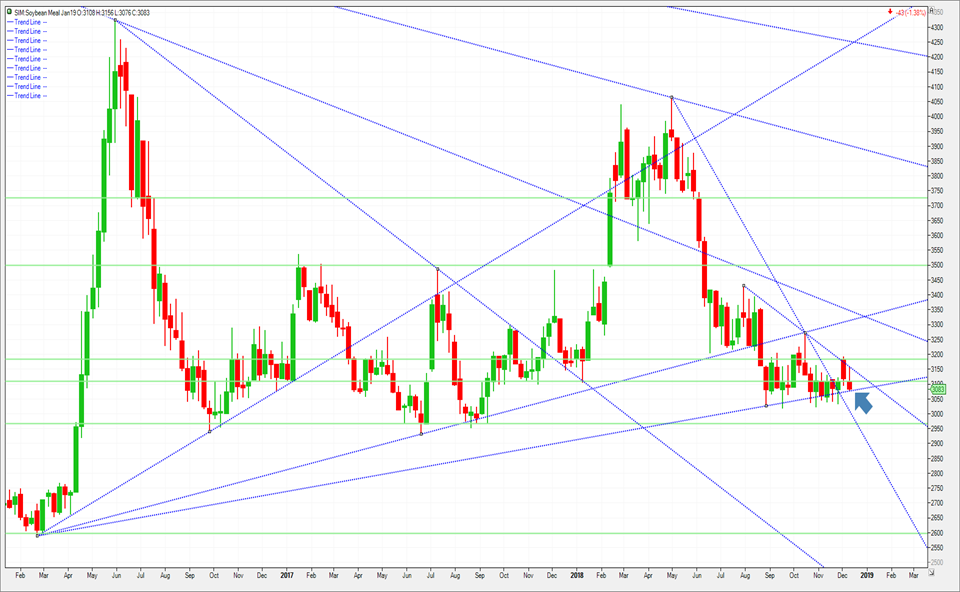

It was about as dull a close for grains to end this week as one could of asked for today. A higher Dollar and a very weak and volatile stock market were two of the culprits that spurred liquidation of wheat, corn, and beans into the close. Soy meal (see chart) has no friends and maybe being pulled lower due to a lack of perceived demand from China over the Hog virus. Beans rallied 70 cents from Nov 25th until Dec 12th on thoughts of trade deals/ pacts negotiated with tariffs lowered. China has since bought US beans and has made some concessions on trade going forward. Trade the charts and watch the meal here as your guide for beans. We settled Jan Meal at 3 tics below a key trend line (Blue Arrow) coming into the week at 307.6. Should we get a hard close under this line, I would be a seller of beans. Old Crop/New Crop beans spreads like May19/Nov19 at 22 under, Or July 19/Nov 19 at 10 under have 8 to 10 cents quickly in them should the soy complex turn over.

Corn and Wheat found willing buyers on dips all week and up until 30 minutes prior to today’s close. The late day selling may only reveal a buying opportunity longer term as demand for both remains firm while global crop sizes for wheat continue to shrink. Old crop /New crop corn spreads are still firm. If you see May 19/Dec 19 corn at 14 cents May under, buy the spread with a 4 cent stop. July 19 /Dec 19 corn sits at 5 cents July under. Look for a pullback to 7 cents and buy it. In my view I think you buy dips on these old crop/new crop corn spreads. Reason: I sense there will be talk of increased corn plantings in the US for the 19/20 crop year. This is based on increased China demand for ethanol along with slight increases in bio-diesel mandates at home as well. Planting less beans and more corn will be the headline.If this noise in the market increases, coupled with beans trading lower, increased corn acres could put pressure on new crop contracts, with old crop the beneficiary versus Dec 19 and March 20 contracts through Spring.

Below is a KC Wheat/Chicago wheat chart basis March. The spread has rallied 13 cents off the low. The upper trend line (Support) sits between 17-16 KC under next week. The spread settled 11.6 under today, its tightest close in a month. It looks poised to eventually test 5 cents under prior to the January crop report. That report could be a game changer for wheat regarding KC, as it could state that HRW plantings could come in less than last year,which if occurred would prompt KC futures to trade to a premium vs Chicago in my opinion. If long this spread, be out on a close under 17.4. Trade the Charts and Avoid the Noise into year end. Please join me for a free grain and livestock webinar every Thursday at 3pm Central. We discuss supply, demand, weather, trade ideas and the charts.