Commentary

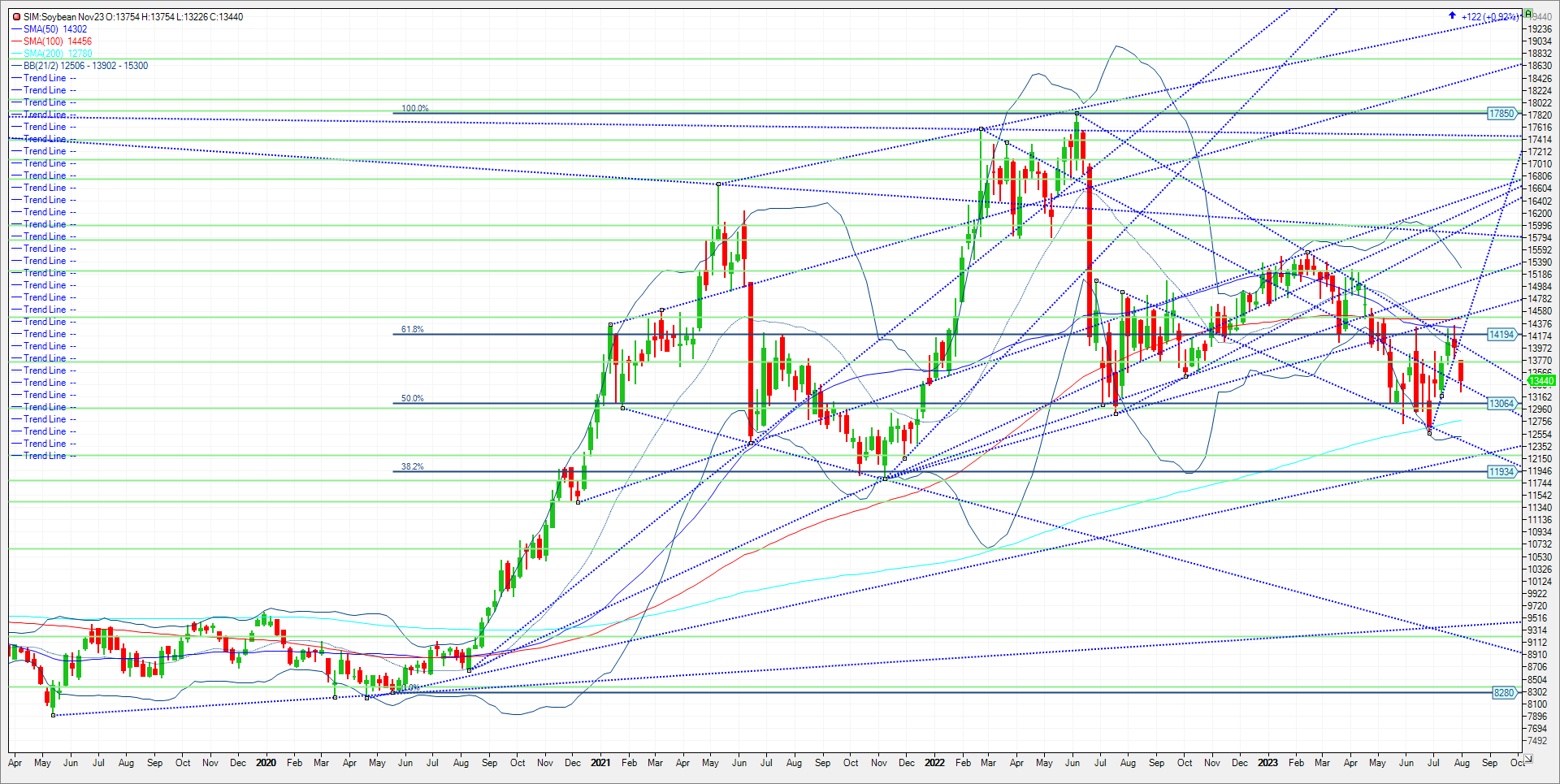

Soybeans saw only a small bump today rallying 9 cents higher to close at 1341 post-Crop Progress. The trend in my view is lower amid a bearish weather forecast for at least the first half of August. Rains are scattered this afternoon and over the next couple days, but action is expected to increase Friday and Saturday with good coverage seen through the weekend, even in drier areas from Iowa north and northwestward. Soybean ratings dropped 2% g/ex to 52% g/ex overall, below 60% last year at this time and behind the 63% five-year average. Soybean blooming and pod-setting also remained ahead of comparable at 83% and 50% done, respectively. Yesterdays drop of approximately 50 cents came on a drop in open interest of over 14K contracts while managed funds liquidated 25K contracts into month end. With weak demand, rainfall chances need to miss in my opinion, for any claw back in futures towards last week’s highs. Or this market will need help from corn and wheat rallies in regards to putting in a near term bottoms on the charts in my opinion. Support for the remainder of this week comes in as follows. Support is down at 13.27. A close under and its 12.95. A close under 12.95 would push the market down to 12.82 and then the 200 weekly moving average at 12.75. Resistance is up at 13.72 then the weekly gap at 1375/79. A close over here is needed to push the market to 14.02/14.04. A close over and its 1431, (the 50-week MA), and the 100-week moving average at 14.44.

Trade Ideas

Futures-N/A

Options-N/A

Risk Reward

Futures-N/A

Options-N/A

Please join me for a free grain and livestock webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.