Commentary

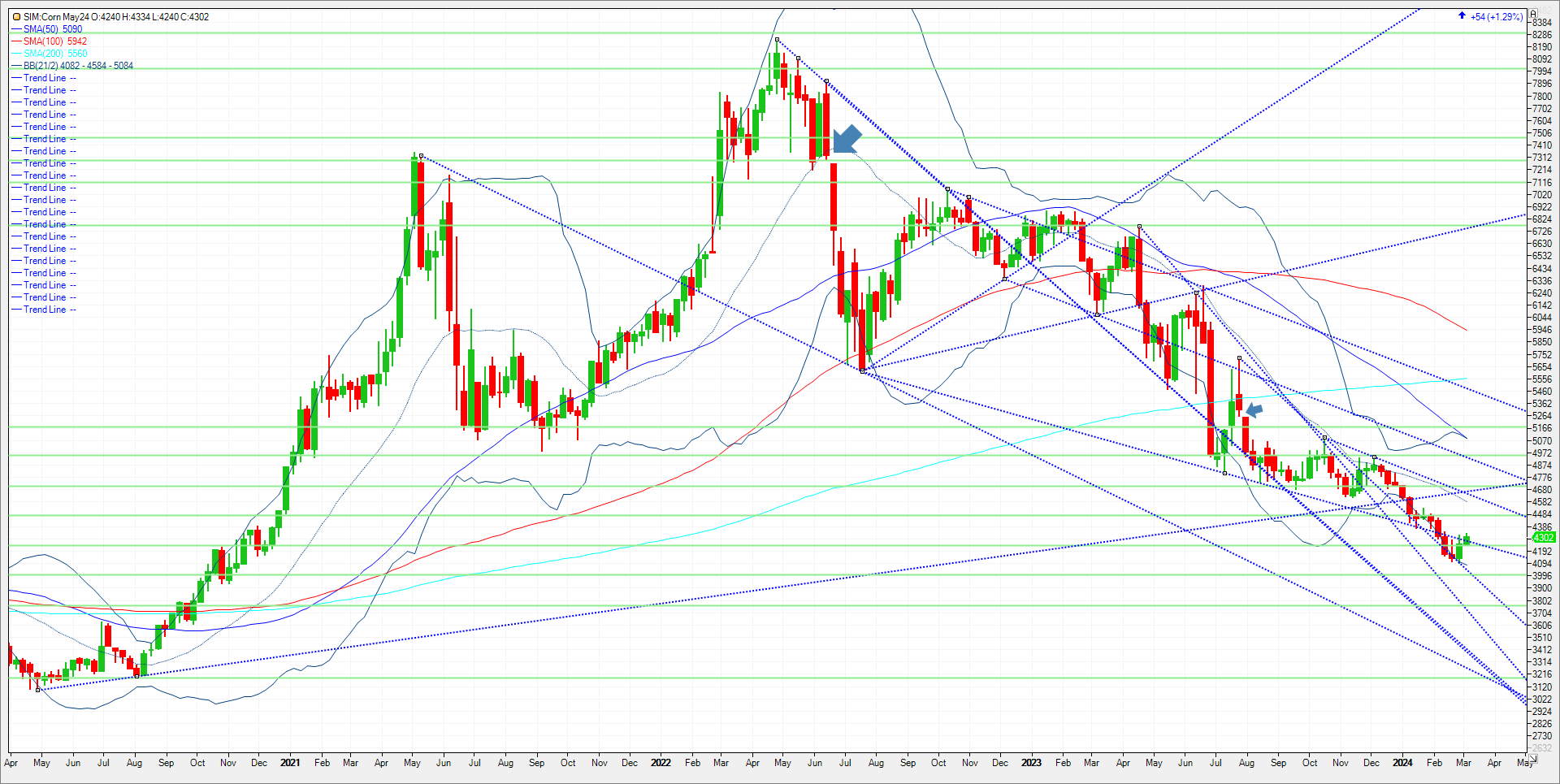

Corn rallied 5 cents today reversing Friday’s losses and giving thoughts to a continuing technical recovery that could be the trend into Friday’s supply demand report from USDA. China has been largely absent from buying US corn the last 18 months or so but demand from other customers especially Mexico remains strong. Marketing year to date corn export inspections to all destinations totals 812 million bushels, up 208 million bushels or 35% from the previous year’s pace, and up 27 million bushels from the seasonal pace needed to hit USDA’s target. The US demand window is open for the next couple months which could be supportive, but any long-lasting rallies above let’s say 4.50 May 24 corn look ultimately like selling opportunities in my opinion should that level be retested. I believe we have a lot of old crop corn unprotected still that has to be moved or rolled. Without a weather market in South America, I’m not seeing how sustainable an old crop corn rally above 20 cents is unless something major unforeseen enters in the market and creates a massive amount of short covering from the 295K managed shorts. I have a bullish diagonal corn strategy below, to capture any potential bullish move.

Trade Idea

Futures-N/A

Options-Buy the May 24 corn 430 call and sell the Sep 24 510 call for even money.

Risk/Reward

Futures-N/A

Options -Unlimited risk here as one is short a September corn option that expires late August versus a long call that expires in late April. Or if one has unpriced old crop may not mind being short the 510 calls until he/she moves their corn. The cost to entry for the trade is even money plus trade costs and fees. The key here is we are financing the at the money call in May with the deferred September call option. Work to cover the spread at 15 cents Sep under May. ZCU24C510:K24C430[DG]

If futures close below 4.24 after Friday’s report or next week, exit the position. Support needs to be defended for this trade to work. Weekly continuous chart below.

Please join me for a free grain and livestock webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604