Commentary

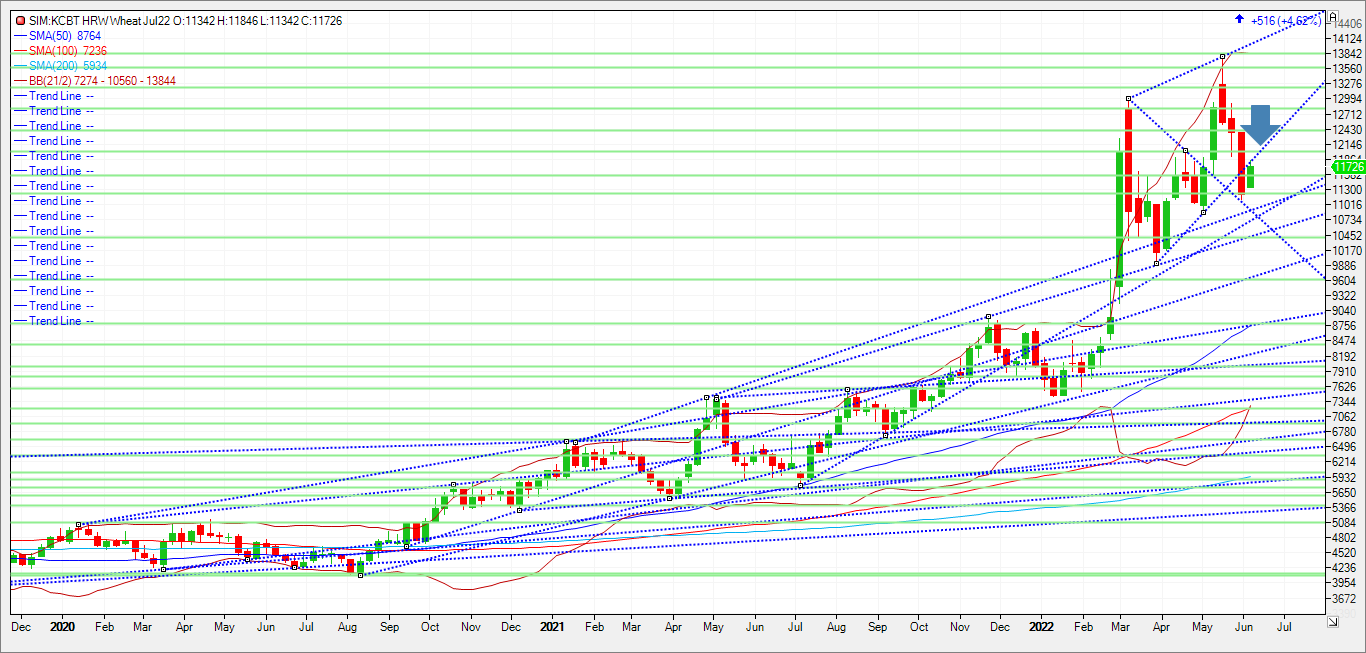

July SRW wheat rose 53 cents to $10.93 and July HRW wheat rose 49 cents to $11.70, both near session highs. July spring wheat rose 38 3/4 cents $12.30 1/2. Wheat futures extended an overnight rally sparked by doubts over a potential agreement to resume Ukrainian wheat shipments, with delayed planting in the U.S. Northern Plains also lending support. Ukrainian President Zelensky said that the country has 22-25 MMT of grain currently stuck in storage with that number rising as high at 75 MMT by the fall; they are discussing export corridors with the U.K. and Turkey and looking for anti-ship weapons, along with more weapons quickly from the West. Zelensky also said that Ukraine is “not ready” to export its grain via rail through Belarus, shutting down that alternative option for the time being. I attached a weekly KC wheat chart. Should we take out trendline (designated by blue arrow) this week, I think this market possibly moves up to 1245/1250 quickly. This assumes no deal to move any amount of grain out of the Ukraine to Turkey. That level is approximately halfway back from the recent high three weeks ago at 1379 to last week’s low at 1112.4. Fifty percent retracement is 1245. In lieu of buying the Board, which carries major risk, a trade to consider would be selling a put spread in my opinion.

Trade Ideas

Futures-N/A

Options- sell the September KC Wheat 1350/1250 put spread at 80 cents OB.

Risk/Reward

Futures-N/A

Options-Risk 10 cents upon entry, if filled at 80 cents, place a GTC buy stop at 90 cents on the spread which risks $500.00 plus fees.

Please join me for a free grain and livestock webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax