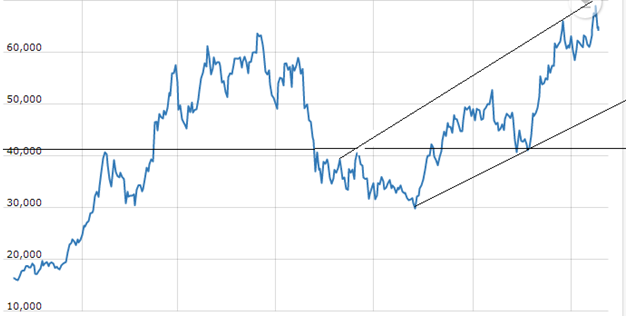

Micro Bitcoin futures (BTCX21) closed last week at 64,235 posting a small gain on the week. The week featured Micro futures hitting another all-time high at 69,360 before pulling back to close almost 5K lower from the weekly high. In my view some profit taking entered into the market the last three sessions last week. Bitcoin futures can still potentially make an eventual move to $75,000 or higher in my opinion as developments in the use of Crypto-coins keep advancing.

Twitter’s Jack Dorsey has commented on using Bitcoin for use of payments and as a holding for investors as well. His commentary comes after last week’s comment by JPMorgan calling for $146000 by year end. Use caution on levels when you enter the market. The crypto market seems to be getting much of the headline’s week in and week out. We have major tech companies as well as major banks discussing and entering into the sector consistently in our view. MICRO Bitcoin futures (MBTX21) had a volume of over 28,000 futures contracts on Friday. The micro contract allows for good leverage in the market in my opinion. The micro contracts minimum tick value is ($5 per tick), with a $2500 maintenance margin. That margin and can change without warning by the CME, and is a continuous monthly rolling contract.

.

Weekly Pivots MBTX21 (11/15-11/19)

Resistance#2- 72332

Resistance #1- 68283

Pivot- 65312

Support#1- 61263

Support#2- 58292

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Peter Ori

peterori@walshtrading.com

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member. Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

DISCLAIMER: Cryptocurrencies are a high risk investment and may not be suitable for all members of the public and all types of investors. Before investing in or depositing cryptocurrency, you must ensure that the nature, complexity and risks inherent in cryptocurrency are suitable for your objectives in light of your circumstances and financial position. You should not purchase or hold cryptocurrency unless you understand the extent of your exposure to potential loss.

YOU SHOULD BE AWARE THAT NFA DOES NOT HAVE REGULATORY OVERSIGHT AUTHORITY OVER UNDERLYING OR SPOT VIRTUAL CURRENCY PRODUCTS OR TRANSACTIONS OR VIRTUAL CURRENCY EXCHANGES, CUSTODIANS OR MARKETS.

More information can be found at: NFA Investor Advisory—Futures on Virtual Currencies Including Bitcoin CFTC Customer Advisory: Understand the Risks of Virtual Currency Trading