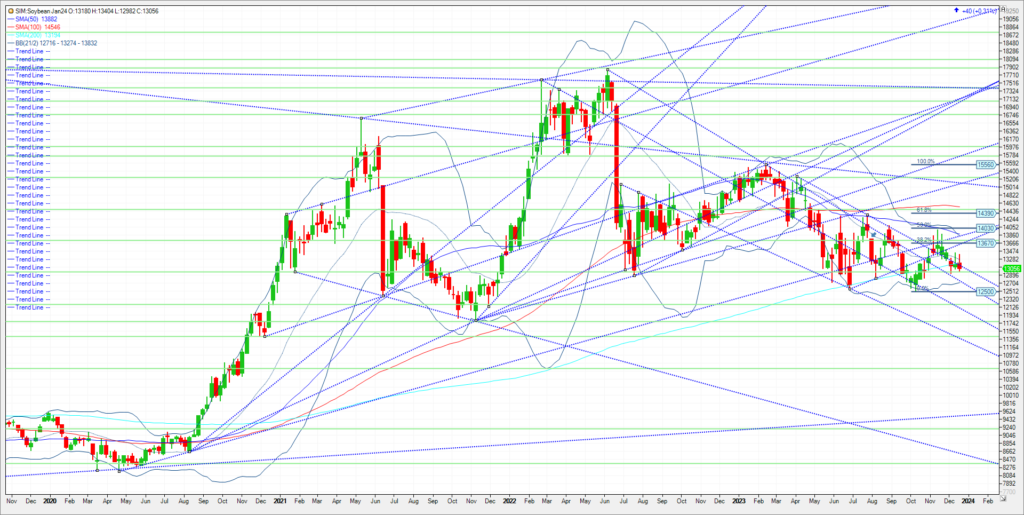

Beans saw some short covering in my view today as the front month came in 28 cents lower on the week. Not much new news to drive the market significantly higher or lower ahead of a three-day holiday weekend. Needed rains have started to show up in many of Brazil’s driest growing regions with more on the way in the 1-to-5-day forecasts. The market perception in the near term is bearish. Therefore, the Brazil weather premium hasn’t produced any significant rally in the recent weeks with any intraday or over the weekend rallies sold into. I think there is some realization that even if Brazil’s bean crop gets reduced to the 150 million metric tons from near 160MMT, Argentina is expected to produce 20 million metric tons more than last year, easily making up for any short fall. However, its early in the season especially for Argentina, as they are approximately 65 percent planted for beans. In short, my best advice is to trade the charts, especially during the holidays amid light volume. March soybeans are now the most actively traded contract. Here are the technical levels for the last week of 2023. March beans to trade higher needs to settle above the trendline at 1307. We settled just underneath it today. Should we close over and hold 13.07, I look for the market to retest the 200-week moving average at 1319 and then the 21-week moving average at 13.27. If we can close over these levels, I look for the market to rally to 13.68 and maybe 13.82. However, if the market stays below 13.07, look for 12.95 next and then 12.71. A close under 12.71 and I think we test the Oct lows at 12.50 See chart below. Wishing everyone a Merry Xmas, Happy Holidays and a happy and healthy 2024.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.