| CATTLE |

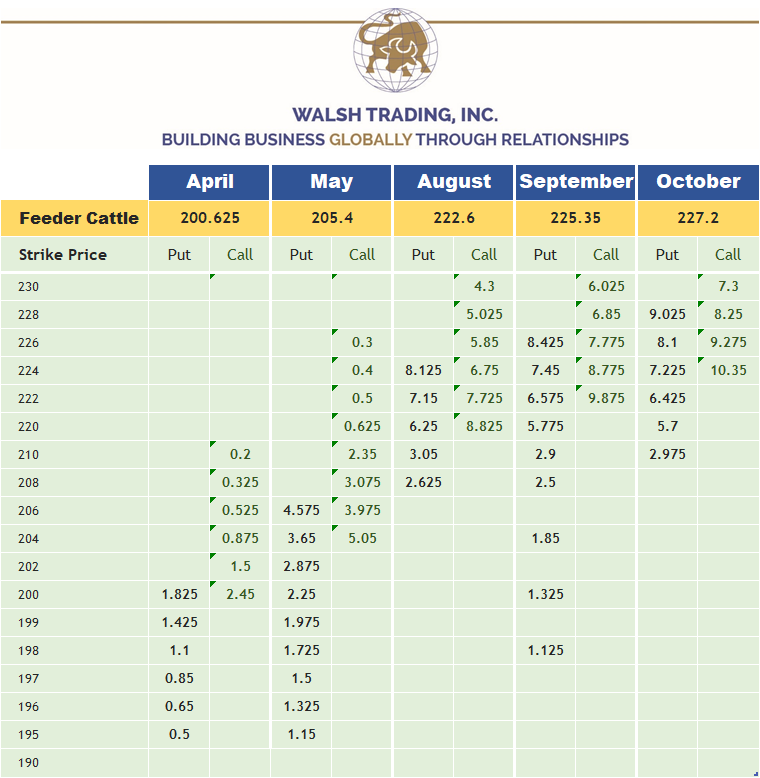

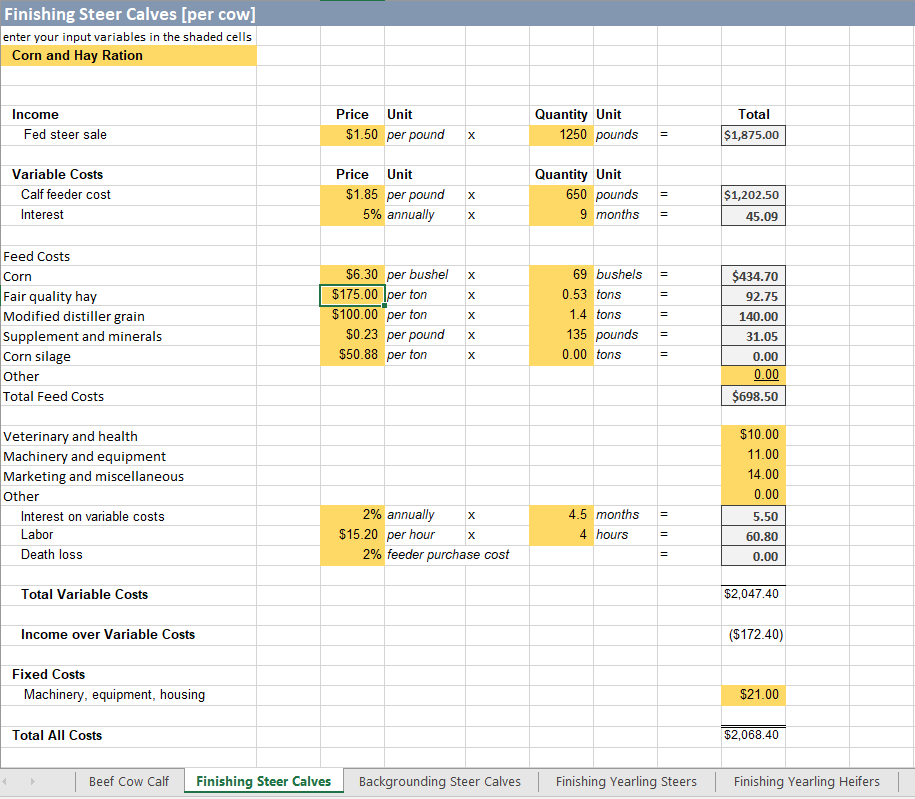

Cattle prices this week rallied sharply ending the week up 1.62% after all contracts gapping higher today due to cash market trades. According to CattleFax, Wednesday, April 5, 2023 Light fed cattle cash trade occurred in the North at mostly $174 live and $272 to $275 dressed, which is mostly steady to $2 higher than last week. Light volumes traded in the South at mostly $170 live, which is $2 to $3 higher than the prior week. Moderate to active fed cattle cash trade occurred in the North at $168 to $172 live and a range of to $266 to $276 dressed with the average being about $171. This is mostly $4 to $6 higher than last week, and the highest trade seen so far this year. Moderate volumes traded in the South at $165 to $168 which is $2 to $4 firmer than last week. Market-ready supplies of cattle in feedlots remain quite tight, as implied by the widening spread between choice- and select-grade beef (at $12.37 as of noon Thursday) and more directly indicated by steer dressed weights at 895 pounds per head, down 15 pounds from year-ago. We also expect grocer beef demand to hit full stride next week as they buy actively for planned features over the first weekend in May. Their buying will probably slow later in the month, but they’ll begin focusing upon purchases for Memorial Day weekend soon thereafter. We still think it’s entirely possible that demand strength and tight front-end cattle supplies will translate into a belated early-May peak in cash cattle prices. See below an example of the Cattle Producers Breakeven Calculator, only available to Walsh Trading customers, to get a more defined outlook at how you can protect your cattle production. Keep in mind, commissions and fees are not included in the cost of the option.

*Cost in above table does not include commissions and fees

*Cost in above table does not include commissions and fees

**Call me for a free consultation for a marketing plan regarding your livestock needs.**

Peter McGinn

Account Executive

Walsh Trading, Inc.

Direct: 312-985-0931

Toll Free: 800-556-9411

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research