Commentary

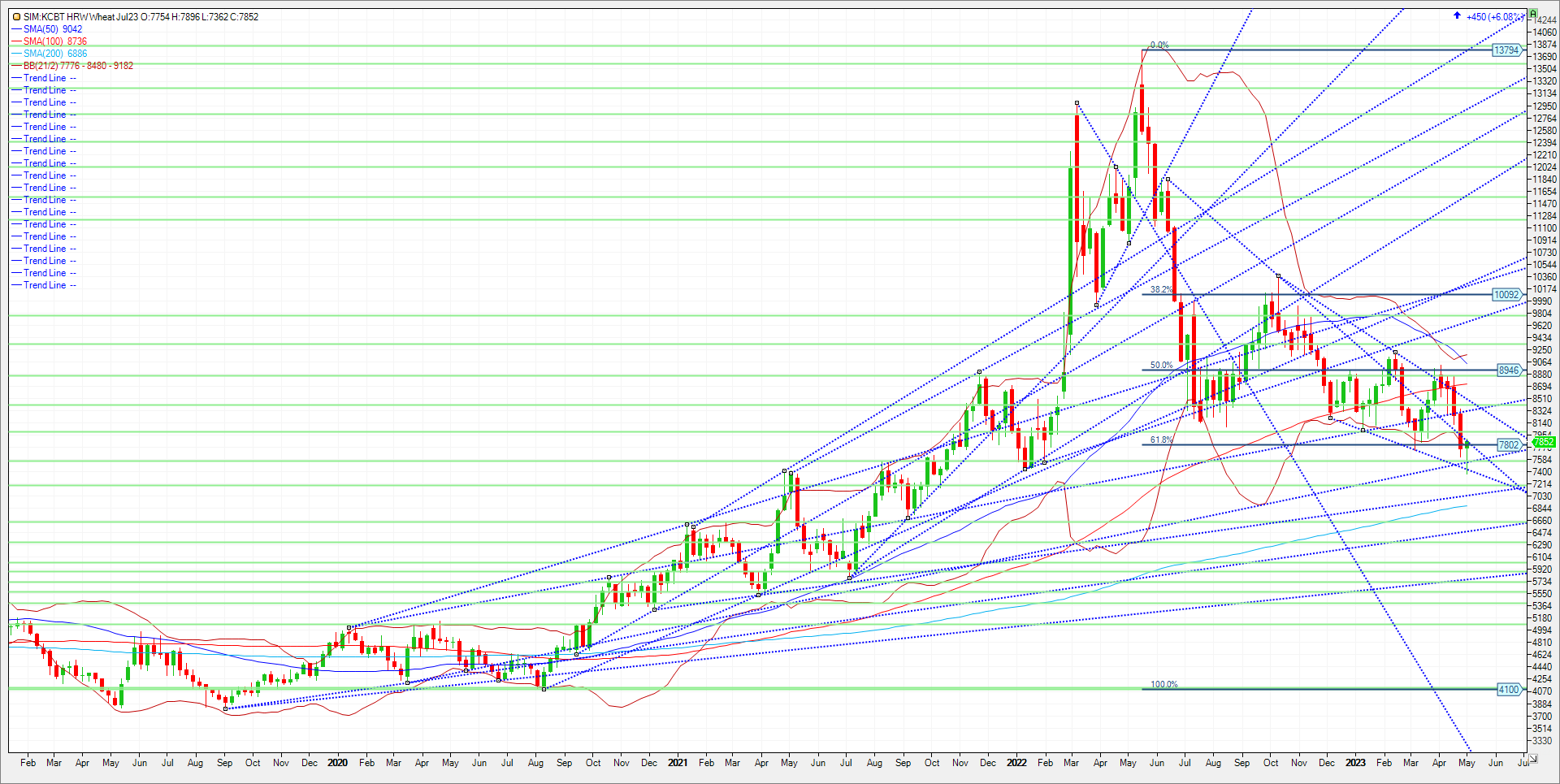

Wheat was sharply higher today as tensions between Russia and Ukraine escalated overnight. The headline driving the strength in my opinion were reports of a drone strike at the Kremlin and while this jolted the markets higher, the bigger concern for traders will be what retaliatory actions will Russian take against Ukraine in this situation. Russia blames Ukraine for a failed assassination attempt of President Vladimir Putin in an overnight drone attack. Ukraine claims it had nothing to do with the attack and says Russia could use it as a reason for another attack in Ukraine. Russia’s claim was made without evidence. A Turkish media outlet claimed Russia, Ukraine, and Turkey would discuss the Black Sea Grain Deal on May 5 in Istanbul. Russia’s Foreign Ministry fired back claiming grain deals talks are not confirmed for May 5. For KC wheat the timing couldn’t be better in my view given the oversold conditions following the $1.30 loss over the past couple weeks and the increasingly short fund position. Funds came in short today in the volume heavy Chicago contract at approximately 128K futures and options contracts. The record net short is 171K. Domestically, crop scouts this week projected Oklahoma’s drought-damaged winter wheat crop at 54.3 million bu., with an average yield of 24.6 bu. per acre, following an annual tour of the state. However, the average wheat production estimate among members surveyed at a meeting of the Oklahoma Grain & Feed Association was much lower at 40.7 million bushels. In 2022, Oklahoma produced a winter wheat crop of 68.6 million bu. on an average yield of 28 bu. per acre. Technical levels for KC wheat through next week come in as follows. Support for July Kc is first at 7.78. A close under and its 7.56. A close under 7.56 and its 7.40. A close under 7.40 and its katy bar the door to 7.12. Next resistance is 8.00. A close over is needed to trade up to the next resistances of 8.33 and 8.44. Above here a realistic target would be 8.73, the 100-week moving average. No trade recs as of this post. A sustained rally in my opinion for wheat would as of now need the Russians to shut the Black Sea pathway down. Domestic demand for US wheat remains nonexistent in my opinion. Fear drives price sometimes and with the heavy fund short, made profit taking amid short covering as easy choice in my opinion with the continued unrest in Eastern Europe.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain and livestock webinar every Thursday 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604