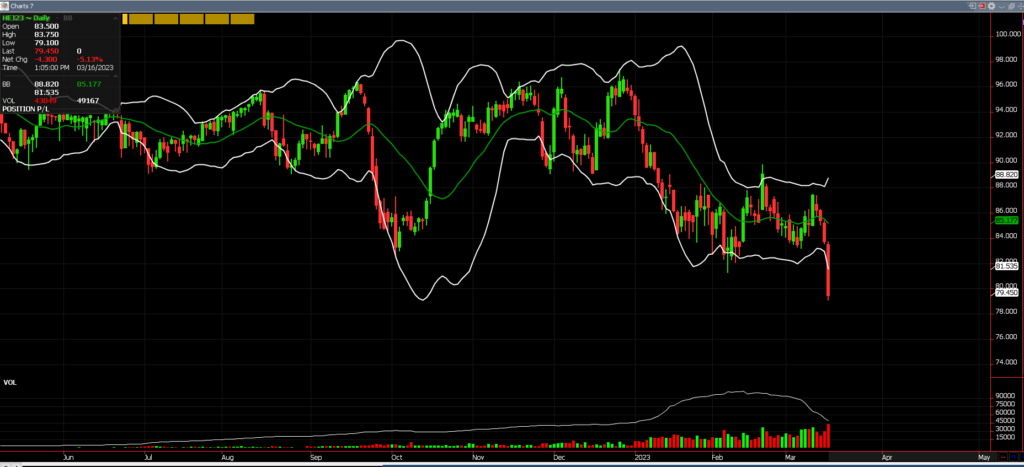

Hog markets again sold off sharply with the June contract going limit down and the April contract settling $4.30 lower at 79.450. Hog supplies are proving a bit larger than year-ago levels, the opposite of what was implied from the USDA expected, falling 2% below last year. On the other hand, this morning’s weekly export sales report indicated last week’s sales totaled 35,600 metric tons, which was up 62% from the week prior and down just 5% from the four-week average. While, the ongoing outbreak of African Swine Fever in northern China has substantially improved the export outlook for the coming weeks and months. The biggest problem for the hog and pork industry is having retailers maintaining retail pork prices above year-ago levels despite significant year-to-year reductions in cash hog and wholesale pork prices. With this current situation, I believe that is the catalyst causing consumer demand to be put under pressure but will very likely do little to slow the usual spring demand surge as grilling season gets underway in early April.

**Call me for a free consultation for a marketing plan regarding your livestock or grain hedging needs.**

Peter McGinn

Account Executive

Walsh Trading, Inc.

Direct: 312-985-0931

Toll Free: 800-556-9411

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research