Commentary

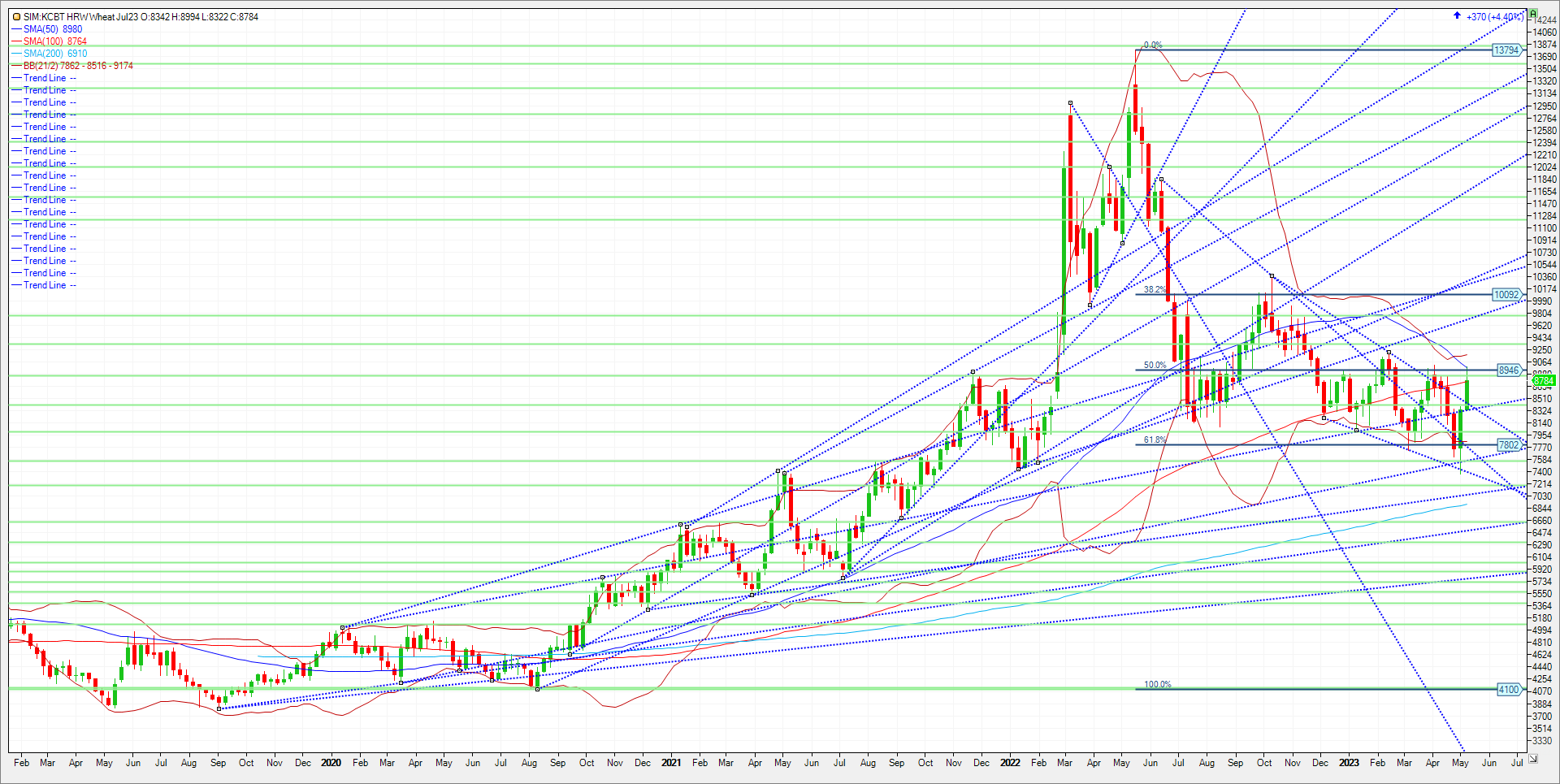

There were no changes to the old-crop balance table for wheat this month to nobody’s surprise in my opinion. The surprise in my opinion was that new crop US production and US ending stocks came in well below trade expectations, and this assumes somewhat normal yield. If weather continues to be a significant issue, the market may move to a higher price level. New-crop wheat production comes in at 1.650 billion bushels, around 130 million bushels below the average guess with the KC wheat or Hard Red Winter wheat deficit making up most of that. New-crop wheat carryout at 556 million bushels is down around 50 million bushels million bushels versus the trade estimate and down from the current year. USDA pegs winter wheat yield at 44.7 bushels per acre, the lowest since 2015 but the furthest below trend since 2002. Yield by State showed #1 producer Kansas down 22% year or year, lowest since 2014. Oklahoma was down 18 percent YOY, lowest since 2014. Texas down 7% YOY, lowest ratings there since 2011. USDA estimates harvested area at 25.286 million acres, up 8% from last year, but producers expect to harvest only 67% of planted area, the lowest ratio since 1917. USDA estimates the HRW or KC wheat crop down 17 million bushels from last year and 77 million bushels less than expected; SRW (Soft Red Winter) or Chicago contract put production up 69 million bushels from last year and 7 million bushels more than expected; and the white winter wheat crop down 26 million bu. from last year and 31 million bushels less than expected. The big decrease of KC bushels versus the increase in Chicago was traded today. This was seen in the KC/Chicago wheat spread that traded to another record at $2.42 over. In other news as of this posting there was no agreement on extending the pathway through the Black Sea for Ukrainian grain shipments. The current deal expires on May 18th. Given that uncertainty, no trade recommendations into the weekend. KC wheat closed right at the 100-week moving average. A close over is needed to challenge the Fall highs near 10.00 in my opinion.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain and livestock webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax