Commentary

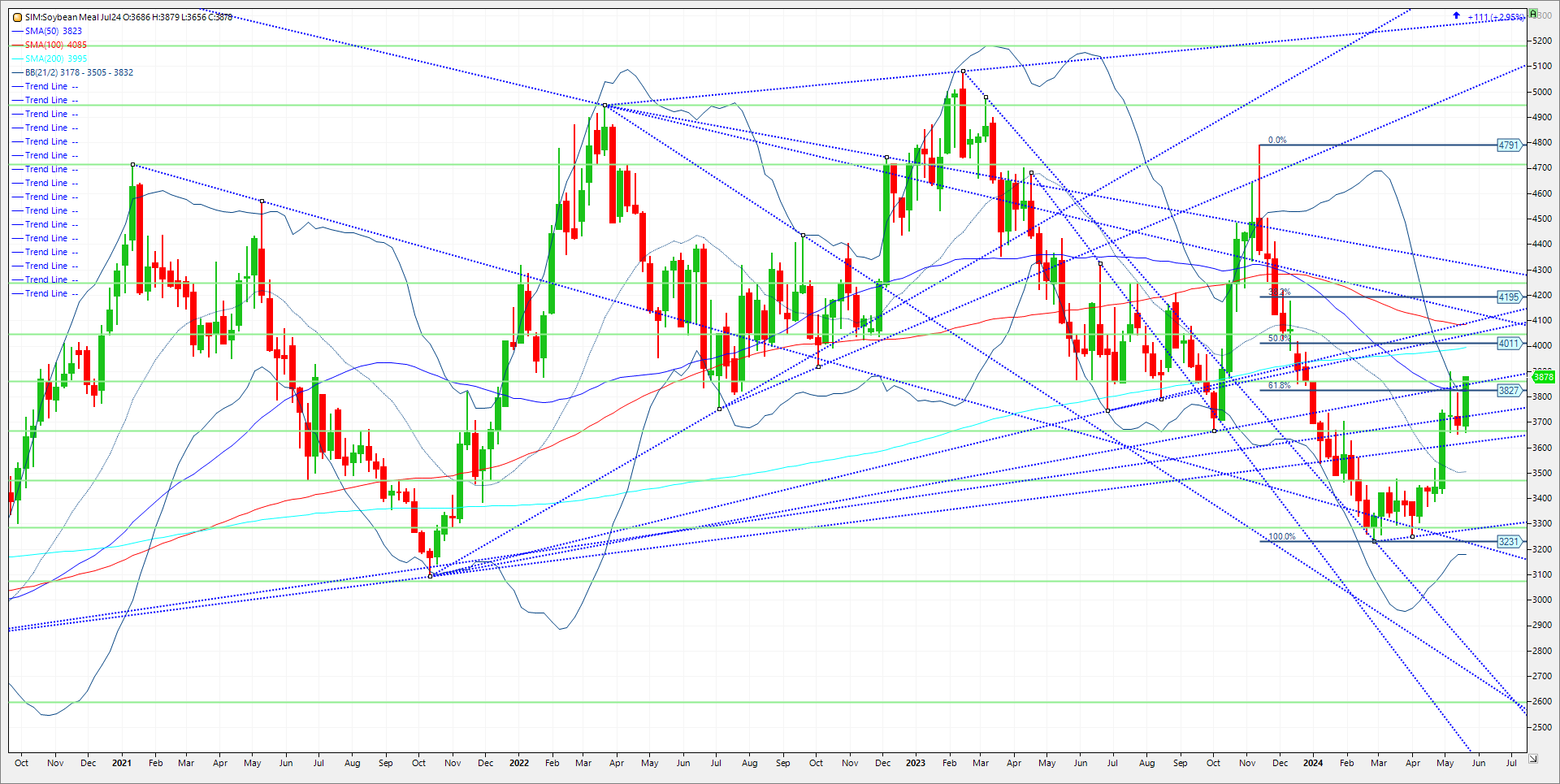

It is my belief that soybean meal strength sustained the soybean market today. Cash markets remain hot in the far west as a shortage of meal supplies ignites a rally. Also, inconsistent launches of new crush plants have soybeans going in, but product is not consistently produced. Argentina’s producer remains a tight-fisted holder of soybeans, where it pays to be patient in my view. The Buenos Aires grain exchange says the Argentine bean conditions rose 1% to 25 percent good to excellent with harvest there at 78 percent complete. Kepler Weber, the largest maker of grain silos in Brazil, says there are 4800 storage silos in Rio Grande Do Sul, more than any other Brazilian state. They will begin assessing the damage from the devasting floods once flood waters recede of the stored grain. Funds have paired their net short in beans to from 140K short a month ago down to 26K, this past Tuesday per CFTC data. However, in meal managed funds are long almost 100K futures and options. The have defended their position on breaks the last few weeks. Technical levels come in as follows for the most actively traded July contract. For July 24 soymeal the market needs to hold 382 and 380. Should that not happen look for the market to retest 369/67. If that fails, its 3.60. Under 3.60 takes the market to 350/348. Resistance is this week closing price 386.8 which is unchanged on the year. The next resistance is the 200-week moving average at 399 and then trendline resistance at 4.05. Above 4.05 is the 100-week moving average at 4.08.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604