Many markets triggered signals that I have covered on the daily voice updates which offer valuable information the cuts to the chase.

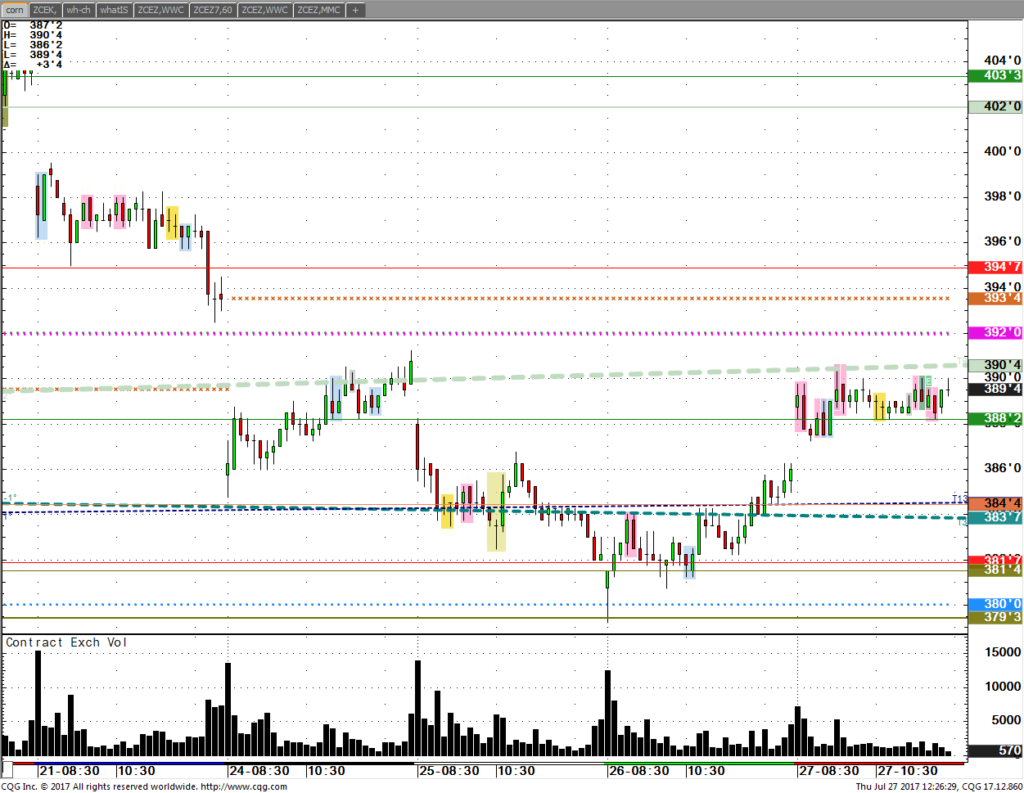

Farmer Alert– I don’t recommend hedging Corn down here as this is a buy level. $3.80 held. This is the time to be on alert to market your crop for producers. $4.15 was posted as the 1st of three levels early this month. I know producers had corn to sell a nickel to dime higher and were left unfilled.

Is a farmer ever really flat ? Look to sell in August so get some quality advise.

Enjoy the charts and be aware that these are the conditions I find the computer algorithm high frequency along with some very large Macro funds deploy buying or selling strategies in the thousands of contracts as I have shown recently in the CFTC COT data. When they hit the line it triggers trends immediately to a small delay.

dollar

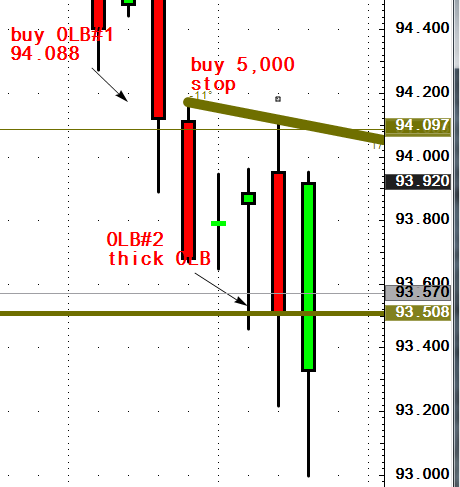

US DOLLAR- My buy level is 93.51. It did go lower for less than a few hours, a day but as you can see, once we got back over my level, it became the low of 93.51 and then started higher. This is a good buy but here I show where computers sell very short term.

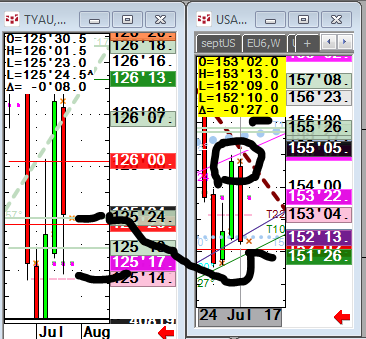

hERE IS ANOTHER VIEW FOR LONG TERM PLAYERS. What is your trader profile? Would you be interested in buying within less than one day of a bottom?

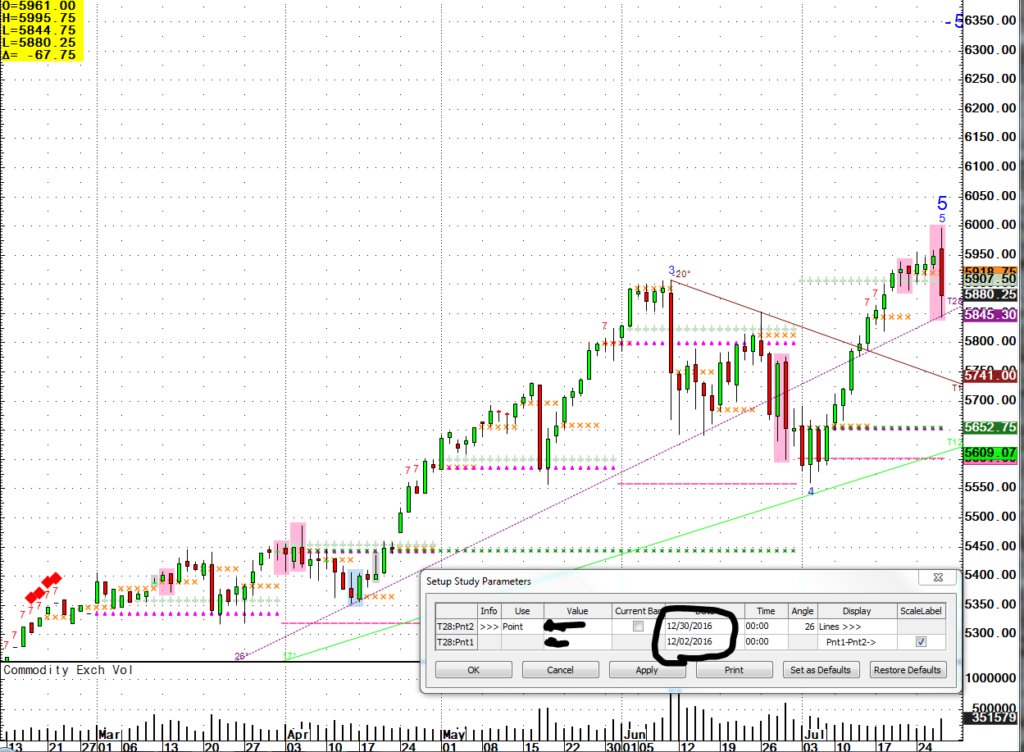

DATA IS IMPORTANT- Here is a long term trend line that is detailed which also was a tick away from yesterdays low. When I get a few levels together they prove here again how powerful they can be. Corn rallied a dime immediately. This is a good trade where a 10 lot in corn which is small picks up $5,000. Now I am getting interest in buying corn after a dime rally. Well, I guess someone has to buy it higher. This could be this weeks summer low into August.

DATA IS IMPORTANT- Here is a long term trend line that is detailed which also was a tick away from yesterdays low. When I get a few levels together they prove here again how powerful they can be. Corn rallied a dime immediately. This is a good trade where a 10 lot in corn which is small picks up $5,000. Now I am getting interest in buying corn after a dime rally. Well, I guess someone has to buy it higher. This could be this weeks summer low into August.

Corn

Bonds- I have and continue to think selling bonds by any of those lines last week.

Markets are ready to really get more volatile presenting opportunities like these.

When you need a good number. Not a lot of noise with levels everywhere but when you need a good level I offer customers the only levels you need to trade off of. Corn to nasd 100, cocoa, coffee soybeans wheat and the US dollar.

YOU GOTTA BELIEVE

BUY THE OLIVE LINE ON BOTTOM that was alerted early. Did your broker have?

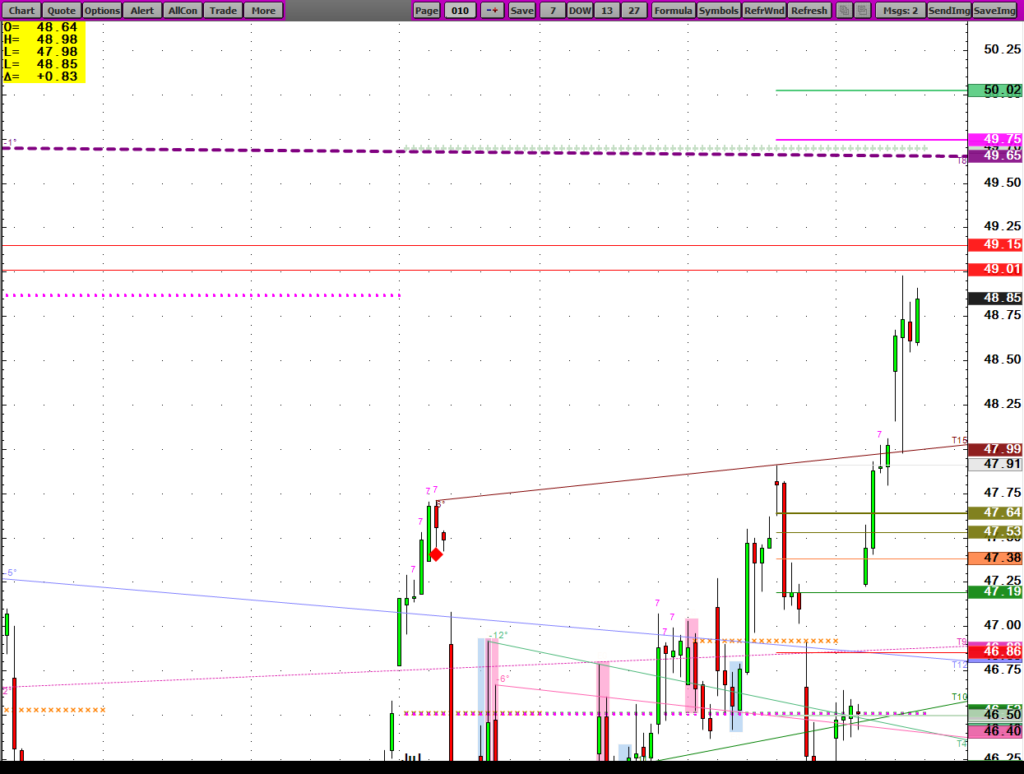

CRUDE OIL- WHEN YOU NEED A LEVEL THESE ARE ONLY ONES YOU USE in my opinion but maybe your are better.

H

nasd 100- see what the low in upper left is as we bounce 50 handles up immediately. That is excellent technical analysis that adds to your bottom line.

THIS LOW IS LESS THAN 2 TICKS OFF. That’s quality after a 600 tick break to be within 2 ticks isn’t it? You need to add this to your arsenal. Experience dealing with money while keeping risk to a minimum over 20,000 hours of studies.

NASD100- THIS MARKET JUST BROKE A WHOPPING 150 HANDLES and your brokers line catches. Is that analysis that you get?

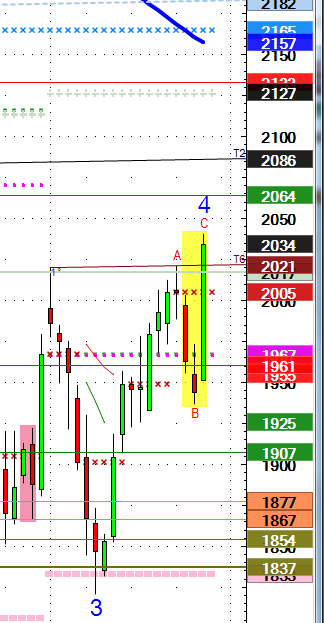

COCOA- NOW BREAKOUT AFTER OLIVE BUY AT BOTTOM.

cocoa-olb1837-neckline2021

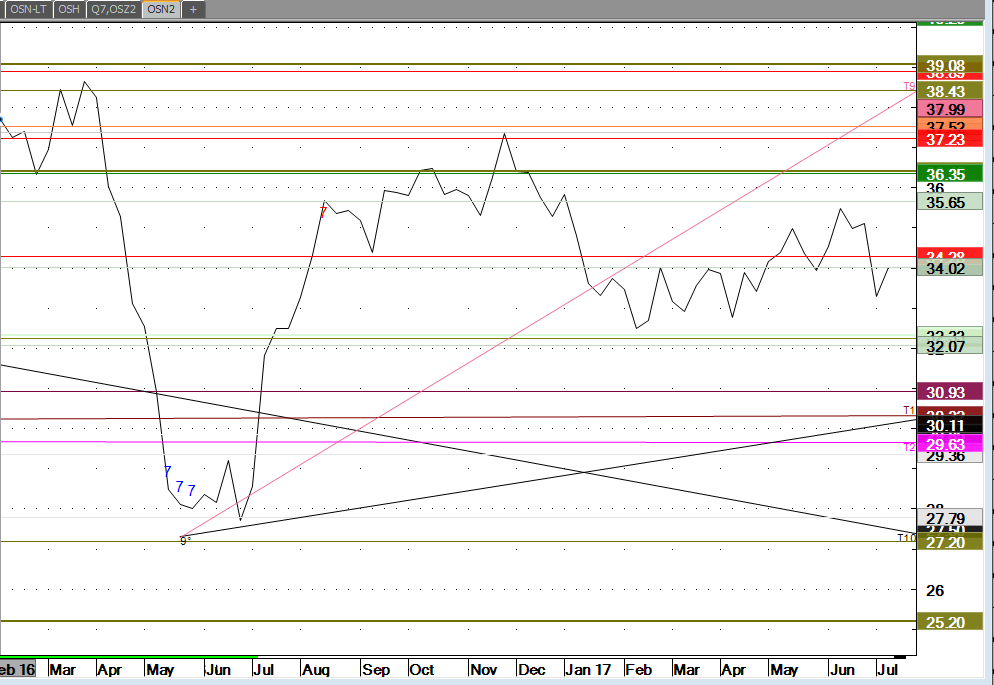

OILSHARE- LONG BEAN OIL SHORT SOYMEAL. OLD CHART FOR EXAMPLE PURPOSES.

Farmers should be getting ready to sell this rally for row crops. Call and let’s discuss a plan.

TAX REFORM- We are in Sequester and this will not be settled in my opinion as this requires constitutional law as well as political parties whose whole purpose is to not get along with the other side. It’s busted and could spin out of control fast. Repatriation is something that should be feared and taxed, not welcomed which can have unintended consequences. If I am correct we are months away from chaos in markets. Find someone to give you color and a game plan.

Best regards, ARP