Commentary

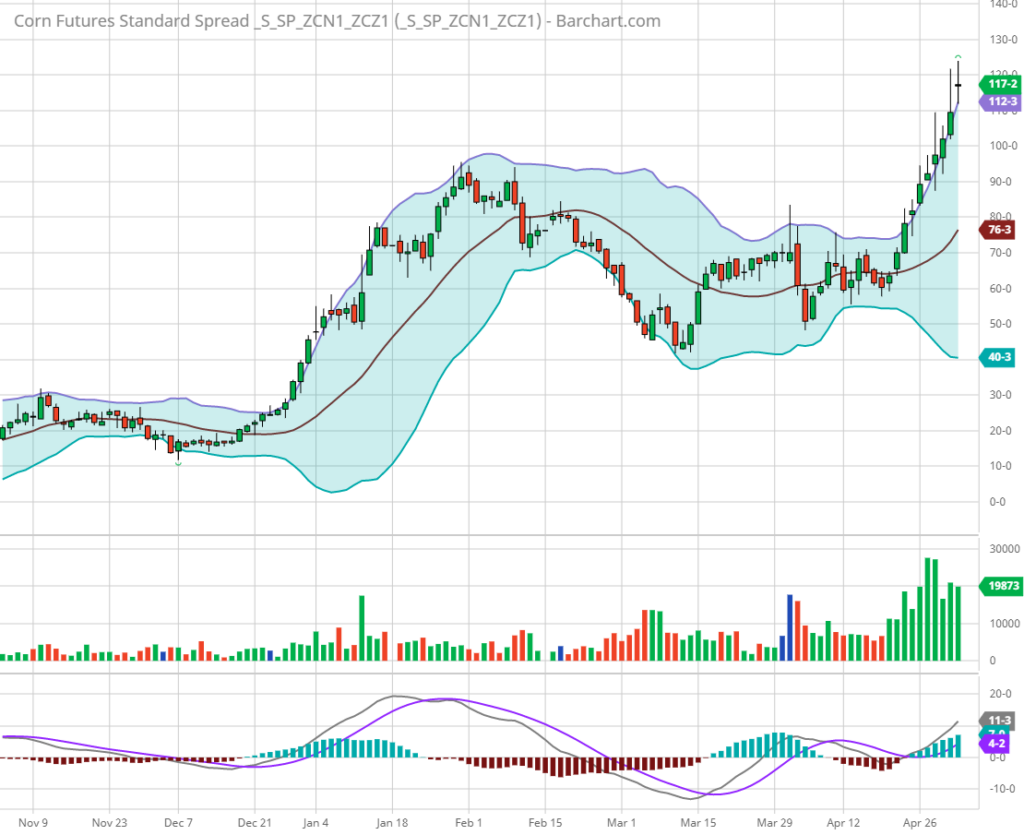

Export commitments of corn continue at record pace as the USDA this AM announced another 84 million bushels of corn were shipped the week ending April 29th. China took in 30 million bushels of the total. Per USDA date, marketing year corn shipments exceed the seasonal pace needed to hit the current target by 126 million bushels, up from 99 last week. Weekly shipments need to average 51.5 million bushels per week to meet USDA’s export estimate. Note the ten weeks prior shows that the US has shipped on average 75 million bushels per week. In my view it is one of the reasons why we have seen old crop corn gain on new crop. (Chart Attached). July/Dec corn has rallied for ten straight sessions with July 21 corn 116.4 cents over Dec 21. The export data and the inverted market has given thoughts that the USDA will further reduce ending stocks given the size of the export commitiiments so far.

Meanwhile, net drying continues to take a toll on Brazil’s safrinha corn crop and cotton producing areas. Northern Mato Grosso is the only area expected to welcome rain “for a while,” according to forecasters. Due to the drought like conditions, private forecasters are downgrading production in Brazil from 109-110 million metric tons down to 100-104 million. Last month’s WASDE report from USDA put Brazilian corn production at 109. Therefore it is assumed that USDA will downgrade both production and therefore ending stocks for both US and Brazil in next Wednesdays report. That necessarily doesn’t mean that USDA will adjust ending stocks lower, but the export data and weather provide them reasons for doing so in my view. I will provide ending stocks guesstimates for the Wednesday May 12th crop report later in the week.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me each and every thursday at 3pm CST for a free grain and livestock webinar. Sign up is free and a recording link will sent to your email. We discuss supply, demand, weather, and the charts.Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604