Commentary

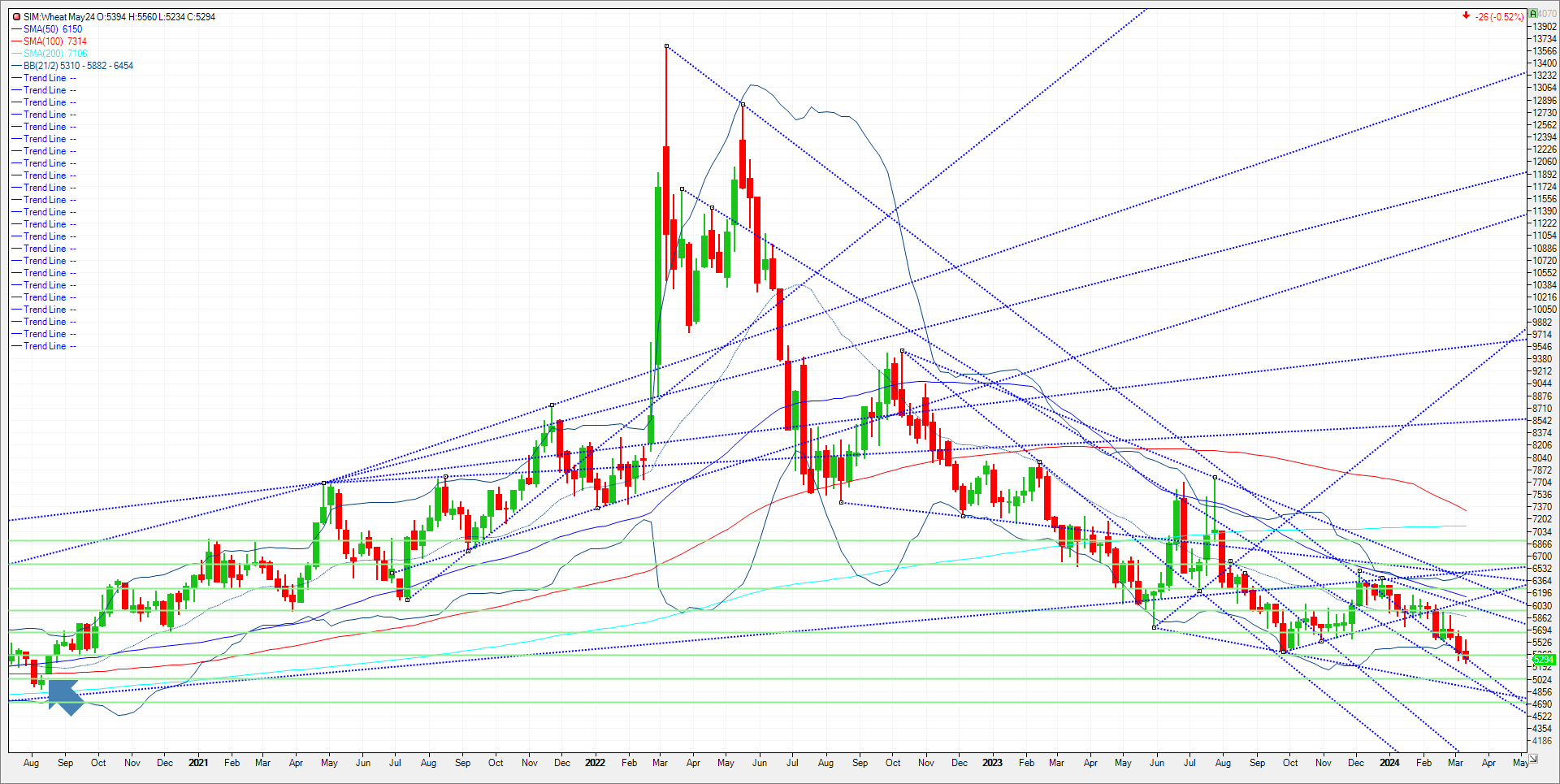

Following a Monday potential upside reversal in wheat that took out two previous session highs, wheat did an about face on Wednesday and didn’t look back. It is my belief that wheat fell again this week on three fronts. First and foremost, Russia is again flooding the global wheat market as Russian export prices for 12.5% protein fell below $200.00 per MT last week for the first time since August 2020, the lowest price for early March since 2017. Russia’s domestic prices are tumbling, allowing exporters to offer lower rates in my opinion. USDA forecasts Russia will export a record 51 MMT (1.874 billion bu.) of wheat in 2023-24. USDA cut its U.S. wheat export forecast to 710 million bu., the lowest since 1971-72. Second, sales for US wheat were virtually nonexistent this week, highlighted by China cancelling three purchases of Chicago soft red winter the last ten days. Third, reports this week that China had canceled 1 million metric tons of purchases from Australia added to the bearish price action in my opinion. In my view the trade will now await the March 28th prospective wheat plantings and stocks report for the next fundamental input with eyes on the weather in between. Weekly chart below. Technically, the market continues to feature lower highs/lower lows. Nothing friendly about that. The latest CFTC reports have managed funds net short Chicago wheat 78K, short 35K in KC and 21K in Minneapolis. This was the net position as of Tuesday 3/12 and doesn’t encompass the last three days of lower closes. Support is at the trendline at 5.23. A close below and it’s the gap from August 2020 gap at 5.08. Under 5.08, 20% down for the year is at 5.03 and a trendline at 5.01. Under 5.01, the next area of support is 4.91. Resistance is just above this week close at 532/33. Consecutive closes above are needed for a relief rally to next key resistance at 5.66. Market continues to price in bearish news and has acted accordingly. That said, caution is warranted down here, the market can flip at any moment on a headline. As we inch closer to month and quarter end, we have a report of consequence on the 28th, while the USDA gives us its first look at winter wheat condition ratings April 7th. Funds who are short have the profit and risk, expect some covering in my view prior to those reports. Where will the Board be though prior to any potential short covering? Watch near term support next week at 5.23, it needs to hold in my opinion.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain and livestock webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604