Commentary

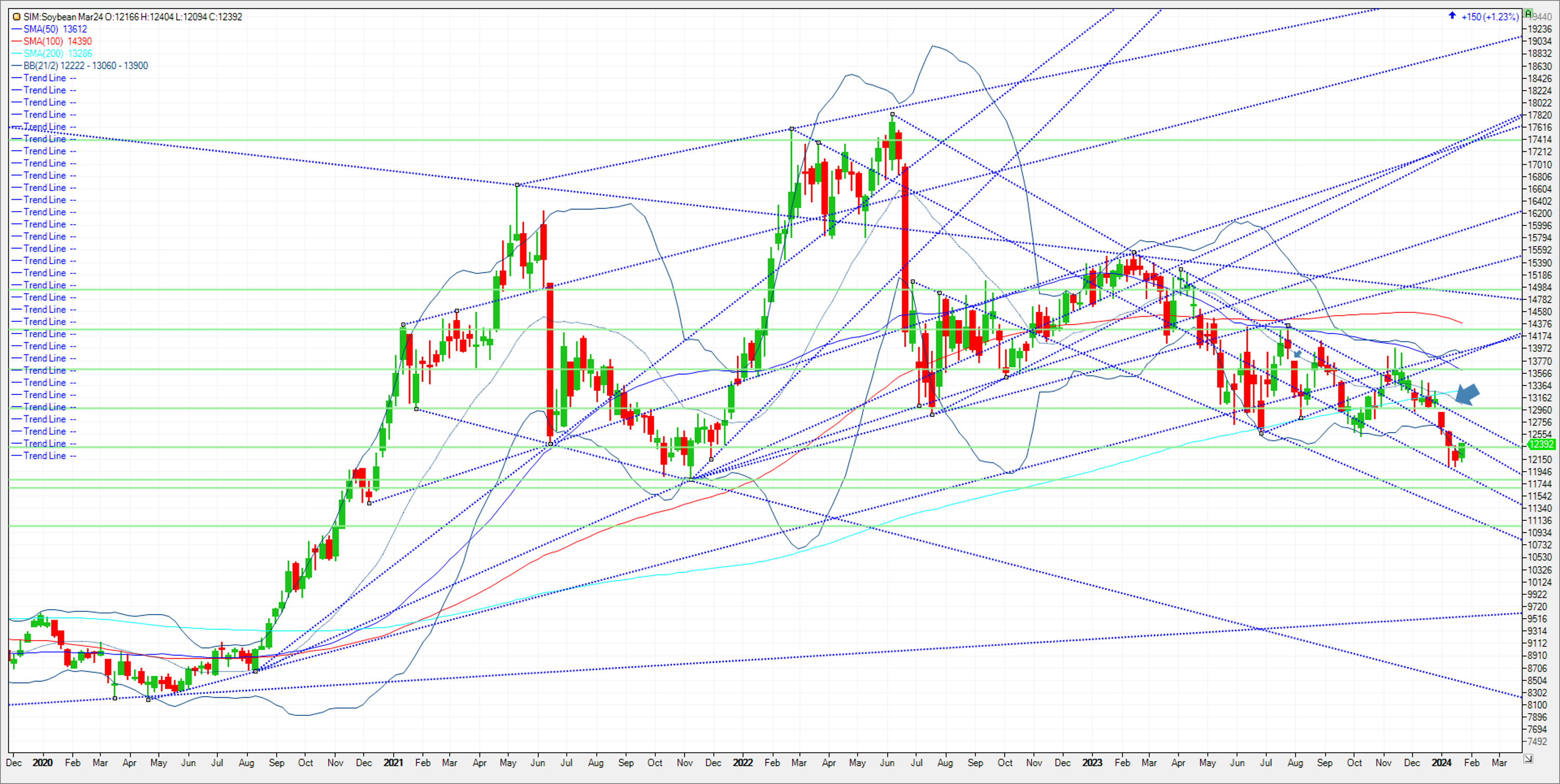

Near term longs in beans have been rewarded for now as the market is up over 25 cents to start the week. Funds began the week with their most bearish position since early 2020, short over 80K futures and options contracts. As Argentina has wrapped up planting, weather runs turn dry as weather forecasters have said El Nino has ended. The El Nino pattern featured cooler and wetter conditions for Argentina into and through planting after two years of extreme drought. Uncertainties enter into the market now amid a potential weather premium perhaps is built. A flip back to La Nina is not forecasted but the extended forecast runs feature hot and dry. For Brazil, a crop tour is ongoing in and the market maybe on edge to hear about how the soybeans weathered the extended hot and dry pattern prior. Brazil is posting Feb offers at a considerable discount to US numbers landed into China. Brazilian soybeans are currently roughly $2 per bushel cheaper imported into China from Brazil versus supplies from the U.S. Gulf, once freight, taxes and currency exchange rates are factored into the price for soybeans February through April. I am watching for any cancellations from previously made US purchases into China. That shell game China likes to play when they are confident in fulfilling their needs from Brazil is bearish demand in my view. The cancellations could make this recent bean rally, one to potentially sell. That said, lets pay attention to the charts. Resistance is 1245. A close over is needed to turn this market higher. A close could push the market to 12.83 this week and then the year opening gap at 1291-1297. Support is 1234, which represents 5% down for the year. The bottom of the Bollinger Band is at 1222. Below that my downside targets this week are first down at trendline support at 1191, then 1181 which is the late 2021 low. Below these levels, my next downside target is 1168, which represents 10% down for the year.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.