Macro Trading

Assessing Social mood

Budget deal can turn immediately. I think you need to be ready with margin money ready to deploy at my olive extremes that present value while I’m looking for at least 5x ‘return on money risked (per bet expected return). I measure against margin money posted also which I look at a little differently.

This is only way I find to trade high frequency idio-sa’s price environment behavior controlled action.

Related contracts, spreads go opposite directions! USDA report Thursday, beware. Will a bullish bean report be sold into? Bean wheat ratio spread at $1.47 over folks, was about $2.00 under not long ago. Spreads are how they waterboard the naked long and shorts in my opinion. When they turn, hang on to winner because it will turn into much bigger winner and fast has been demonstrated time and time again.

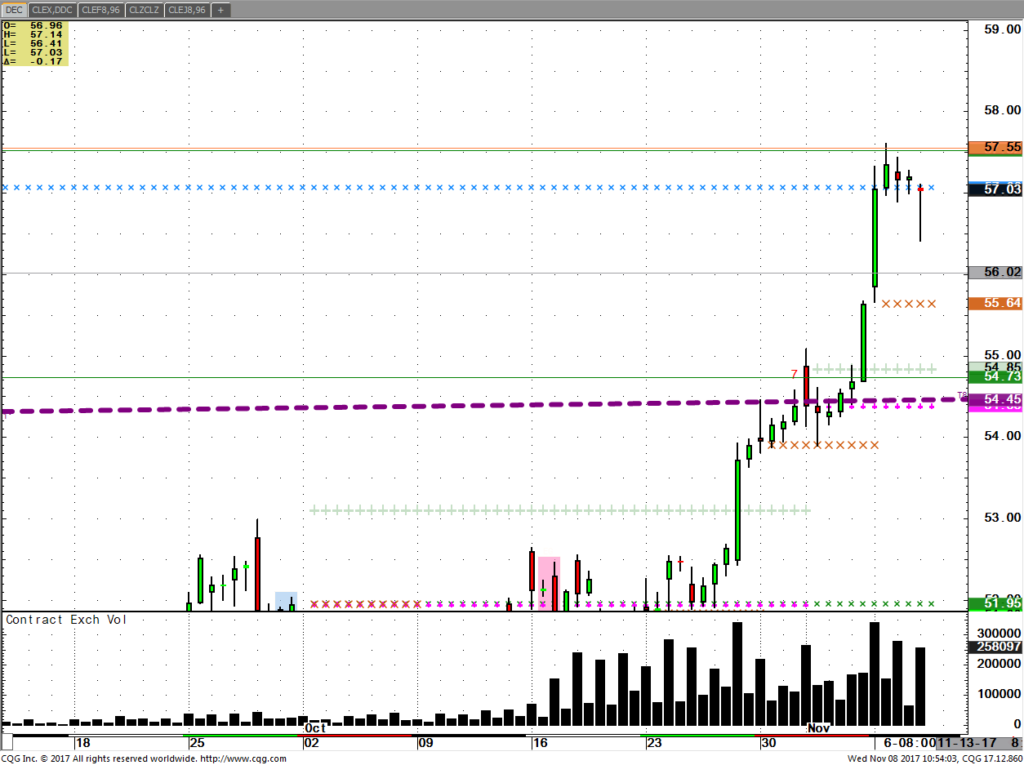

Two levels, orange and a green, different duration’s but two levels this close is potent, or can be like here. This could be the high in crude but new high stop if playing is key. Do you see the pattern?

Clz17-CLZ18- case you n point, recent range minus $2.00 – plus $2.00 is or was a conservative way for non-traders to participate rather than get naked one way or other. Let me find the trades for you or ask for daily levels if that’s your profile.

Fed FRB YIELD Curve narrowing. Does that make you nervous? 2-10’s- now .67-.70 BP. Come on Ag bankers don’t let those big city banksters slap you around and DO NOT SELL out too cheap. Life Ins. Buying farmland. Keep it. You always want to be an owner. Look at Soros and that gang caught short short short US stocks last year today! Think money creation my ranchers.

Speaking of Cattle my non livestock fundamental trader mind question today is this Argentina tied buying by an insider. Arg had little chaos playing out but at end. Did a buyer switch to USA beef? Didn’t someone NY have something a while back.

Yes this is teasing stimulation but I can put ideas your not capable of asking or visualizing the landscape backdrop. You want a broker that asks the right questions. Right? I got that back at Tudor. Dow high, no such thing pik on www.WalshTrading.com yesterdays my walsh post.

Also signup for my daily general voice recap of what extremes I casually see like beanoil now over 35.00 up from OLB buy and hold 32.32 posted 7 weeks ish ago. Outside up week as we speak but levels just above that may provide hooks.

If you like my beanoil story you bought it. When it hit macro event sell lines we peeled a few off but, looks and could be explosive, use stops. This is why today. You never know how much winners are going to pay, now up respectable 300 points, small contract, $6 a tick, 10% move almost. Oilshare has been covered for years to pros and came to 33.87 had two levels within 20 ticks on last 300 break against meal soybean meal.

Many other thigns offering opportunities so you may want to consider coming over to Walsh so I can find these and offer them up to you. Best.

ARP

Crude- steady on the year might be simple enough if you have not been short and think the US is energy dependent, or more than before. The event that just crushed shorts could seem like a good short since I can make a case that nothing has changed. Notice the relentless pattern denoted by the red diamond. If looking to short and I always say new high stop max, but watch these levels.

Sure demand is up but that really has been for the last year if I am correct.

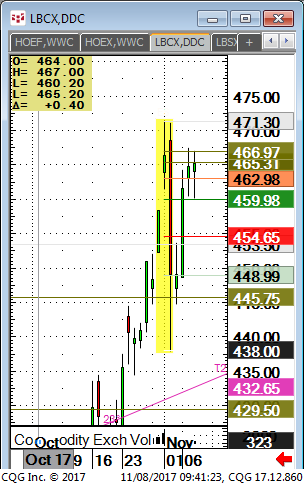

Lumber- This is over a 442, sell level and does not appeal to me. This may be a little overshoot due to how small this futures market is so let’s pay attention especially with the roll. Lumber is like Spu’s in that they only slow the accent and do not break in any meaningful way. Are the insurance companies buying lumber as a hedge? If you like abstract ideas that sometime hit the wall then let’s chat for a few.

Rice- This held good lows last two weeks if you’re a user. It is just a decent level 11.43 and this train may be leaving station. Silver- buy it when it crashes, it seems to do it all the time in my opinion. Coffee- Commodity funds feel like they are selling to infinity? Is that what is happening to volatility to finance the budget deficit?

Oats- $2.31 was low OLB and even though we broke 25 cents this feels glued to the highs. What’s up in oats?

Live Cattle- Once this took out 120.60-ish it was ‘all shorts out of pool’ A new level might prove to spill Dec LCZ as it seems the huge buyer on gap over my level may have liquidated. This happens as a big player bought 10,000 cattle and then on other post when algo sell was detected they got out as shorts paid up.