2/7/24

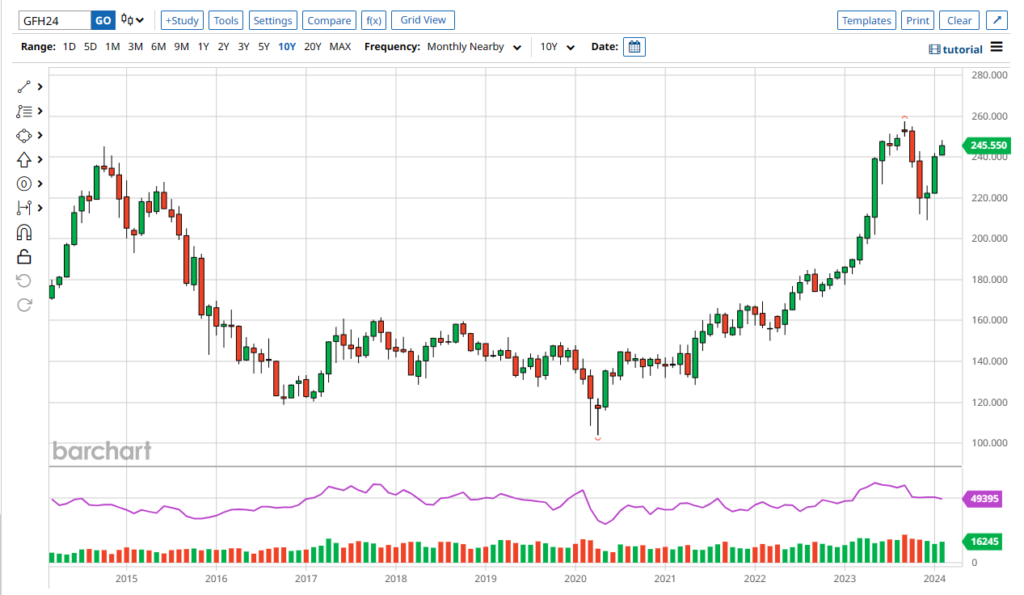

The Cattle Markets traded close to the 1-month highs this morning, then broke back down, while the Grains dropped on the open. April’24 Live Cattle was 1.275 lower today and settled at 184.800, just above today’s low of 184.350. Today’s high was 186.200, just below the 1-month high of 186.575. The 1-month low is 172.275. Since 1/5 April’24 live Cattle are 11.400 higher or about 6 ½%. The feeders followed the same pattern. March’24 Feeder Cattle closed 1.125 lower today and settled at 245.550, half a dollar above today’s low of 245.050. Today’s high, set this morning was 248.250, and is also the 1-month high. The 1-month low is 223.850. Since 1/5 March’24 Feeder Cattle are 21.400 higher or mor than 9 ½%. The Hogs also fell today. April’24 Lean Hogs were 0.150 lower today and settled at 81.100, just above today’s low of 81.050. Today’s high was 83.075. Since 1/5 April’24 Lean Hogs are 4.725 higher or just over 6%. The Beans and Corn Markets continued to break today, while the Wheat market climbed above $6.00. March’24 Soybeans dropped 10 ½ cents today and settled at 1189. The Beans bounced 9 ¾ cents off today’s low of 1179 ¼, which is also the 1-month low. The 52-week low is still 1145 ¼, just 34 cents from today’s low. We will see what happens tomorrow. Since 1/5 March’24 Soybeans are down 67 ¼ cents or over 5%. The Corn Market was lower and set new lows today. March’24 Corn was 4 ½ cents lower today and settled at 434 ¼, not far above today’s low, the 1-month low and 52-week low of 432 ¾. Since 1/5 March’24 Corn is 26 ½ cents lower or almost 6%. The Wheat Market was the only one positive today. March’24 Wheat gained 7 cents today and settled at 602. Today’s high was 606 ¾ and the low was 590 ¾. The 1-month high is not far away at 617 ¼, while the 1-month low is 573 ¼. Since 1/5 March’24 Wheat is 14 cents lower or over 2%. There is a WASDE Report tomorrow. and we will see what influence that has on the markets. The weather is South America has improved, and the harvest is underway. I still feel that there will be more acreage planted in the Soybeans than expected, and I believe the South American crop will be huge. I still feel the Cattle Market is overpriced. It might climb a little more in the short term, but it’s still my opinion we will see a break starting soon and continue through the summer. If you are a producer, I recommend you protect your downside exposure. The Chart below is the 10-year Feeder Cattle Chart. The movement from 2014-2015 looks very similar to the 2023-2024 movement so far.

-Bill

312-957-8079

I have Option Strike prices every Friday.

I have market commentary and option charts in Pure Hedge – Livestock

and Pure Hedge – Grain at WWW.WALSHTRADING.COM

Call for specific trade recommendations.

1-312-957-8079

Email me for free research.

Bill Allen

Senior Account Executive

Direct: 1 312 957 8079

WALSH TRADING INC.

53 West Jackson Boulevard, Suite 750

Chicago, Illinois 60604

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.