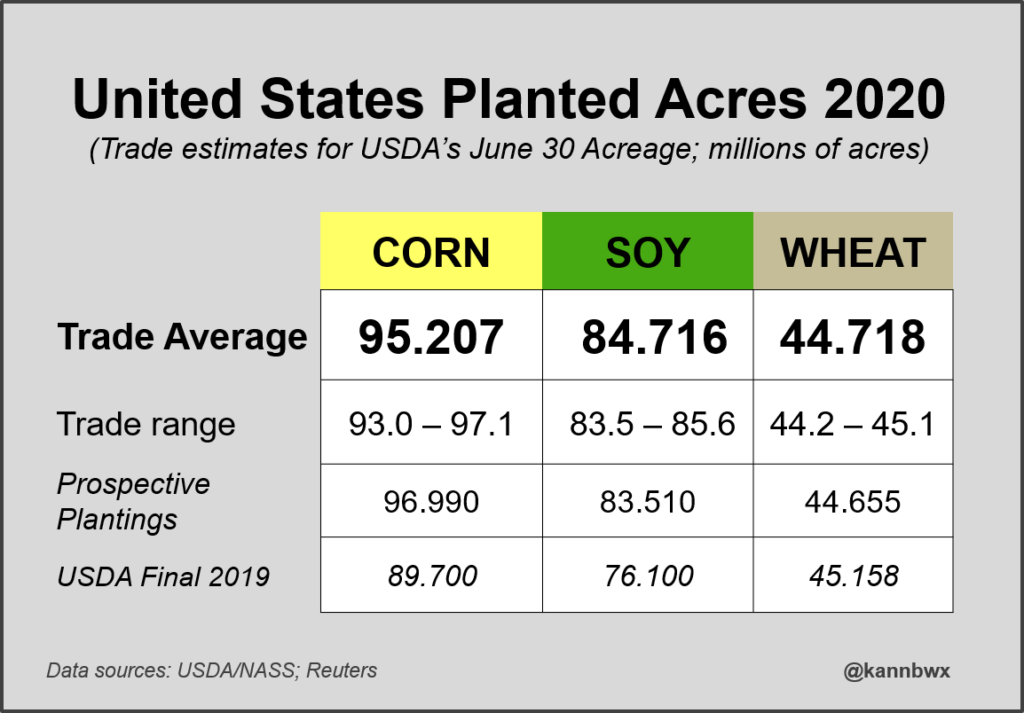

Trend and Index following funds who have amassed sizable shorts in corn and wheat took profits today while longs in beans most likely did the same. Surprises on the quarterly reports are often seen with either the on-farm stocks number being adjusted or a curve ball being thrown with prospective plantings thus giving the trade a surprise. No matter the reports finding , when the trade returns from the three day holiday weekend on Monday, funds will most likely forget tomorrows numbers and focus on weather and then demand. Multiple forecasts are showing a hot July in my view. The question going forward: Will the heat be accompanied by rain? Today’s crop progress report wasn’t much of an adjustment on the national average. The USDA gave us a slight one percent higher in the good to excellent category for corn and beans. However states in the Eastern belt including Illinois, Indiana, and Ohio to name a few saw significant jumps in the G/E category. These crops have defintely benefitted from recent rains. As the calendar turns to July, timely rains need to show up to keep conditions firm in my view because funds most likely won’t sell on drought. However while we have some dry spots here and there, crop conditions are near ideal so far in many grain belt states and todays condition report verifies it. Im not making any predictions here on the USDA number tomorrow. Longer term projections for corn and beans to the downside come in as follows on a percentage gain/loss for the year. 20 percent down for corn for 2020 is at 311.4. (Low for year has been 309.2) 25% down 293. 30% down is 274 . For Beans 10 percent down is 860. 15 percent down is 813. 20 percent down is 764. Planted estimates below.

Trade Recommendation-

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain and livestock webinar every Thursday at 3pm Central. Sign up is free and a recording link will be sent upon signup. We discuss supply, demand, weather and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.