Commentary

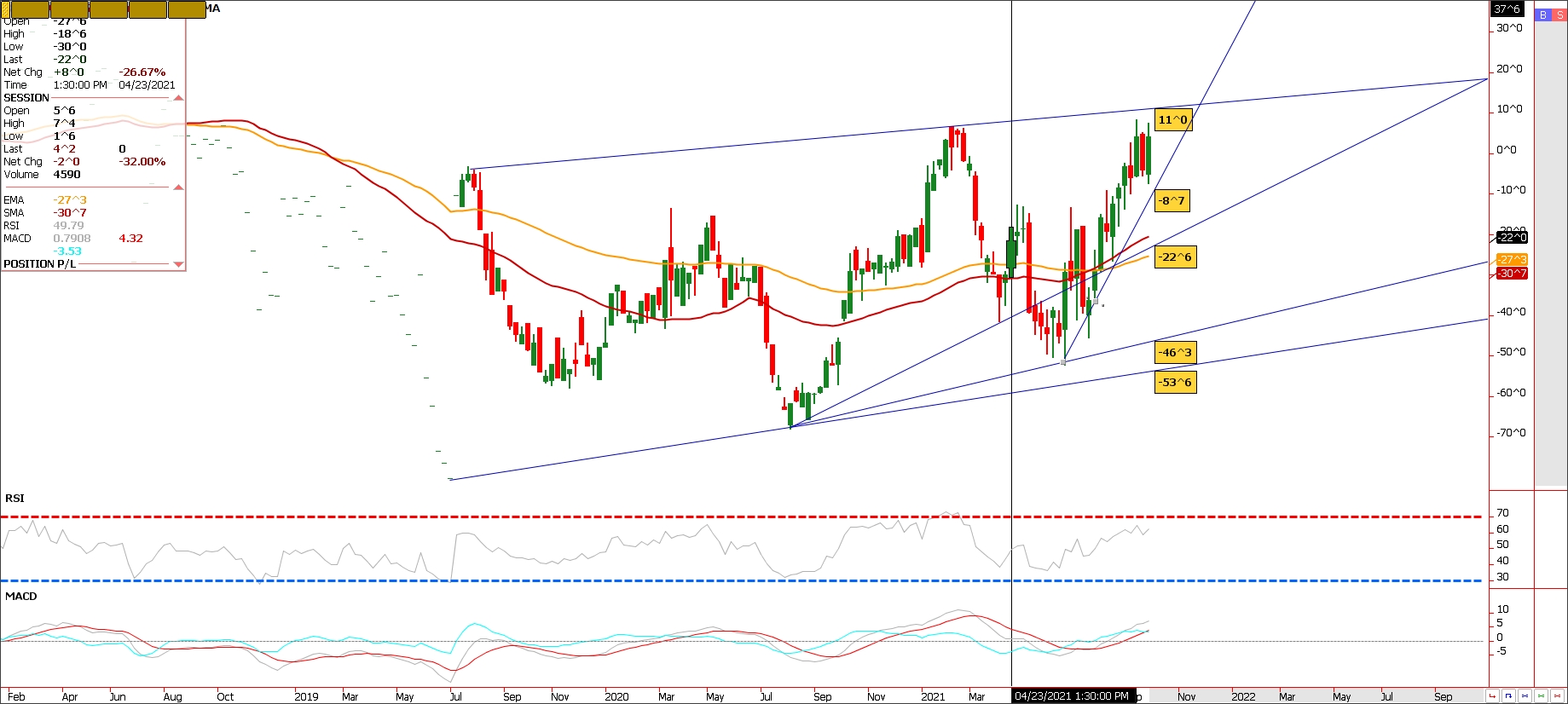

Wheat in all classes as been the leader in the Ag sector as the market turns the calendar to October. Fresh inputs from the USDA yesterday showed its all wheat production estimate downward by over 50 million bushels, with hard red winter losing 28 million, other spring losing 12 million and white winter losing 9 million from the August estimate. This comes after recent declines in output from Canada and Russia. Supplies of quality milling wheat are tight in the world, and yesterday’s numbers reinforce that fact in my opinion. In summation an already short crop got smaller. European Union milling wheat futures pushed to a new contract high on the news while Russian wheat export tariffs will reach a new high of $57.80 per MT for the week of Oct. 6-12, a $4.30 jump from the week prior. The weekly formula-based duties intended to curb food price inflation have climbed steadily since their June launch. I included a KC/Chicago Dec 21 futures spread. We write about this relationship periodically as the premium of Chicago over KC intrigued us for some time. However that premium has faded as KC has taken the lead here. In my opinion, the absence or shortage of quality Spring wheat or Milling wheat futures has severely dwindled, potentially making the higher protein KC variety more sought after than soft-red winter or Chicago wheat. In our view we could see KC extend in the weeks and months ahead until potentially next Summer. The last two years Chicago wheat has held a premium over KC for the most part and in a few instances traded to 90 cents over KC. Today it settled 4.2 cents under Kc. In 2011 and 2014, Kc has traded as much as 1.45 over Chicago. Bottom line here we think that Kc has the potential to trade to more of a premium to Chicago due the fact there’s a story here with then USDA’s numbers possibly verifying this with yesterdays report. Call me with questions. I’m going to refrain from putting a specific recommendation here but would add that options are a possibility if the futures spread doesn’t interest you. If you do play the spread use a GTC stop loss always.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain and livestock webinar at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604