This is larger Macro big picture swing type trade levels, use stops accordingly. HOW TO READ CHARTS- Look for high or low bars to be on a level exactly. Yes these are that research specific and where computers buy or sell off of.

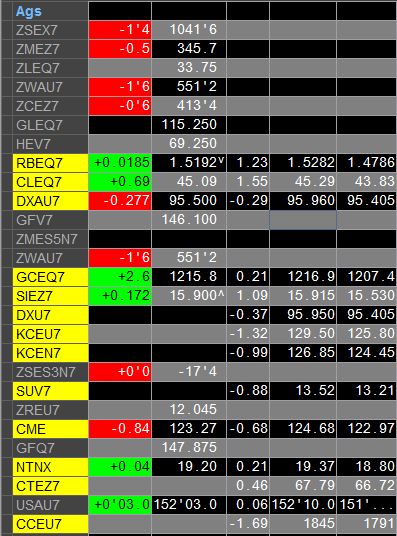

Hogs– possible major top cited 71.44 as OLS olive sell, potent. Below levels 69.00, 66.21**. Hogs up 14% ish since Apr end. My charts are a day trader’s dream, levels pretty clean time sequence specific.

Dec Cattle– 120.60 – 111.93 range bound. Danger under imo. AUG- 113.44, 112.58 are must hold support. Any small markets I have but you need to inquire. These are all the same conditions programmed which keeps signal levels clean. When they break line they go.

Feeders– small breakout up Aug, 151.70-152.10 both big 1st time up. 149.20 next area where buying runs out.

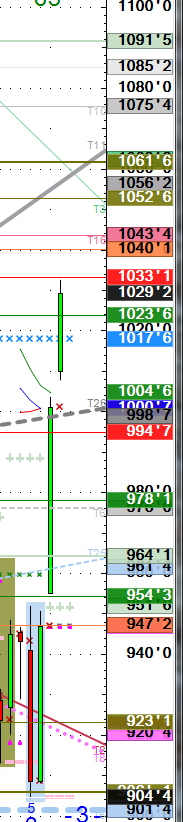

Beans- Continues parabolic upward thrust off $9.06-08 level, summer play. 1050 small level, not much over now. I would have had you long there with one rule which is a must. YOU MUST KEEP THE RUNNER, LET IT RIDE and this is why. Yes it is hard but like this rally.

Gold- Buy levels 1200 small, 1176, 5% lower.

Crude No comment. Funds have been crushed imo. May reassess game. buy under $42, shorter term has higher levels, 43.18-ish. Oct.

Dollar- 94.50 last. I think we will be sloshing around in glut of dollar is my trader feel long term. This will be wild as unfolds.

Stocks Index- No comment, sell nasd levels 100 higher, relax.

Aug beans- 3rd week bull mkt. 1033 is a 50% & high. 1056, 1061.5 OLS decent w tight stop if bearish., 1091 above SEPT BEANS – 1038.75 IS GOOD if need a sell #. I do not use and consider sept a bastard month, Delivery month.

levels in right column.

c

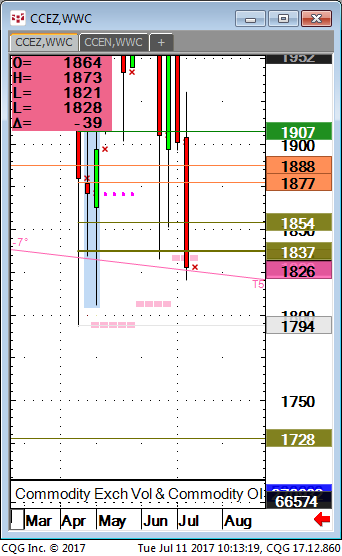

BONDS AND NOTES- LONG TERM TOP MAY BE IN, 156 handle cited

BONDS AND NOTES- LONG TERM TOP MAY BE IN, 156 handle cited

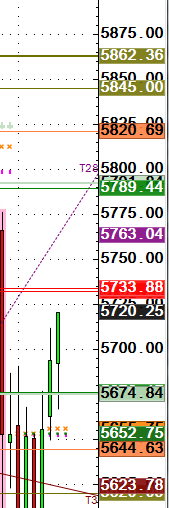

BELOW IS soybean chart in reverse. This is where they get traders, funds and shorts all jacked up, and flat or they flip long has happened for last year in everything asset class.

The olive line hurts most traders. Some DJ Titan Stock index. No comment but you tell me what you would do?

nasd100

Aug beans- sell olives if bearish, line also 1062. 2 day 50 cent break? Maybe.