It was getting ugly in the wheat complex with spec longs among others getting run out well below 5.00 amid yesterday’s rout. Both KC and Chicago contracts were staring at the 4.60 level should we have fallen hard below the last bastions of key support at 4.87 (Chicago) and 4.82 (KC). We have been bemoaning the lack of demand for …

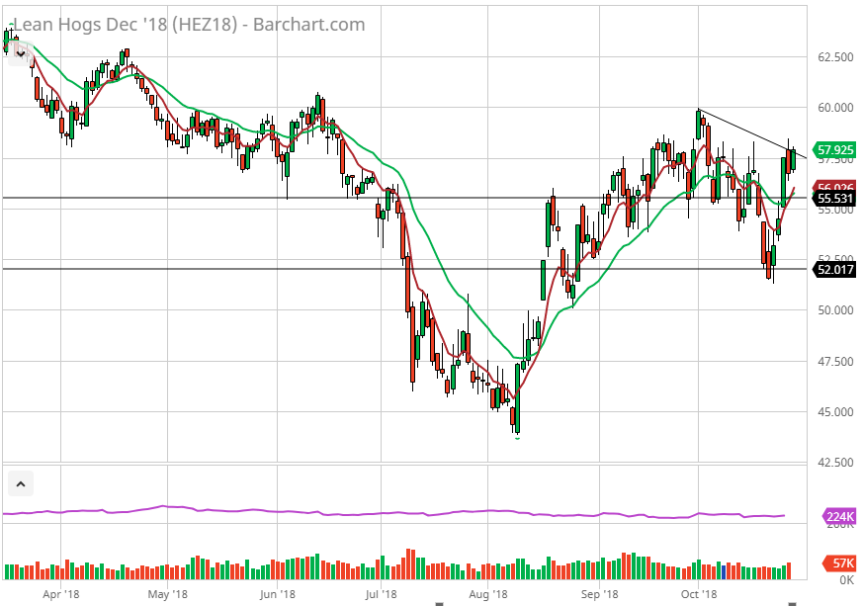

Lean Hog Call Strategy

Hog option strategy. In my opinion, I think Hogs will strengthen further, I am looking at Call option strategies with Put hedge’s. Hogs are highlighted from swine fever, from the world’s largest producer China, with Europe and Russia having the same issue, the Chinese head counts being culled by some 300,000 also Russia and Europe having to do the same. …

AG TIME – Crush it All

The markets are rebounding today led by meal. It is my belief we are potentially on the verge of a large shift in the oilseeds in general. The slow down in Chinese imports is a large story. The ramifications larger. The demand growth for beans and consequentially meal has been unprecedented year after year. This is stalled. Actually predicted to …

Nasd FANGS buckle, Egypt Wheat?

ARP HERE, ALL OPINIONS,ESTIMATES,NEWS,THAT I PERCEIVE MOVE THE MARKET. I have talked for some time in my posts that stocks are overvalued. It is my belief the NASDAQ PE is silly high. My goal is to assist you in these extreme levels through the Olive Line. In my approx 40 years of charting and trading the markets, these may become …

End of October Focus

Storage tightness with beans and corn, first notice day against the November beans, end of the month position squaring, political events and the impact on trade policy and attitudes might be what we will be talking about on Sunday night and Monday morning when we return from the weekend……………………………Of course, most of the air in the room will be spent …

Grains, Consecutive down now? Softs

EQUITIES – STOCKS It is my belief we may be in “The beggar thy neighbor economic cycle.” I can’t remember seeing action in the US like this. Perhaps in Europe and China. US stocks, I put out a OLS in the nasdaq100 at 7685. Nasdaq now has OLB below the market – give a call for levels. Nasdaq – I …

AG TIME FULL PRESSURE

The soy under pressure as harvest rolls on, The weather looks very solid to push harvest numbers. The South American weather has been good. There are a couple areas of concern creeping in. As said yesterday this is a normal scenario. It is impossible to plant a crop over the size area all of SA covers without some areas of …

Awaiting Harvest’s End

It appears that we’re flushing out some speculative longs in wheat and oats while corn and beans haven’t been as nasty to the downside as the only longs there are farmers holding the physical and end users are patiently awaiting a final flurry of selling near the end of harvest when some forced selling because of storage tightness might occur…………………………………………….It …

Livestock Report

The cattle markets continued their choppy trade on Wednesday, October 24, 2018. Both markets rallied and tested upper resistance levels. January Feeder Cattle saw buyers come in and lift prices above resistance at 152.30 to the session high at 152.425. Sellers came in and took price lower and Feeders settled at 151.35. This below the 151.55 key level and follow …

AG TIME – The Numbers Don’t Lie

The soy remains under pressure. There are not a lot of new stories out there. The Harvest progress domestically is progressing nicely. The long term weather outlooks support more of the same. The South American planting, especially as it relates to Brazil, is advancing rapidly. The Brazilian is approx 50% or so planted. The weather outlook there remains favorable except …