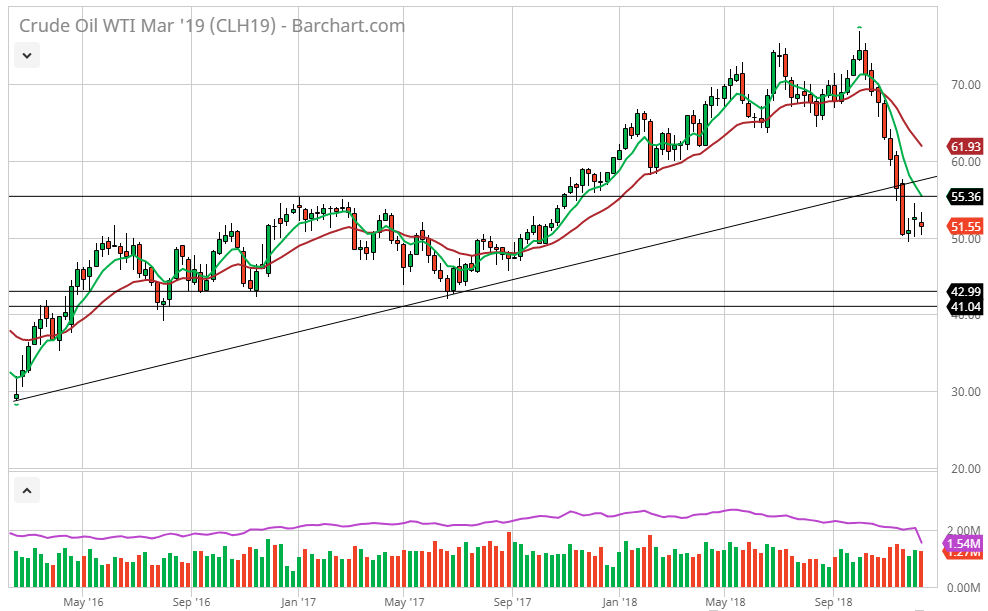

Crude Oil fundamentals are still pointing lower in my opinion, US fracking companies are pumping at their highs and OPEC is fracturing apart. Regardless of OPEC’S production cuts, some non OPEC countries are pumping at or near their highs. Data from the EIA shows solid stockpiles of crude oil. Also providing stability to the oil outlook in my view is OPEC countries like Nigeria, needing to keep Oil flowing because they depend on oil revenue for their economy in a big way, also China’s oil output will still increase to get back their investment money from deep sea exploration and fracking. In my opinion I look for Oil to go lower towards$42.00, last as of the writing 51.81 in MARCH 19 futures.

With this in mind consider the following trades:

Buy MARCH 2019 43.00 Puts costing .63 = $630.00 of quantifiable risk plus fees and associated costs per transaction to enter the trade, the MARCH 2019 45.00 Put cost .79 = $790.00 of quantifiable risk plus fees and associated costs per transaction to enter the trade, or the 42.50 Put costing .47 = $470.00 of quantifiable risk plus fees and associated costs per transaction to enter the trade.

I always provide a contrarian view to my strategies, so look at the MARCH 58.50 Call costing .92 = $920.00 of quantifiable risk plus fees and associated costs per transaction to enter the trade, in case of market disruptions or a geopolitical event.

The MARCH 2019 options settle in 62 days 2/14/2019 on MARCH 2019 futures.

To discuss any strategies please feel free to call 888 391 7894 or email peterori@walshtrading.com

Walsh Trading, Inc. is registered as an Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors.Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise ofa long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information,communications, publications, and reports, including this specific material,used and distributed by Walsh Trading, Inc. (WTI) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

The information contained on this site is the opinion of the writer and obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in current market prices.