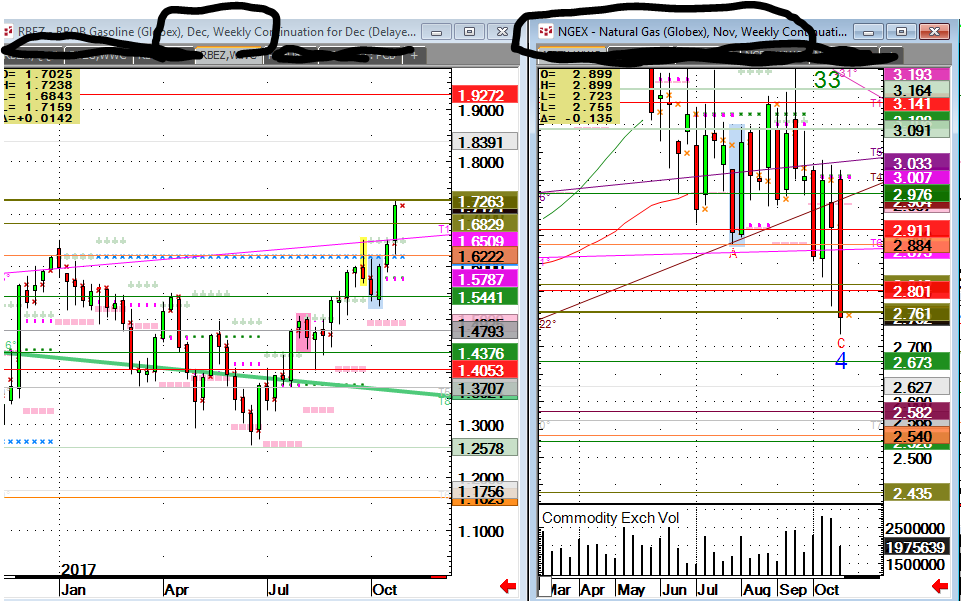

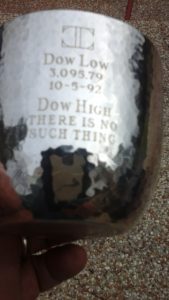

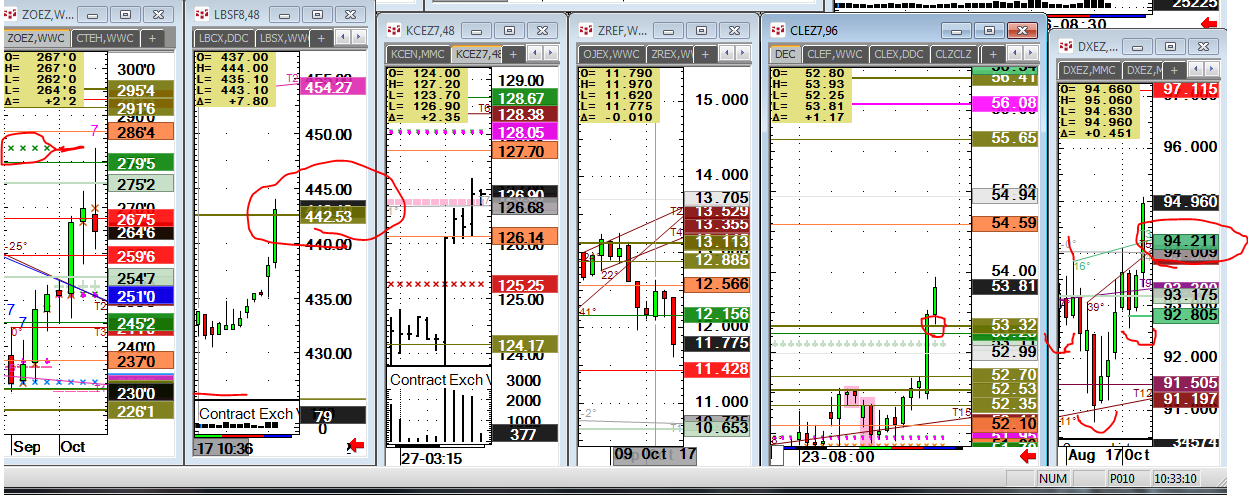

Today we had some wild swings across the board as you will see in the charts. Study the charts because there is a rhythm to this. Get over a line, especially an olive, algos buy as a scratch and pushed crude up today but this happens everywhere. Stocks are out of control but S&P and Dow are at a few

small yet large levels in percentage terms. Dow had a tiny OLS today and yesterday, not new highs, for last few days anyway. Stocks making new highs can’t be shorted as proved on the butt rippin in NASD today. Breathtaking to me. Foreign money buying?

Amazon is taking over the World, retailers down big today. This is cannibalizing all human employment and these guys pay no income tax, per se.

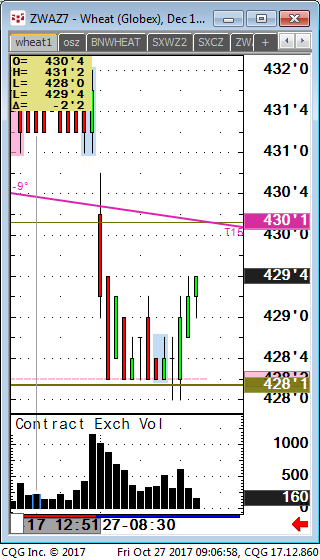

Grains, not much, wheat could be value play down here. Beanwheat interesting levels as extremes now in spreads again. BOZ- now up 250 off that 3232 OLB pretty much straight up pattern.

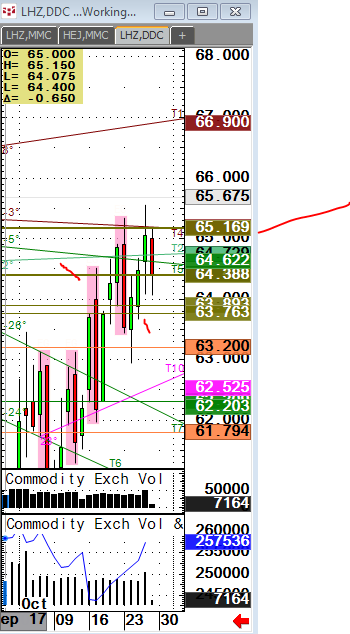

Meats in general- If looking for a top this is a level but back over like this am I would be concerned so use stop over highs. These meats are sometimes sloppy, sometimes pretty tight with my levels but someone starting selling patterns down. Use each level as a pivot if your trading is my only comment and opinion.

If you think this would enhance your trading, call. I find these patterns work in everything. What’s ethanol doing? Nat Gas crude both hit olives in opposite directions. Is there a pattern?

Good Afternoon,

If one is looking to sell cattle this is sloppy but I have my olive sell levels. Notice how this interday looks where selling just seems to come out of nowhere. New high stop as this is sloppy, same in hogs.

I wouldn’t want to be short over but this gives some perspective on how this price action plays. Check the two feeder charts if interested. LUMBER-? CALL me Monday. There is too much to write about so be sure to check my voice file comments.

May beans hit a long term macro support line, Nov also but off bottom of old lows. A chart is worth 1000 words so enjoy the charts. Look when olive get taken out like in crude, one chance to scratch and then blast.

If your bearish, call me.Sugar up 50, looks decent, OLS sells above. 14.70-ish last.

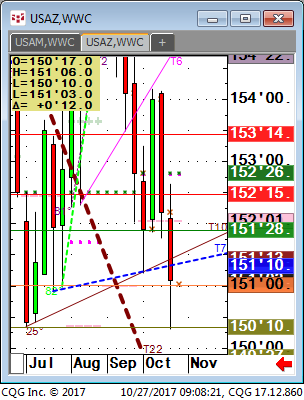

BONDS HIT OLB#1 THIN. This is how this plays in bonds at low.

OLB#1 is 150.10. Today it was exact low and what I had to strive to discover. This is the most potent tool I think I have. You would take it or take a pass. Bounced almost $1,000 per one lot.

h

h

h