PURE HEDGE

| CATTLE |

April live cattle rallied $1.325 to end the week at $165.425; which marked a 5-cent weekly rise. March feeder cattle futures rose $1.425 to $190.00, while the April contract surged $2.175 to $196.025. That was a weekly gain of $2.45 for the April contract. History in the form of the 10-year average implies cash cattle prices will reach a seasonal peak in late March, but in my opinion, spring rallies tends to last into late April of years when steer weights are running below year-ago levels (which reflects a shortage of market-ready animals in feedlots). That is certainly the case this year, with the latest steer dressed-weight reading coming in at 906 pounds per head versus the comparable 2022 figure at 921 pounds. The wholesale market has room to rally I believe, since choice beef cutout spiked to $475 during the pandemic and twice topped $340 in 2021. The record for cash cattle prices is around $172.00 from 2014. Given current market conditions I think the bull market in cattle and feeders is likely to continue next week, since market-ready supplies are extremely tight and demand remains robust. Cash cattle trading for the Monday-Thursday period averaged $164.84, up $1.19 from the week prior and $1.12 over last week’s five-area average. Choice beef cutout rose $1.58 to $290.08 at midsession Friday, which puts it in position to challenge the January 2022 high of $293.50 in the days ahead. Given the modest slide in retail beef prices over the past 15 months, we expect consumer buying to remain robust in the short term.

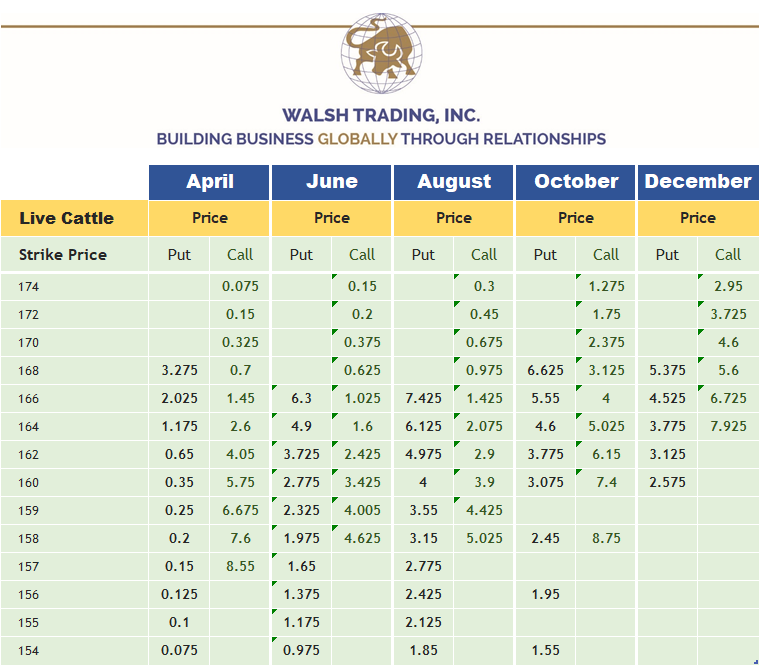

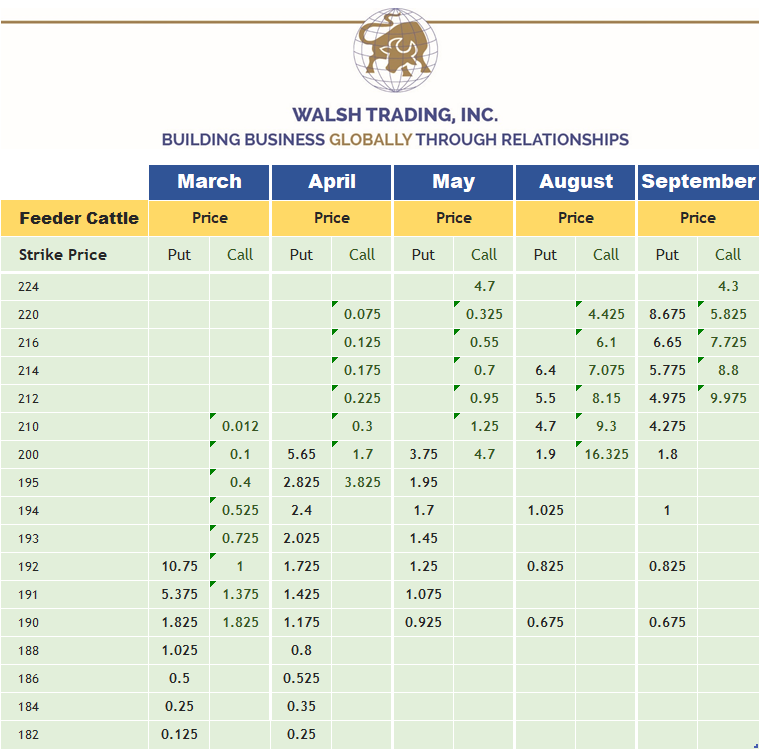

See below an example of the Cattle Producers Breakeven Calculator, only available to Walsh Trading customers, to get a more defined outlook at how you can protect your cattle production. Keep in mind, commissions and fees are not included in the cost of the option.

*Cost in above table does not include commissions and fees

*Cost in above table does not include commissions and fees

**Call me for a free consultation for a marketing plan regarding your livestock needs.**

Peter McGinn

Account Executive

Walsh Trading, Inc.

Direct: 312-985-0931

Toll Free: 800-556-9411

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research