Commentary

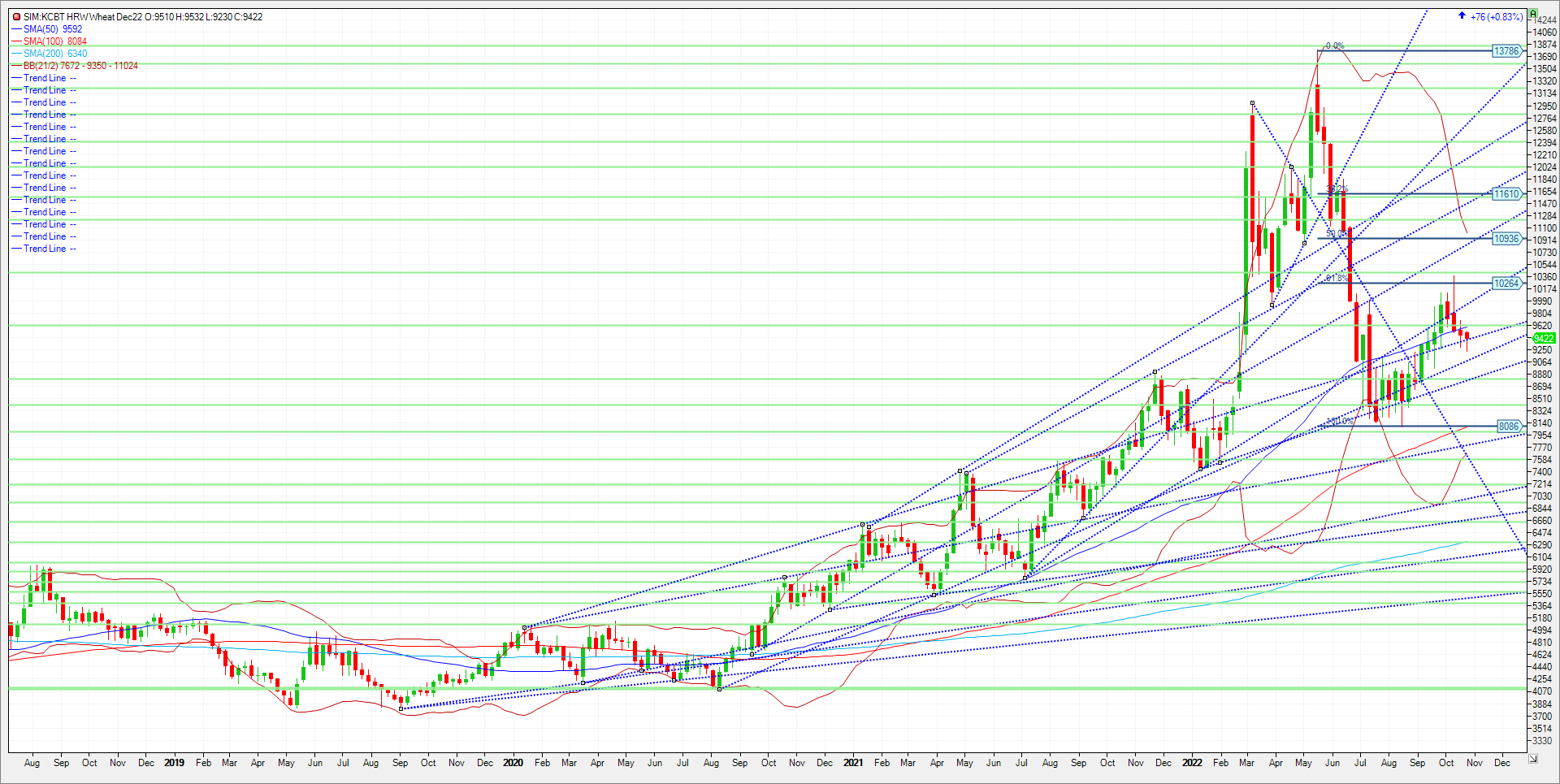

Wheat traded slightly higher as drama continues in the Black Sea. The latest news tidbit that came out last night’s session was that ship traffic has been temporarily halted in Ukraine’s Black Sea corridor as a suspicious mine-like object is inspected. The object was reported on Tuesday, and two boats set out to investigate on Wednesday morning. The Black Sea grain shipment agreement brokered by the United Nations is set to expire on November 19 unless all parties agree to extend it. Grain shipments out of Ukraine have slowed the last few weeks as according to the Ukrainians, Russia has slow walked ship inspections. . All ships approaching Ukraine must be inspected for weapons, according to the agreement that allows grain to flow out of three approved Ukrainian ports. Russian officials are participants in those inspections that take place in Turkey. However, the Russians have been accused of stalling the process which has resulted in backing up more than 160 vessels. The Ukrainian wheat harvest of 22/23 is estimated at just over 50 million metric tons of grain compared to 86 million in 2021. It looks as if winter wheat could be down 40 percent due to the War in my view. With this in mind I suggest an option position in new crop wheat.

Trade Idea

Futures-N/A

Options-Buy the July 2023 KC Wheat 11.00/12.00 call spread for 15 cents OB.

Risk/Reward

Futures-N/A

Options-The cost and risk on this trade is 15 cents or $750.00 plus commissions and fees. This is just one strategy to get a bullish bet on the cards. One can put a stop loss at 5 cents GTC, which reduces the risk to approximately 10 cents, or $500.00 plus trade costs and fees. One can also put a profit objective at 40 cents GTC.

Please join me for a free grain and livestock webinar at 3pm Central every Thursday. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604