Commentary

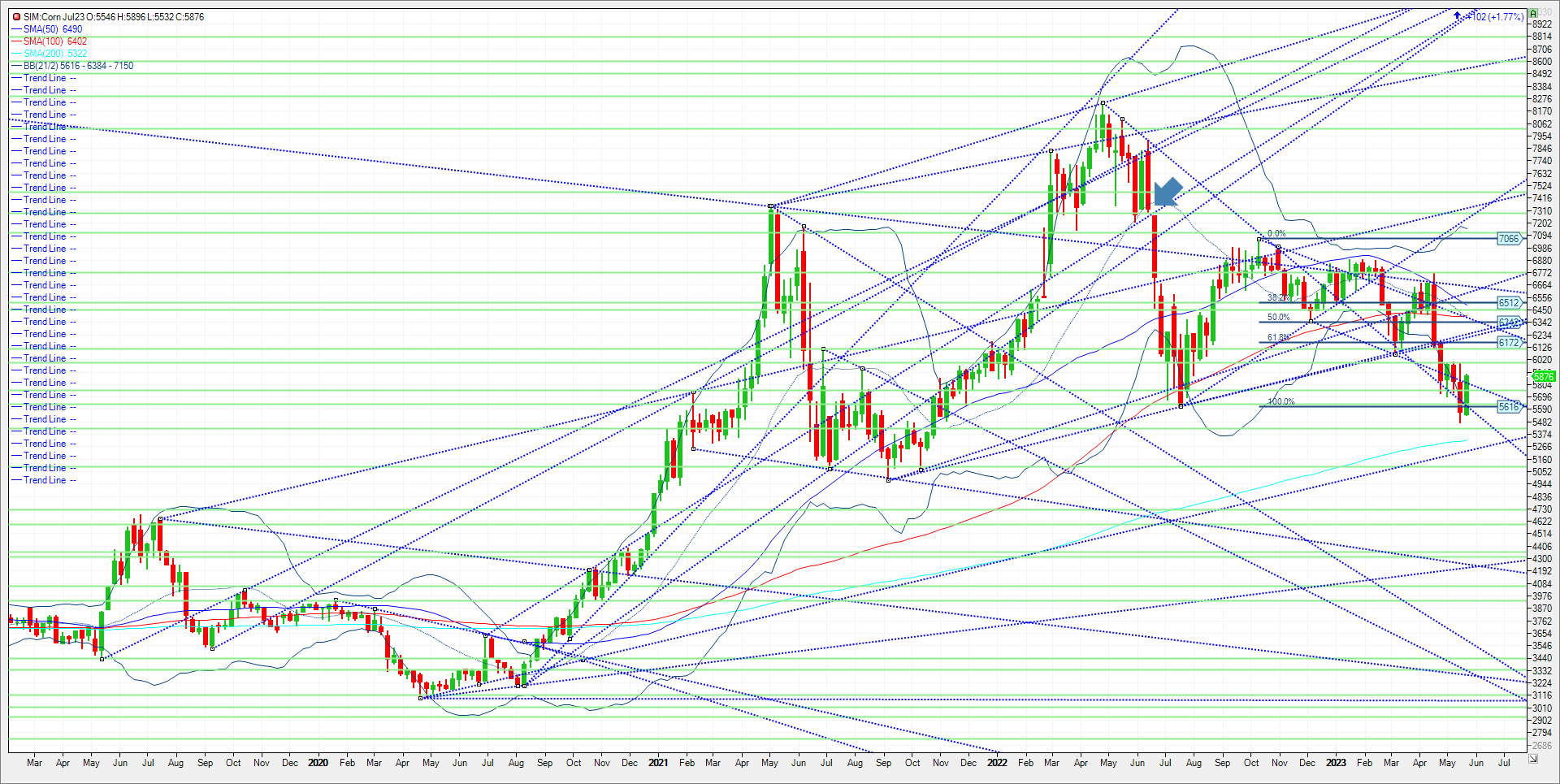

July23/Sep23 corn rallied again up another 6 cents on strong volume with over 37K contracts trading today on the calendar spread. Historically it is a very strong inversion and the spread looks poised to test the previous high at 84 cents July over. (See Chart) Outright July corn is being aided by a combination of short covering amid an unwind of long wheat/short corn positions as well as managed funds bidding up July/Sep Corn and July23/Dec 23 on dips. July corn took out key resistance today at 5.82. Right now, we have a bullish engulfing pattern on the weekly continuous. (See Chart) However, the week isn’t over yet, so closing over this level is key to keep the bullish momentum going. Funds are short both old and new cop corn as it stands right now per CFTC data. New crop corn is going to need a weather premium built to rally back up to the $6.00 level in my view. But old crop supplies are still tight here and Brazil hasn’t begun its 2nd crop corn harvest yet. We could still see an old crop squeeze to 6.20, maybe 6.40 before July goes off the Board in my opinion. However, a failure at 5.82 this week and all bets are off, as the market could pull back to 5.65/5.60 quickly. Weakness in wheat and for now a weak bean and meal close today isn’t aiding corn for now at least. Trade the charts! The corn market with this week’s rally has shrugged off recent Chinese cancellations amid a 60-day extension of the Black Sea corridor deal. Hence a bullish reaction to bearish inputs in my opinion. Two charts attached. First July corn weekly continuous. Second, July23/Sep23 Corn.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain and livestock webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax