Commentary

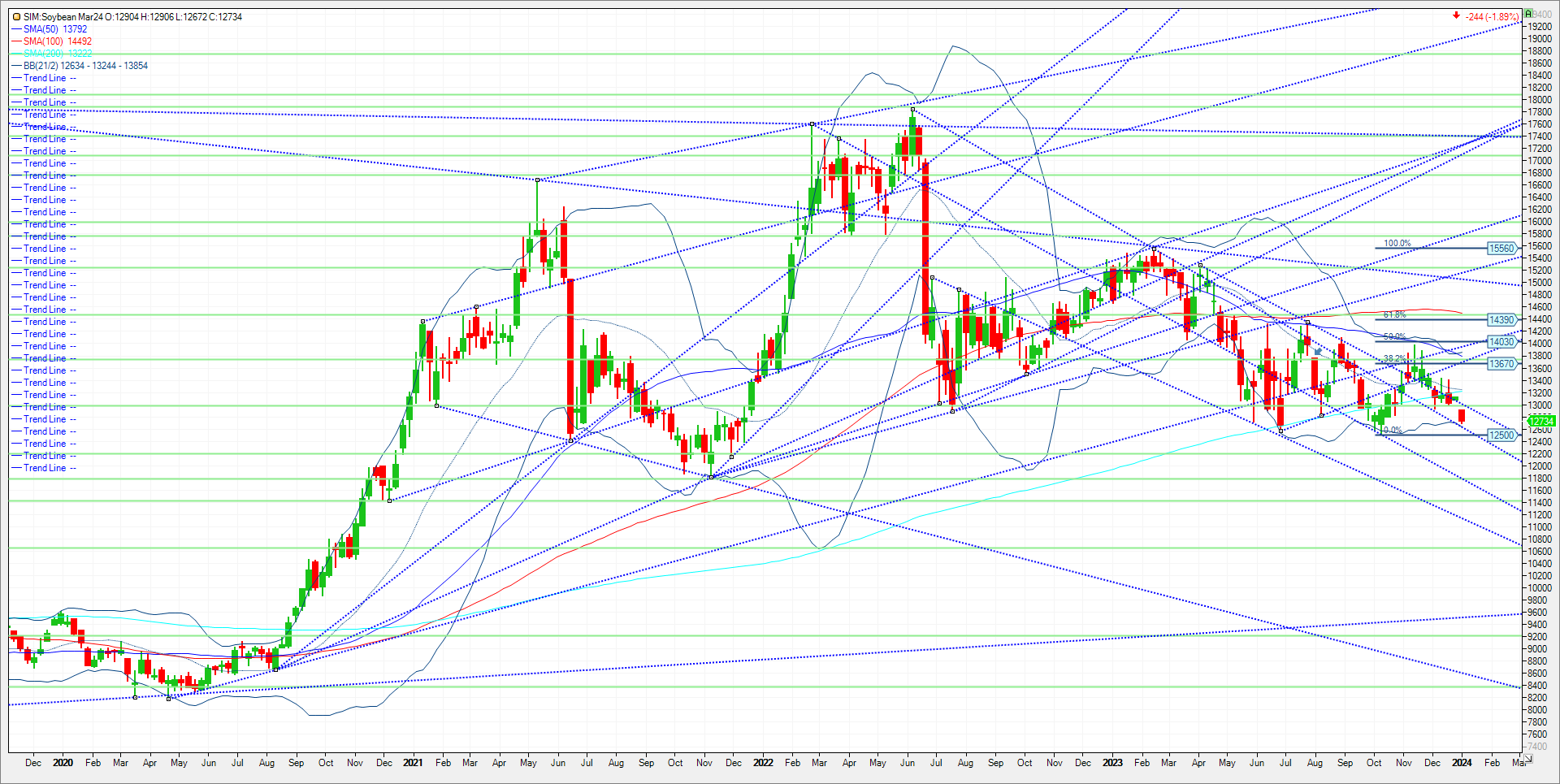

It is my belief that as we enter into a new year with all eyes on Brazilian weather over this past weekend and for the next ten days. In my view it was the theme for the break in the soybeans and meal today. It was reported by crop scouts that weekend rainfall was highly variable with some of the greatest amounts in eastern Mato Grosso and western Goias. These are areas of need. One weather site, World Weather Inc. says “rainfall is expected to favor northern areas of the country over the next 10 days, while south-central and southern locations will see more sporadic rains. Argentina will be drier this week, which will benefit areas in eastern parts of the country that have been too wet recently”. While recent crop scouts have lowered Brazil’s bean crop from the low 160’s to 151-153 million metric tons, the projected cut in production has been dismissed by managed funds so far. Perhaps the reason is that Argentina is projected to add up to a possible 20 million metric tons of production over last year while neighboring Paraguay and Uruguay see increases as well as the transition from La Nina to El Nino bring s needed rains and somewhat cooler temps to these areas outside of Brazil. Larger production in these areas increases their exports and, in my view, could continue to erode market share for U.S. origin. That being said, we have a major crop report out next week, the January report, which could be a big market mover. In demand news, today’s export inspection report showed 5.3 million bushels of soybeans for export in the week ending December 28th, with 17.3 million bushels headed to China. Technical levels for this week come in at the trendline at 12.65 and bottom edge of Bollinger Band at 12.63. (See Chart) A close under and it’s the Oct lows at 12.50. If 12.50 is taken out look for managed money to challenge 12.34, which represents five percent down for this calendar year. We closed 2023 at 12.98 and trendline resistance is at 13.02. We need to close over 13.02 in March soybeans to turn bullish. I would not be surprised to see the gap filled from 1290.6 to 1298 made last night prior to next week’s crop report. If that happens, where to from there? As mentioned, 13.02 is key resistance, a close over and the market can revisit the 200-week moving average near 1320 and last week’s high at 1328.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me every Thursday at 3pm Central for a free grain webinar. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604