Commentary

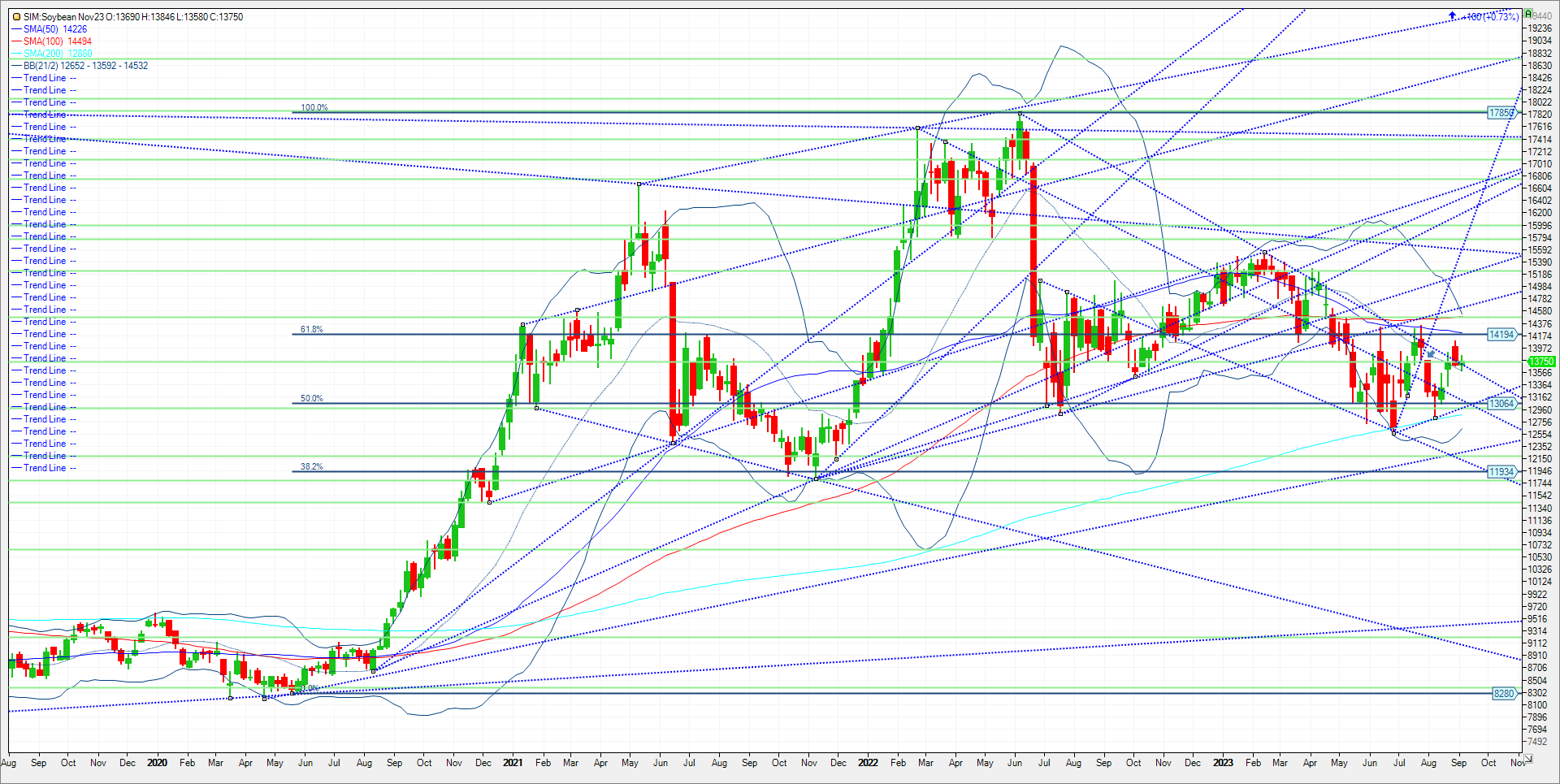

November soybeans rallied 11 cents before closing at $13.76. December soybean meal futures closed $1.60 higher at $399.2 but ended nearer the session low. USDA reported that soybean ratings lost 5%, now at 53% good to excellent, behind 57% last year and the 60 percent five-year average; soybean pod-setting and dropping leaves stand at 95 percent and 16% respectively, also slightly ahead of comparable paces. National soybean condition ratings fell by more than expected this week, led by #1 producer Illinois which lost 10 percent in the good to excellent category. The soybean crop as of these latest ratings decrease shows the worst-rated crop since 2013 and tied for the third worst of the last two decades. The 2013 crop did rebound a bit into late September but still finished around 4% below trend at 44.0 bushels per acre. I wouldn’t be if the market went bid into the September 12th crop report. Many unknowns here regarding crop size given the latest crop estimates and ratings declines. It is possible that funds may bid prices up ahead of Tuesday’s WASDE report in my view. Chart below. Key support next week is 1363. Consecutive closes below could see the market droop all the way down to the 1280-1300 level. Key resistance is 14.02 A close over and we could see a rally to 14.20 and potentially the 1440-1450 area.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain and livestock webinar every Thursday at 3pm Central. We discuss supply, demand, weather and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604