Commentary

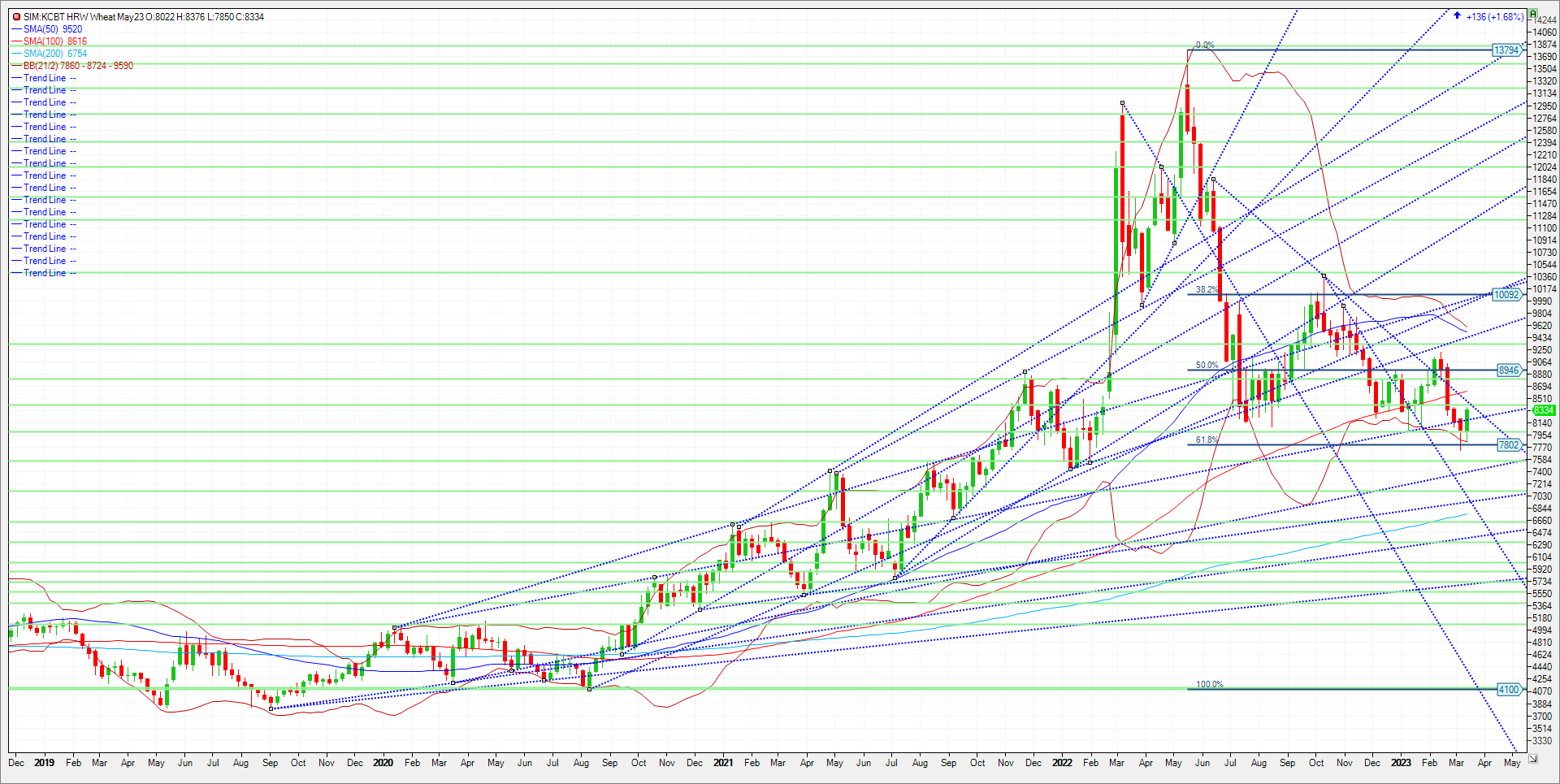

There is increased chatter and noise regarding the health of the winter wheat crop, Specifically the hard red winter wheat or KC Crop. Most weather forecasts imply little hope for a significant spring improvement in the KC crop. Several signs point to conditions likely to be at or near record lows when USDA publishes its first Crop Progress Report April 3. It remains to be seen if the market has priced in such conditions or whether poor results will spark a rally. The Black Sea export agreement looks like a done deal in my opinion. The Kremlin today reiterated their government stance of only extending the Black Sea grain deal for 60 days, rather than the previously-agreed-upon 120 days that Ukraine and Turkey are pushing for. The deal expires tomorrow. Short covering rally the last few weeks has been featured as uncertainties abound regarding crop conditions in hard red winter wheat areas, war in Ukraine, and now a potential banking contagion. Technical levels for May KC wheat as follows. Major resistance at the 840/44 area. A close over is needed to push the market to the 888/894 area. Major support isn’t found until 810/8.09. A close under and next support at 800. A close under 8.00, pushes the market to the 7.80/83 area. A close under here and its Katy bar the door to lows not seen since the Fall of 2021 in my opinion. Weekly Chart attached. No trade recs into the weekend.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain and livestock webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604