Good morning Farmers, Trader’s and you,

If you like the levels so far here on Walsh from meat sell levels (feeders, live cattle) or the soy complex (meal and oil included) buys hit last few weeks I want to use this time to explain a live level on how I think we approach technical patterns when they appear. I only want to focus on decent moves of 4 or 5% moves min. Here the nasd100 got over thick olive line and went up to targets is point being made. I think this is how professional

money plays and so should you, my customer. I think major turns just happened in what I have provided market color the last month here at Walsh but I need some feedback and I need to be your Broker if you like this research. Enjoy this Nasd top that topped on a firm citing the Fang stocks which are in the stock indices we trade.

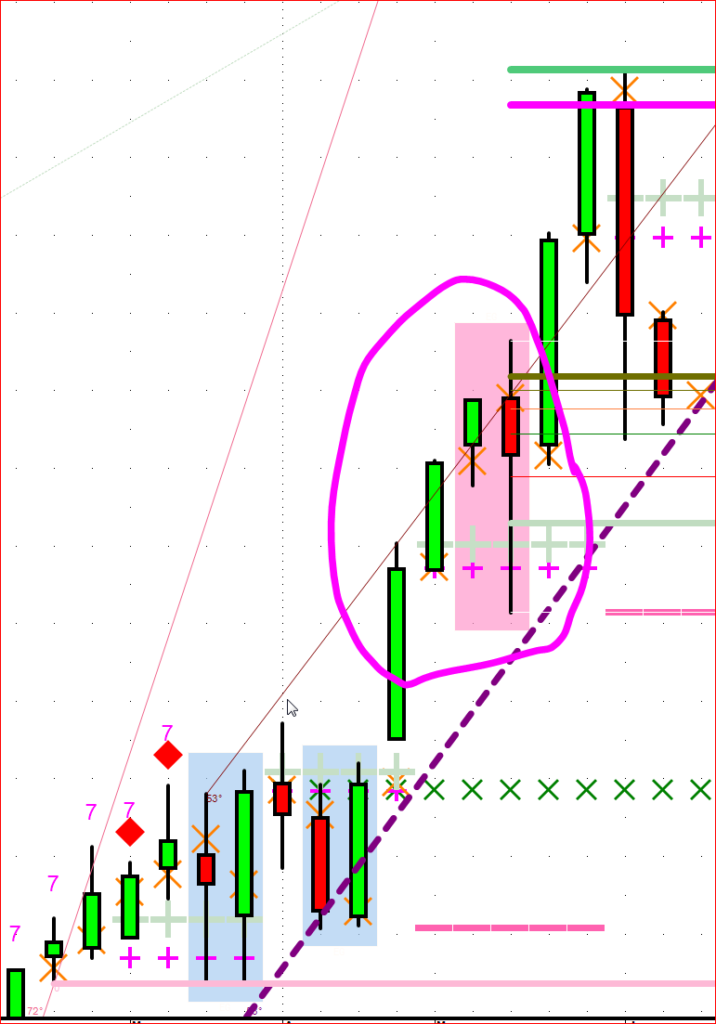

Rule, when an olive line sell is violated; NASD100 futures here 1st.

I try to explain the sequence as I see this master algo rule of an olive line violation.

This is how I see whomever big uses this must have discovery.

Over 5709 I have cautioned there was absolutely nothing to be short against otherwise.

Result here was a pretty perfect straight up move, fast and other characteristics that ballpark this.

On way up remember we did consecutive up not once but several times which has never happened before.

Now of course this rule is over but I wanted to point out how to use the charts if one doesn’t get the full appreciation for the olive line

The number that hurts the greatest amount of traders.

This last part of my study has taken two years to make more sense of it besides just using the levels to trade off.

I hope it makes more sense so you can make cents.

Ignore levels on way down but a green was there of this whole tiny 230 handle break.

One Macro strategy pattern I suggest. No shorts over is how algo plays. Buyers buy up to targets, explanation needed of course.

h I am not long term bearish. This is more how to play macro moves and not an opinion in a few words. They want me to keep short, levels.

Here is how I see they hook bearish players. You need game plan to reverse long over this olive sell level. When it is wrong it is really wrong (short that is here). This is computer language opinion from a technical analyst floor trader and has been called out last two weeks on Walsh.

This turned into a bear hook. It worked one day. Do you think it deserves respect? Depends on your timeframe.h