ommentary

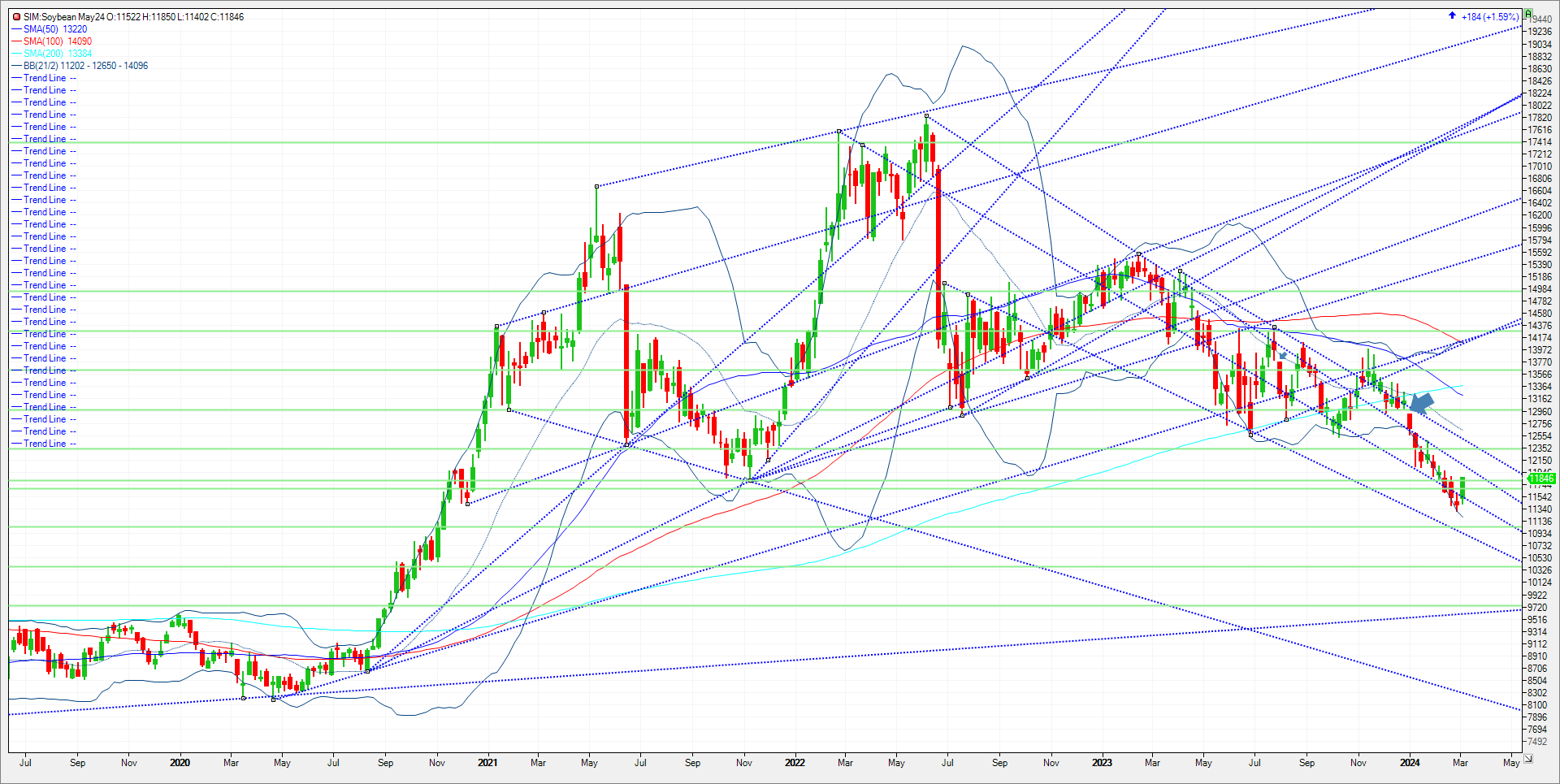

Ahead of the report, corn futures were trading 2 to 3 cents lower, soybeans were mostly 2 to 6 cents lower, winter wheat markets were 5 to 7 cents higher, spring wheat was 2 to 3 cents higher. Beans finished the day up 17 cents, corn up 1.6, Chicago wheat up 9, KC up 14, Minneapolis up 8 cents. USDA made no changes to either the supply or demand side of the U.S. old-crop soybean balance sheet, maintaining the ending stocks forecast at 315 million bu., which would be the highest since 2019-20. Please keep in mind the first three USDA reports of the year were bearish versus expectations in my view. The Jan and Feb WASDE along with the February Ag Forum. The first two reports, USDA raised the size of last year’s crop while simultaneously decreasing demand as a weather premium in South America eroded. The AG Forum in mid-February predicted that ending stocks will rise over 400 million bushels for new crop while raising projected yields yet again above 52 BPA. In my view such predictions to this point are like throwing darts with a blindfold on. Today’s report was a yawner. The USDA punted leaving ending stocks unchanged from the month prior, which is a statistical impossibility, but not uncommon for the trade. Funds have pushed out to a record short per the CFTC commitment of trader’s report released this afternoon. Corn just posted a record short a few weeks prior and has seen a decent bounce from the lows. Same with beans today and I wouldn’t be surprised to see a further push higher through March potentially. There wasn’t much bullish in today’s release, but the report wasn’t bearish. Sometimes that is all that it takes for a start of an unwind of short covering in my opinion. Technical levels for next week come in as follows. Resistance for May soybeans first at 1199. A close over and the market could push to 1234, and then 1245. Support is down first at 1168. A close under and its 11.53. A close below that and its katy bar the door to 11.20 and then 11.03, which represents 20% down for the year.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604